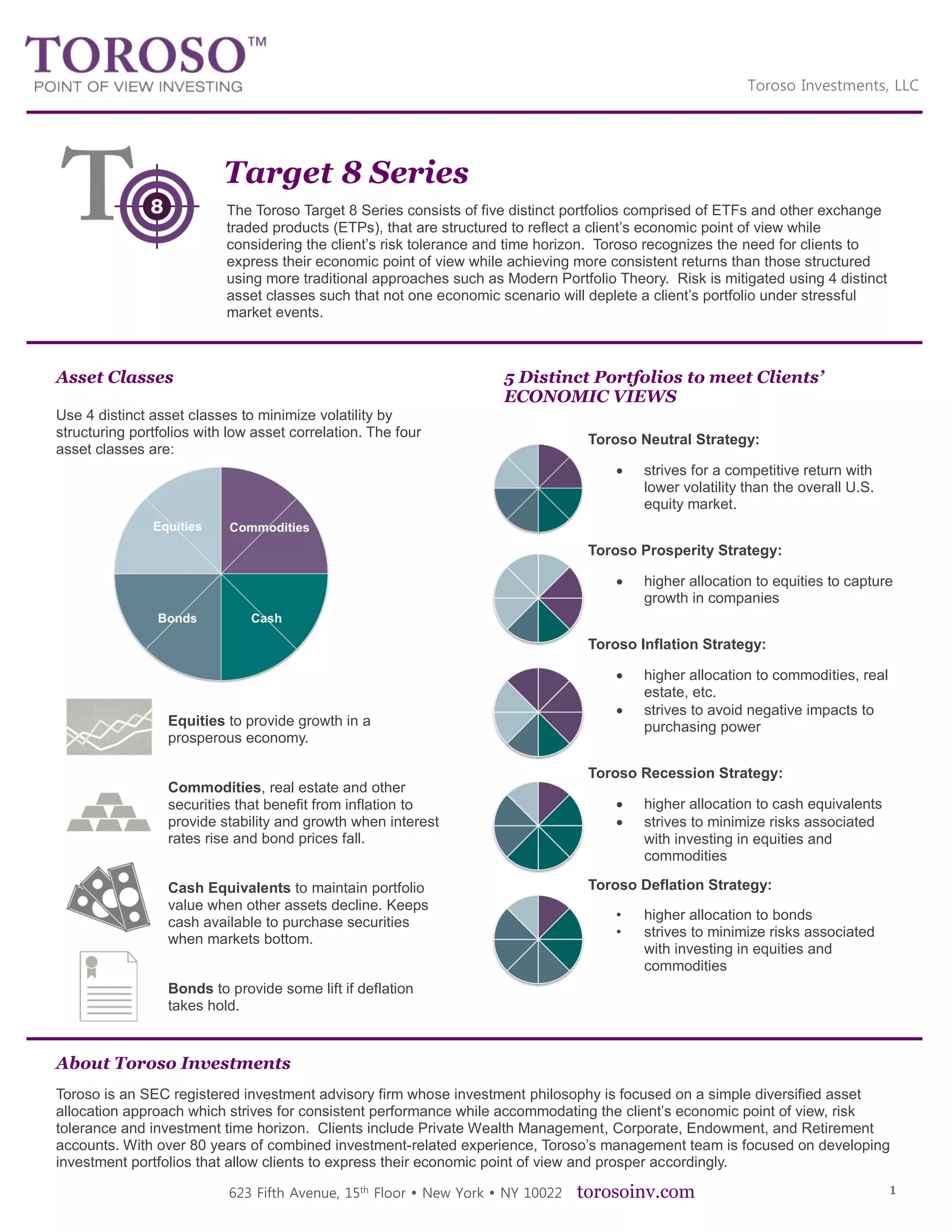

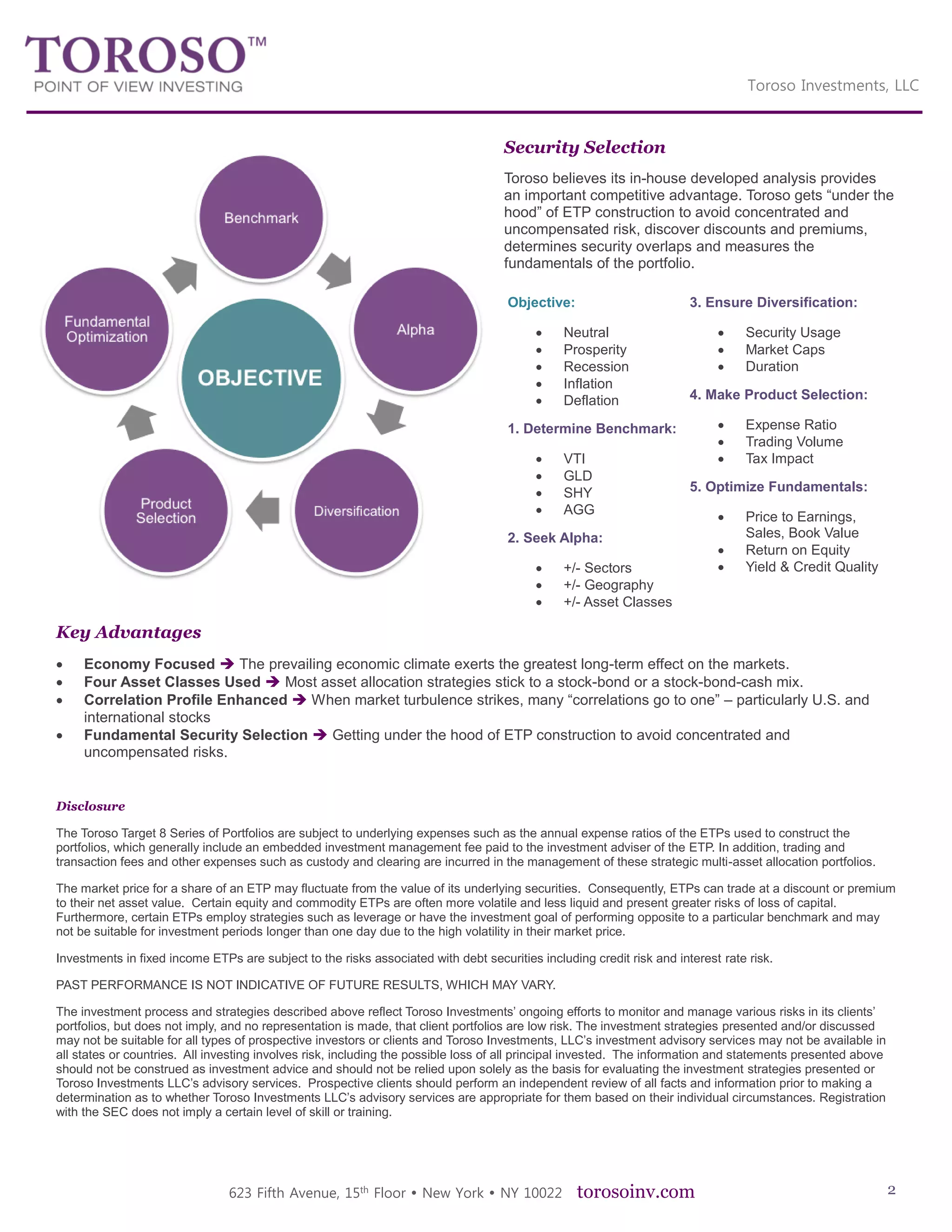

Toroso Investments, LLC offers the Toroso Target 8 series, which includes five portfolios designed to align with clients' economic viewpoints while managing risk and volatility through diverse asset classes. Each portfolio is tailored for specific economic scenarios—neutral, prosperity, inflation, recession, and deflation—aiming for consistent returns beyond traditional approaches. The firm employs rigorous security selection strategies and analysis to mitigate risks associated with investments and ensure optimal portfolio performance.