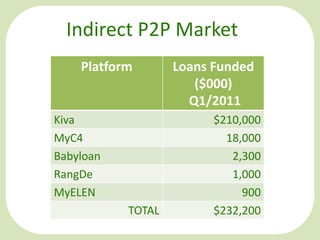

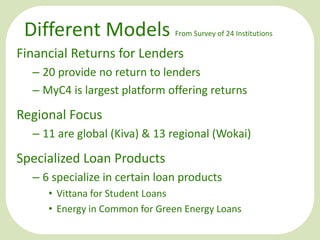

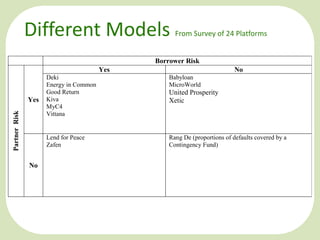

This document discusses indirect person-to-person (P2P) lending platforms that connect individual lenders with borrowers through microfinance institutions. It notes that indirect P2P lending has raised over $250 million to date. It then describes different models of indirect P2P platforms, their global impact in providing early funding to microfinance institutions, and both the advantages and disadvantages they present. Finally, it considers how the sector may evolve in the future to provide larger loans to small and medium enterprises as well as new insurance products, and raises questions about the future growth and regulation of indirect P2P lending.