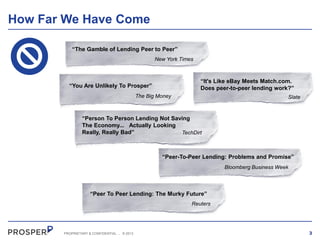

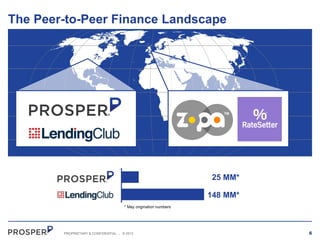

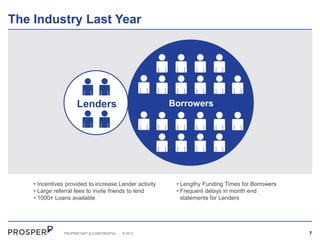

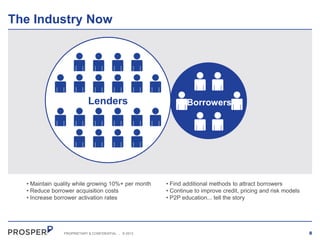

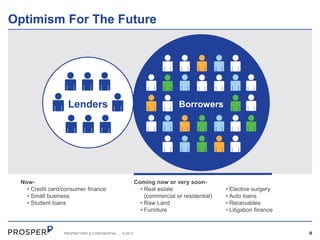

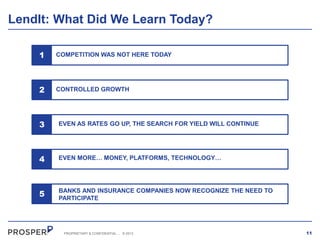

The document discusses the growth of peer-to-peer lending and outlines both its past challenges and future potential. It notes that P2P lending platforms have grown significantly in recent years, originating $25 million in loans in one month. However, early platforms struggled with issues like lengthy funding times. New platforms now focus on controlled growth while improving risk models. The future of P2P lending is seen as promising if certain conditions persist, like low interest rates and demand for higher yields, and if new asset classes and better data analysis are incorporated.