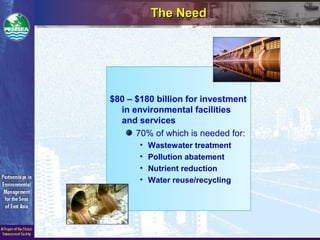

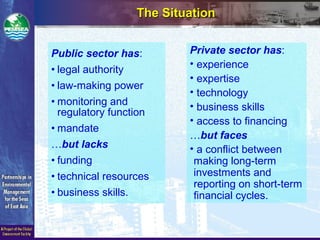

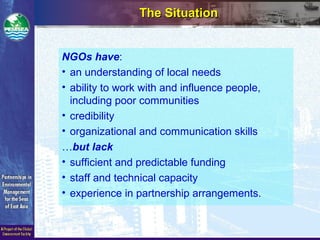

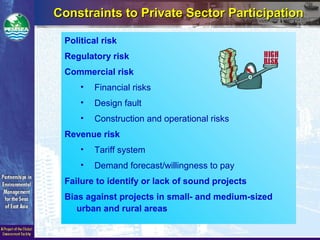

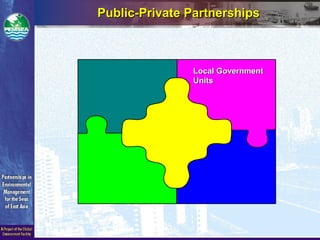

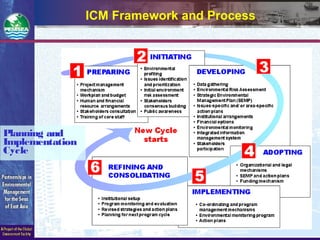

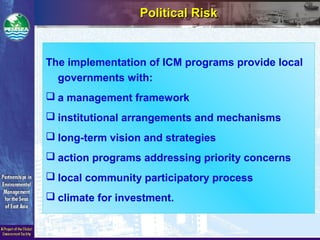

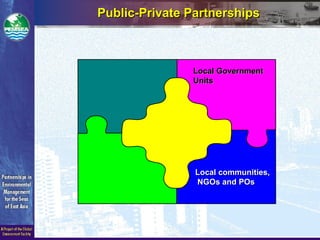

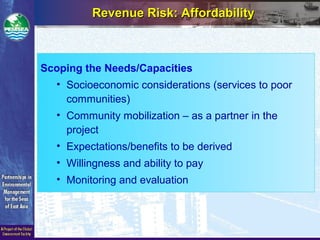

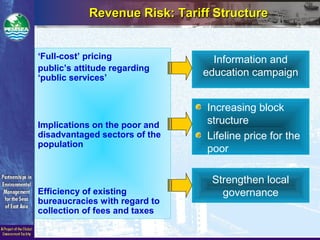

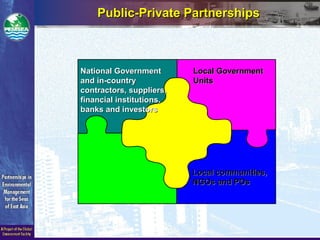

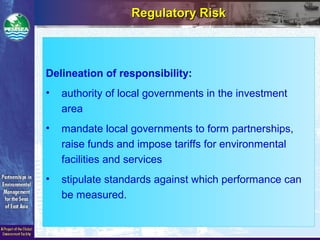

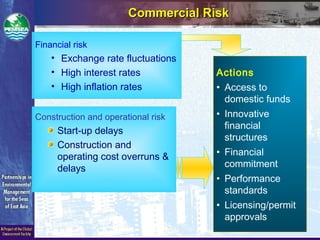

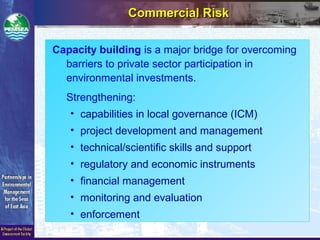

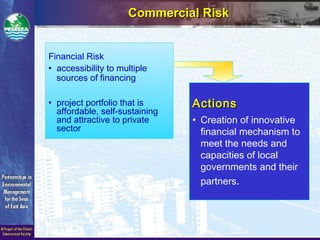

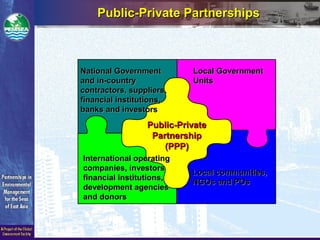

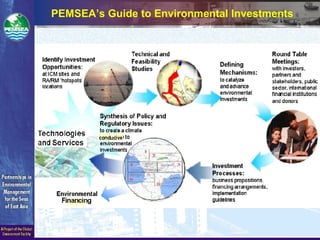

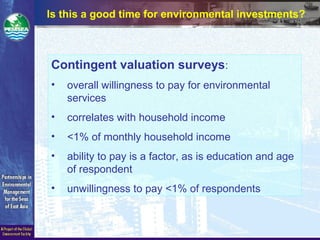

The document discusses building sustainability through public-private partnerships for environmental investments. It outlines that the public sector lacks funding and technical skills, private sector faces short-term profit pressures, and NGOs lack funding and capacity. Successful partnerships require the public sector to set standards, private sector to provide expertise, and NGOs to represent communities. Key challenges include political, regulatory, commercial and financial risks. Overcoming these requires capacity building, innovative financing, and delineating clear roles and responsibilities for partners.