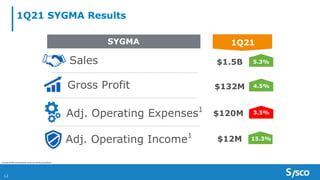

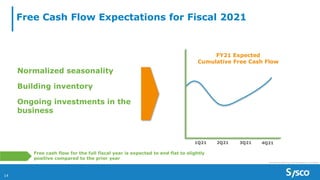

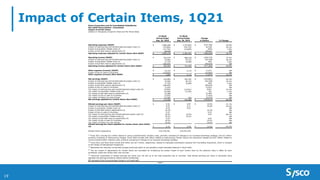

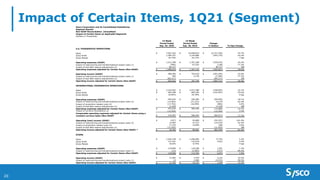

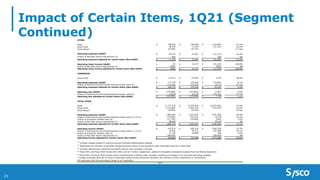

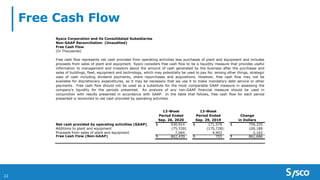

Sysco reported earnings results for the first quarter of fiscal year 2021. Total sales declined 23% to $11.8 billion due to the COVID-19 pandemic negatively impacting restaurant customers. However, the company delivered $365 million in adjusted operating income and strong positive free cash flow of $862 million for the quarter through cost savings initiatives. Sysco remains well positioned with over $8 billion in cash and liquidity as management continues transforming the business for long-term growth.