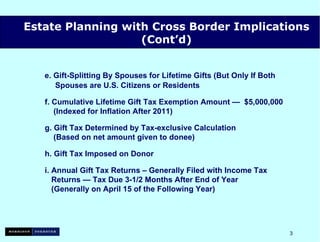

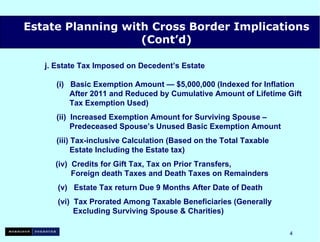

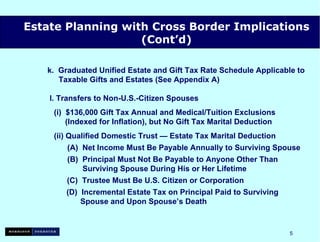

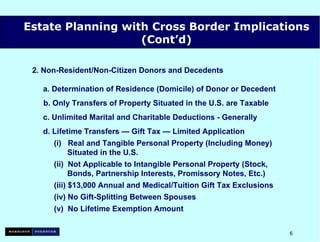

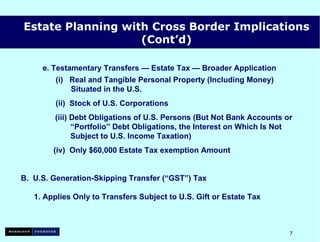

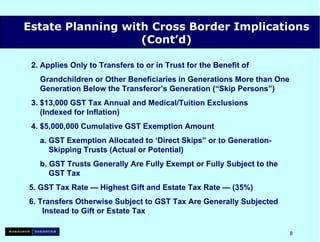

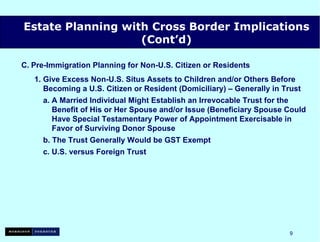

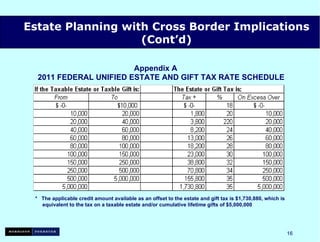

This document provides an overview of estate planning considerations for individuals with cross-border implications. It discusses U.S. gift and estate tax rules for U.S. citizens and residents as well as non-residents. It also covers generation-skipping transfer tax, pre-immigration planning, planning for permanent non-residents, and departure tax rules for expatriates. Special trusts and foreign holding entities are recommended for managing cross-border tax and asset protection issues.