Family Limited Partnerships Update - Diagrams and Bullet Points - February 6, 2014

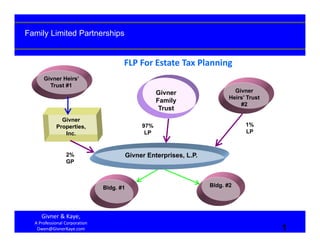

- 1. Family Limited Partnerships FLP For Estate Tax Planning Givner Heirs’ Trust #1 Givner Family Trust Givner Properties, Inc. Givner Heirs’ Trust #2 1% LP 97% LP 2% GP Givner Enterprises, L.P. Bldg. #1 Bldg. #2 Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 1

- 2. Family Limited Partnerships FLP With Collateral Protection (LLCs) Givner Heirs’ Trust #1 Givner Family Trust Givner Properties, Inc. 1% LP 97% LP 2% GP Layering ➜ Givner Heirs’ Trust #2 Givner Enterprises, L.P. LLC Bldg. #1 LLC Bldg. #2 Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 2

- 3. Family Limited Partnerships FLP With Stand‐by Foreign Trust [additional layering] Givner Heirs’ Trust #1 BKG Trust Layering ➜ Givner Heirs’ Trust #2 (NZ) Givner Properties, Inc. 2% GP Layering ➜ 1% LP 97% LP Givner Enterprises, L.P. LLC Bldg. #1 LLC Bldg. #2 Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 3

- 4. Family Limited Partnerships FLP Which Establishes A Foreign Trust [additional layering] Givner Enterprises, L.P. Layering Liquid LLC Bldg. #2 assets LLC Bldg. #1 BKG Trust (NZ) Nevis LLC Layering Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 4

- 5. Family Limited Partnerships FLP With Collateral Protection (LLCs) Givner Heirs’ Trust #1 Givner Family Trust Givner Properties, Inc. 2% GP Layering with Nevada Entities Givner Heirs’ Trust #2 1% LP 97% LP Givner Enterprises, L.P. Nevada LLC Bldg. #1 Nevada LLC Bldg. #2 Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 5

- 6. Family Limited Partnerships FLP With Nevada SSST Establishes Foreign SSST New Zealand SSST Step 2: Capitalizes with Nevada SSST liquid assets Step 1: 97% LP Step 3: 100% Member Givner Enterprises, L.P. Step 4: Nevis LLC Loans money Nevada LLC Bldg. Givner & Kaye, A Professional Corporation Owen@GivnerKaye.com 6

- 7. LAW OFFICES BRUCE GIVNER (bruce@GivnerKaye.com) OWEN D. KAYE ( o we n @ G i v n e r K a y e . c o m ) KATHLEEN GIVNER (kathy@GivnerKaye.com) NEDA BARKHORDAR (neda@GivnerKaye.com) GIVNER & KAYE A PROFESSIONAL CORPORATION SUITE 445 12100 WILSHIRE BOULEVARD LOS ANGELES, CALIFORNIA 90025 www.GivnerKaye.com www.MajorTaxProblems.com PHON E (3 10) 207 -8 008 (8 18) 785 -7 579 F AX (3 10) 207 -8 708 (8 18) 785 -3 027 February 6, 2014 Family Limited Partnerships 1. Audits. 1.1. IRS Form 706. Question 11a: “Did the decedent, at the time of death, own any interest in a partnership (for example, a family limited partnership), an unincorporated business, or a limited liability company; or own any stock in an inactive or closely held corporation? 11b: “If `Yes,’ was the value of any interest owned (from above) discounted on this estate tax return? If `Yes,’ see the instructions on reporting the total accumulated or effective discounts taken on Schedule F or G.” Instructions, page 26: “Valuation discounts. If you answers `Yes,’ to Part 4 – General Information, line 11b for any interest in a partnership, an unincorporated business, a limited liability company, or stock in a closely-held corporation, attach a statement that lists the item number from Schedule F [Other Miscellaneous Property] and identifies the total effective discount taken (that is, XX.XX%) on such interest. Example of effective discount: a Pro-rata value of limited liability company (before any discounts) $100.00 b Minus: 10% discounts for lack of control ( 10.00) c Marketable minority interest value (as if freely traded minority interest value) $ 90.00 d Minus: 15% discount for lack of marketability (13.50) e Non-marketable minority interest value $76.50 Calculation of effective discount: (a minus e) divided by a = effective discount $100.00 - $76.50 ÷ $100.00 = 23.50% If you answer `Yes,’ to line 11b for any transfer(s) described in (1) through (5) in the Schedule G [Transfers During Decedent’s Life] instructions (and made by the decedent,

- 8. LAW OFFICES GIVNER & KAYE A PROFESSIONAL CORPORATION Family Limited Partnerships February 6, 2014 Page 2 of 5 attach a statement to Schedule G which lists the item number from that schedule an identifies the total effective discount taken (that is, XX.XX%) on such transfer(s).” 1.2. Privilege. 1.3. Separate Counsel. For Children or Children’s Trust Trustee. 1.3.1. E&O coverage for trustee. 1.3.2. Evidence of negotiation. 1.4. Independent Third Parties, e.g., charity. 1.5. Timing Of Funding. Senda, 8th Cir. 2006: no evidence that parents contributed the stock to the partnership before they transferred the partnership interests to the children, therefore they were gifts of stock. Taxpayers must avoid the reality and appearance of an integrated transaction (step-transaction doctrine). 1.6. Gifts Of Present Interests? Wimmer, TC (6/4/12): to satisfy the criteria for a present interest under §2503(b), must prove (1) the partnership would generate income, (2) some portion of it would flow steadily to the donees, and (3) that portion of income could be readily ascertained. Cure: give the donee of the LP units the right, upon receipt of the interest and for a reasonable time thereafter, to require the partnership or the donor to buy back the donee’s units that were the subject of the gift. Similar to a Crummey notice. 1.7. Parents As Officers Of Corporate GP. 1.8. Annual GP Report. 1.9. Tax Returns vs. Corporate Records. 1.10. Texas Isn’t Actually Part Of The United States. Keller v. U.S., failure to fund the FLP before death was held OK because, under Texas law, her intent governed and the estate’s payment of the estate tax was retroactively characterized as a loan to the partnership thus entitling the estate to the deduction for interest incurred!! 2. Creditor Protection. 2.1. Change in LLCs. Effective 1/1/14 new 17705.03(c) vs. old 17302(c). 2.2. Revised ULPA: California Corporations Code §15907.02. (a) A transfer, in whole or in part, of a partner's transferable interest:

- 9. LAW OFFICES GIVNER & KAYE A PROFESSIONAL CORPORATION Family Limited Partnerships February 6, 2014 Page 3 of 5 (1) is permissible; (2) does not by itself cause the partner's dissociation or a dissolution and winding up of the limited partnership's activities; and (3) does not, as against the other partners or the limited partnership, entitle the transferee to participate in the management or conduct of the limited partnership's activities, to require access to information concerning the limited partnership's transactions except as otherwise provided in subdivision (c), or to inspect or copy the required information or the limited partnership's other records or to exercise any other rights or powers of a partner. (b) A transferee has a right to receive, in accordance with the transfer, distributions to which the transferor would otherwise be entitled. (c) A transferee is entitled to an account of the limited partnership's transactions only upon the dissolution and winding up of the limited partnership. (d) Upon transfer, the transferor retains the rights of a partner other than the interest in distributions transferred and retains all duties and obligations of a partner. (e) A limited partnership need not give effect to a transferee's rights under this section until the limited partnership has notice of the transfer. (f) A transfer of a partner's transferable interest in the limited partnership in violation of a restriction on transfer contained in the partnership agreement is ineffective as to a person having notice of the restriction at the time of transfer. (g) A transferee that becomes a partner with respect to a transferable interest is liable for the transferor's obligations under §§15905.02 and 15905.09. However, the transferee is not obligated for liabilities unknown to the transferee at the time the transferee became a partner. (h) A transferee of a partnership interest, including a transferee of a general partner, may become a limited partner if and to the extent that (1) the partnership agreement provides or (2) all general partners and a majority in interest of the limited partners consent. 15907.03 (a) On application to a court of competent jurisdiction by any judgment creditor of a partner or transferee, the court may charge the transferable interest of the judgment debtor with payment of the unsatisfied amount of the judgment with interest. To the extent so charged, the judgment creditor has only the rights of a transferee. The court may appoint a receiver of the share of the distributions due or to become due to the judgment debtor in respect of the limited partnership and make all other orders, directions, accounts, and inquiries the judgment debtor might have made or which the circumstances of the case may require to give effect to the charging order. (b) A charging order constitutes a lien on the judgment debtor's transferable interest. The court may order a foreclosure upon the interest subject to the

- 10. LAW OFFICES GIVNER & KAYE A PROFESSIONAL CORPORATION Family Limited Partnerships February 6, 2014 Page 4 of 5 charging order at any time. The purchaser at the foreclosure sale has the rights of a transferee. (c) At any time before foreclosure, an interest charged may be redeemed: (1) by the judgment debtor; (2) with property other than limited partnership property, by one or more of the other partners; or (3) with limited partnership property, by the limited partnership with the consent of all partners whose interests are not so charged. (d) This chapter does not deprive any partner or transferee of the benefit of any exemption laws applicable to the partner's or transferee's transferable interest. (e) This section provides the exclusive remedy by which a judgment creditor of a partner or transferee may satisfy a judgment out of the judgment debtor's transferable interest. (f) No creditor of a partner shall have any right to obtain possession or otherwise exercise legal or equitable remedies with respect to the property of the limited partnership. 2.3. 2.4. 3. In re Schwarzkopf, 626 F. 3d 1032 (9th Cir. 2010). Standby Foreign (or Nevada) Trust. All remedies are local. Relationship To Other Structures. 3.1. Captive Insurance Companies. 3.1.1. FLP can own the captive. 3.1.2. Captive can invest in the FLP. 3.2. Pensions. 3.2.1. Pension can co-own a property with the FLP (mere co-ownership is not a prohibited transaction). 3.2.2. Pension’s investment in a non-disqualified person (less than 50% fiduciary, owner of plan sponsor, etc. – IRC §4975(e)(2)) which can reduce value of DBPP which can increase funding obligation. Just one example of solving tax problems using estate tax planning. 3.3. “C” Corporations. 3.3.1. Fact. More now due to increased California personal rates.

- 11. LAW OFFICES GIVNER & KAYE A PROFESSIONAL CORPORATION Family Limited Partnerships February 6, 2014 Page 5 of 5 3.3.2. ROLPs. Again solving tax problems using estate tax planning. 3.4. Life Insurance. 3.4.1. ILITs As LPs. 3.4.2. FLPs As Alternatives. 3.5. Real Estate. 3.5.1. February 29, 2008, BOE LTA Q&A 17. 3.5.2. §1031 Exchanges. No “before” holding period. No exchange of LP interests. 3.6. 3.7. CRATs. 3.8. CLATs, especially T-CLATs. 3.9. 4. Series LLCs. CUTMA. Reasons To Choose. 4.1. Step Up In Basis. 37.1% capital gains tax rate (38.288%?) Note February 6, 2006, IRS “Bogus Optional Basis Adjustment” announcement. 4.2. LLC Alternative. Gross receipts tax is discouraging. 4.3. Estate Tax Planning. 4.3.1. The 3 Legged Stool. 4.3.2. Preferred Partnerships. Parent retains fixed, annual, cumulative preferred interest but no growth in excess of coupon. Also liquidation preference. Junior equity has minimum value equal to at least 10% of the entity’s gross assets under the subtraction mention of value. The smaller the percentage that is preferred, the better “coverage”. With big lifetime exclusions, having a lower percentage is easier. Interest is based on high quality publicly traded securities. Parents can transfer preferred interest to a CLAT and use to freeze a QTIP.