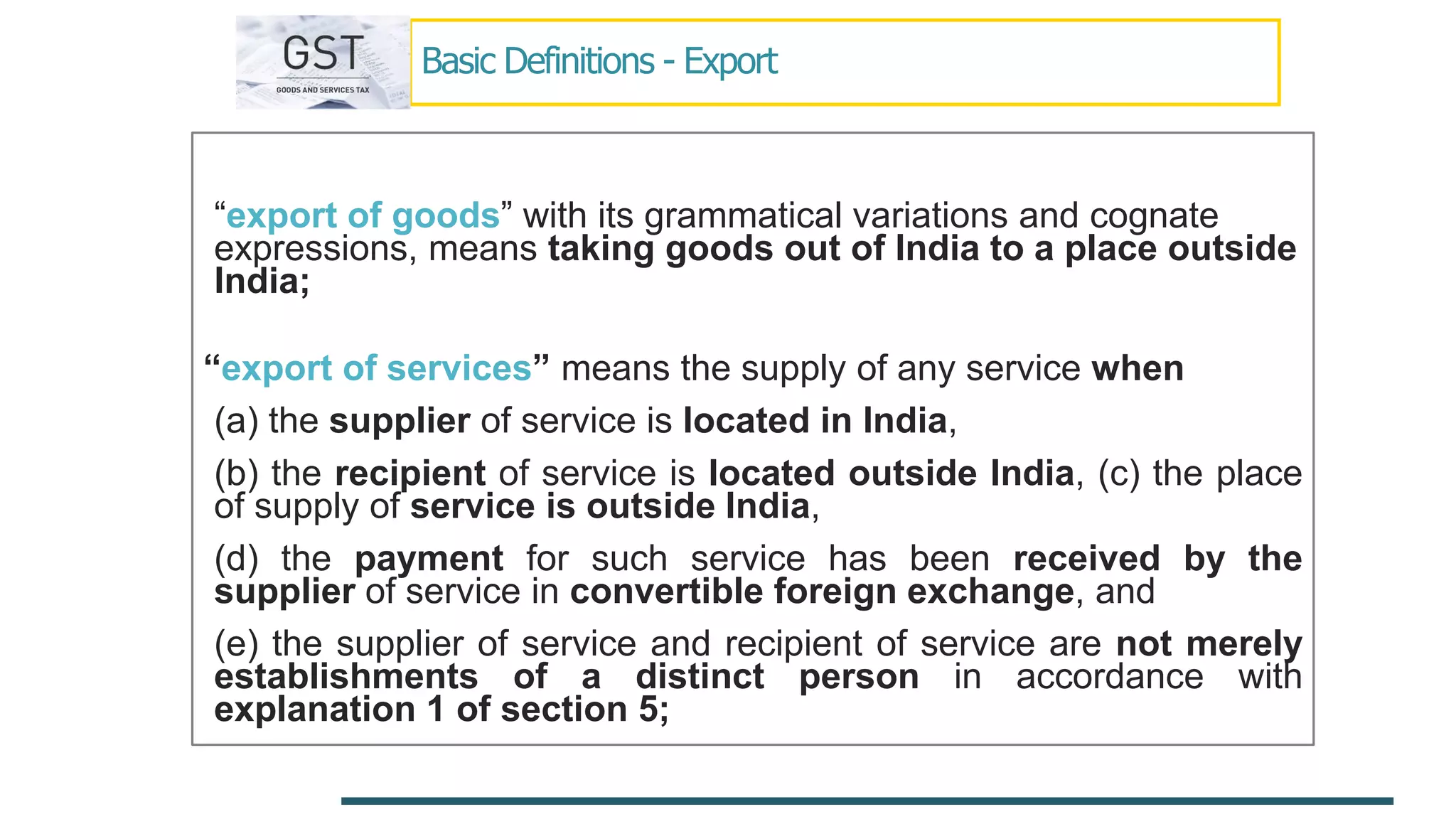

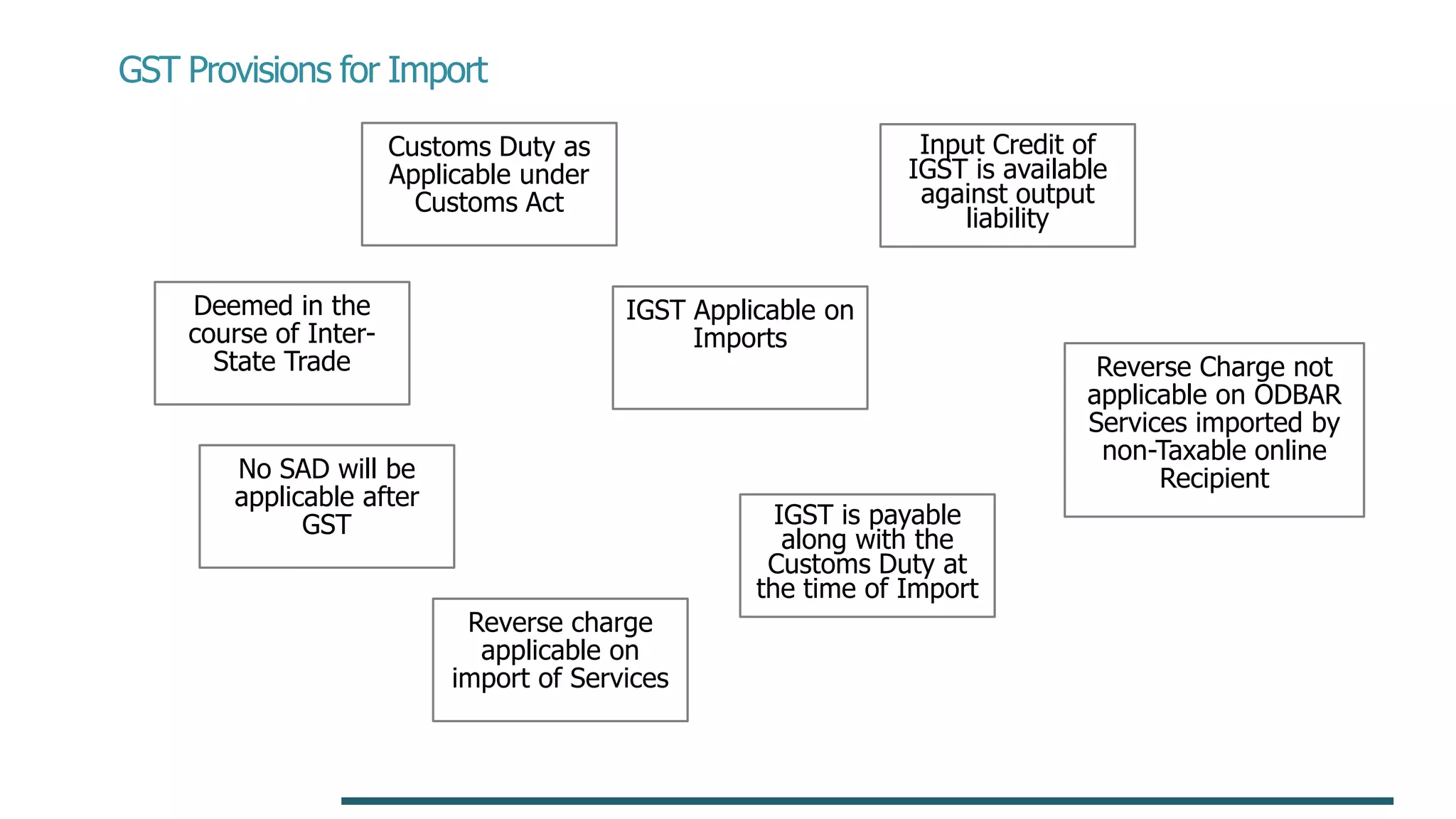

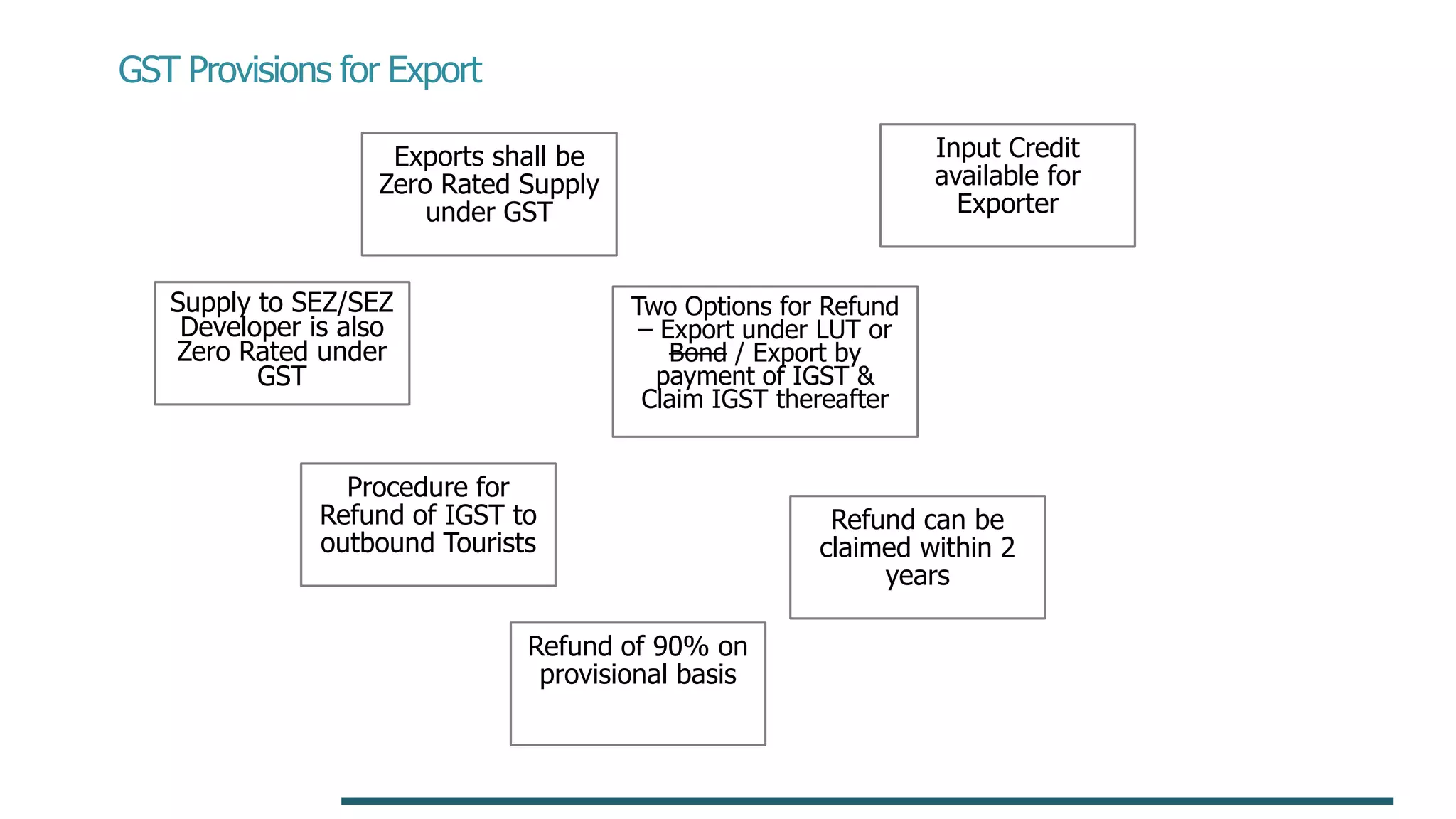

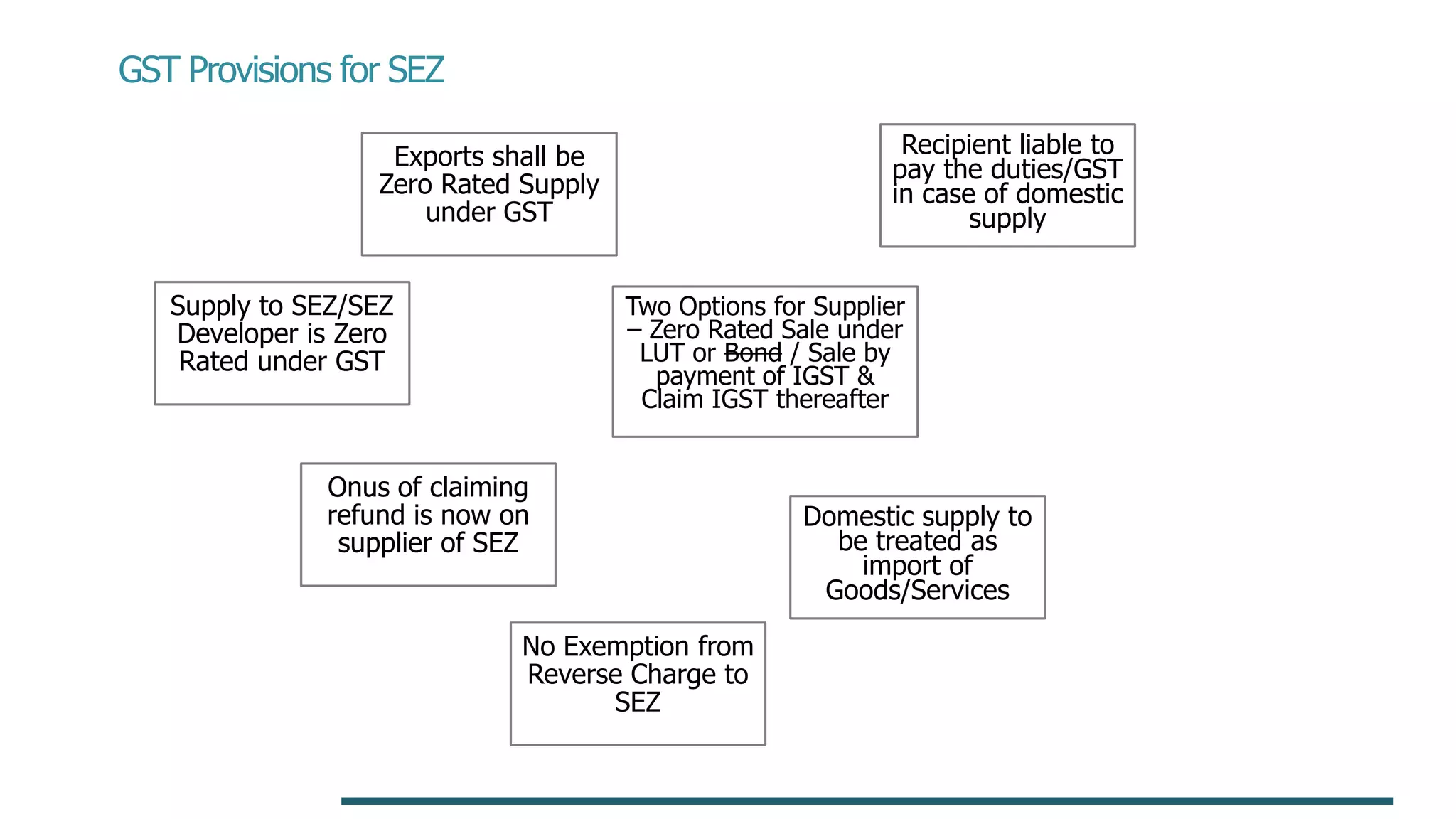

The document discusses import and export procedures under India's foreign trade laws. It outlines requirements for importers such as submitting evidence of import and remitting payment within six months. Exporters must realize the full export value through an authorized bank and repatriate proceeds within nine months. Advance payments against imports or exports up to certain limits are allowed. The document also provides definitions and GST provisions related to imports, exports, and special economic zones. Refund procedures for exporters paying integrated GST are described requiring documents like shipping bills and valid tax returns.