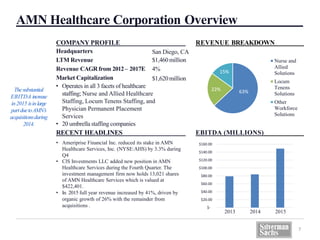

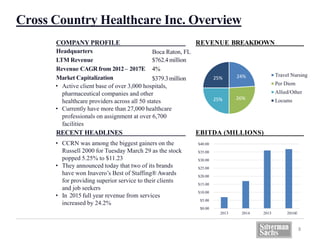

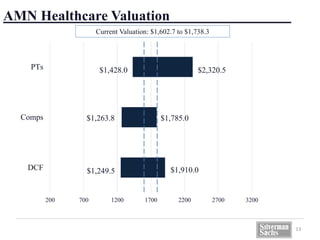

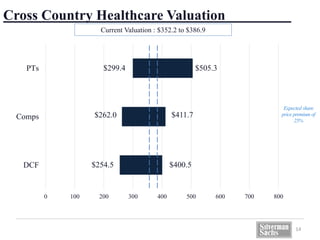

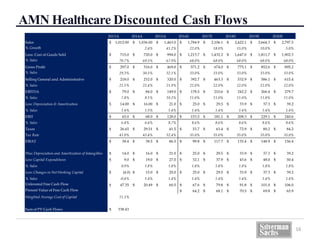

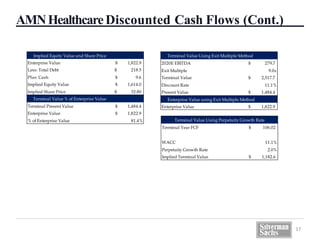

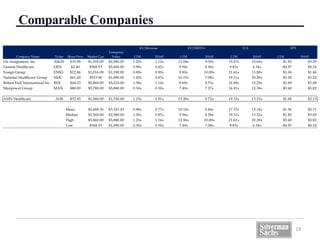

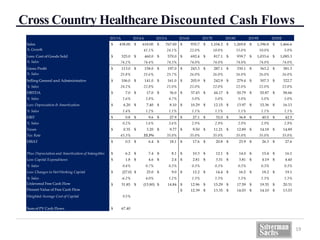

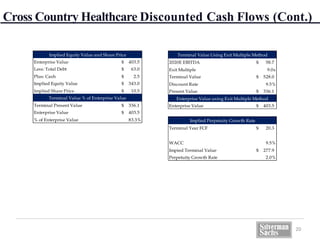

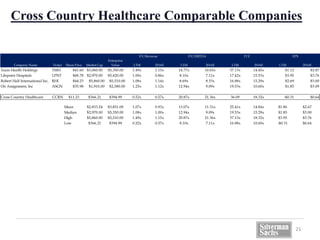

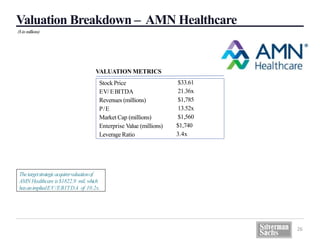

AMN Healthcare and Cross Country Healthcare were valued using three approaches: discounted cash flow analysis, comparable company analysis, and precedent transaction analysis. Based on the DCF, AMN's implied equity value is $1.6 billion and share price is $32.80. Cross Country's implied equity value is $299 million to $505 million. The comparable company analysis implies a valuation range of $1.6 billion to $2.3 billion for AMN and $262 million to $412 million for Cross Country. Taking an average of the three approaches, AMN's current valuation is estimated to be $1.6 billion to $1.7 billion and Cross Country's is $352 million to $387 million.