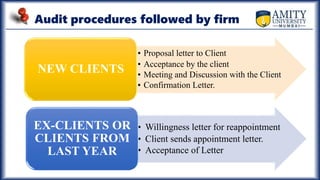

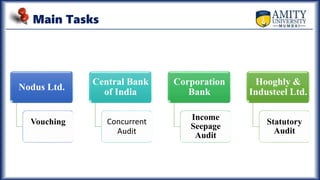

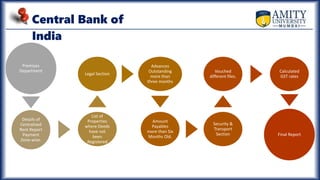

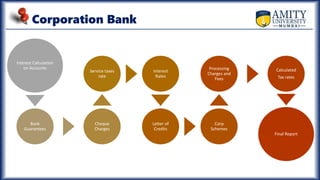

This document summarizes an internship presentation about an internship at ECOVIS R. Kabra Corporate Advisors Ltd. It provides information about the company, objectives of the internship, methodology, audit processes and procedures in India, audit procedures followed by the firm for new and existing clients, main tasks completed during audits of various companies including vouching, verification of tax filings, and preparation of reports, and conclusions about learning experience.