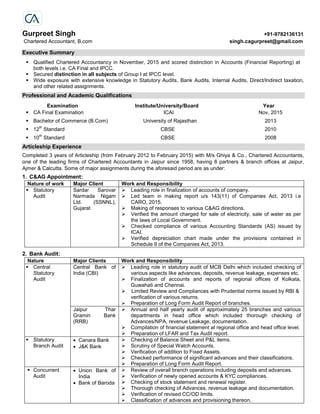

Gurpreet Singh is a qualified Chartered Accountant from India with extensive experience in statutory audits, bank audits, internal audits, taxation, and other related assignments. He completed his articleship with a leading audit firm in Jaipur where he worked on audits for companies, banks, and other clients. Some of his responsibilities included finalizing accounts, preparing audit and tax reports, verifying financial statements, and checking compliance with accounting and auditing standards. He has advanced knowledge of accounting and banking software as well as Microsoft Office products.