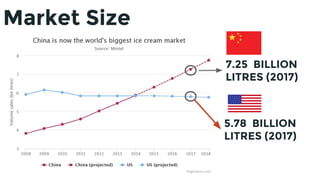

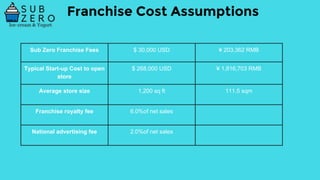

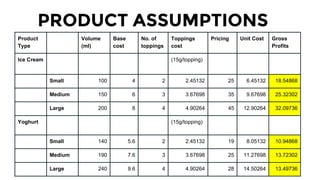

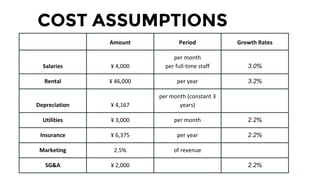

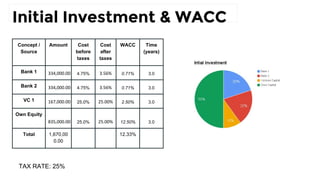

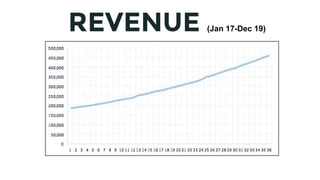

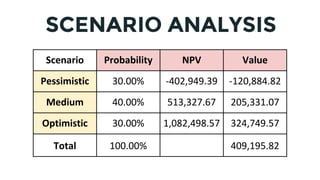

This document summarizes the business plan for a yogurt and ice cream franchise in China. It outlines the large and growing market opportunities in China for these products due to trends of increasing consumption and focus on health. The plan provides assumptions on startup costs, product pricing, costs, and financial projections estimating over $400,000 in net present value over three years. It requests $835,000 in funding and introduces the founding team.