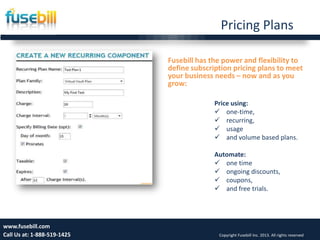

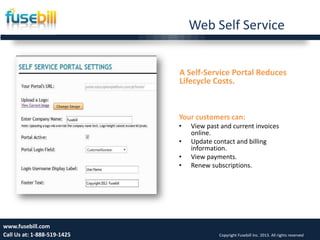

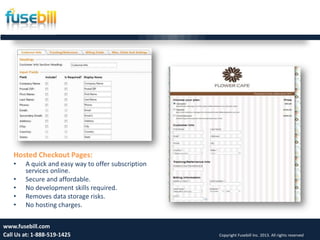

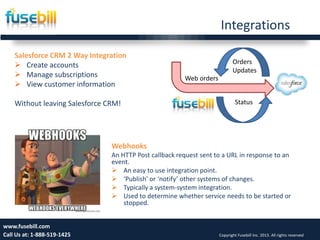

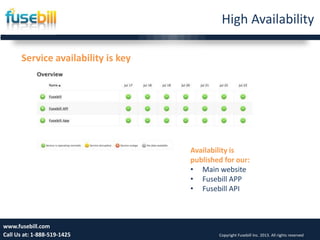

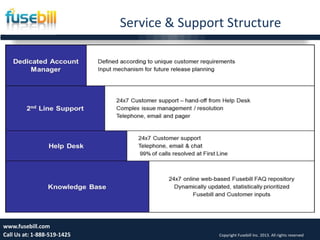

Fusebill automates billing, invoicing, and payments for subscription-based companies. It aims to reduce costs, speed cash collections, and extend customer lifecycles. The presentation covered the subscription economy, benefits of automated billing platforms over payment gateways, features of Fusebill including pricing plans and customer communications, and their commitment to customer service.