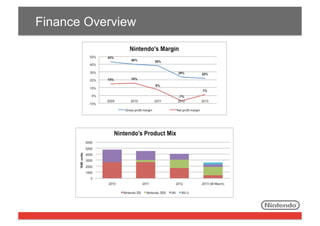

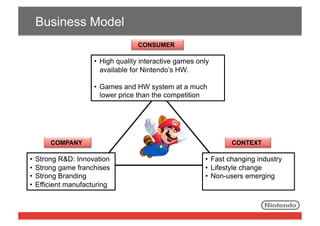

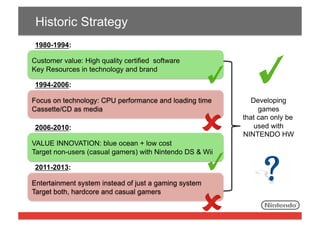

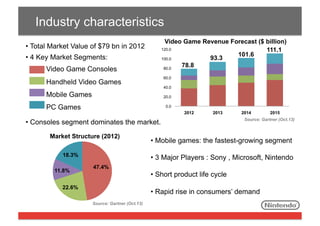

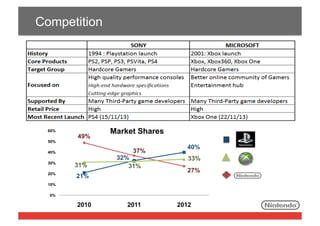

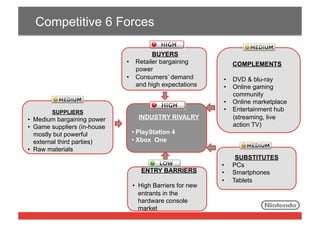

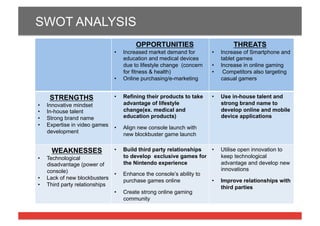

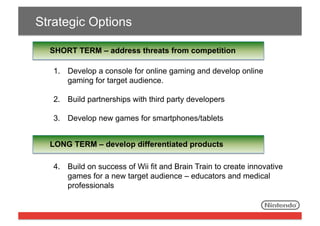

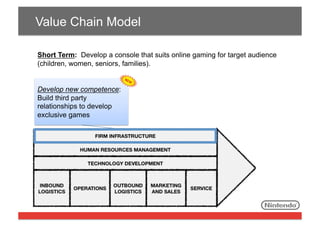

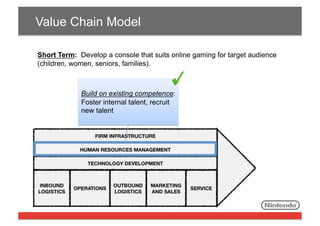

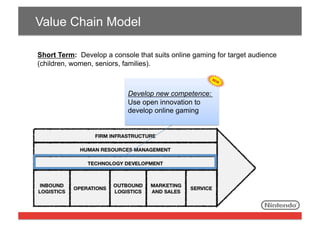

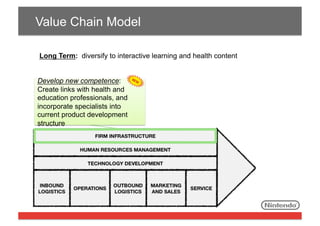

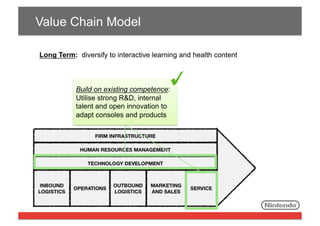

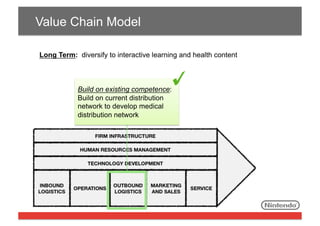

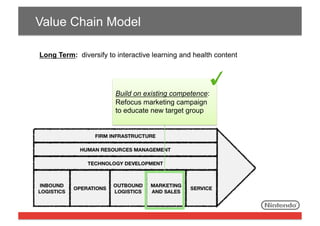

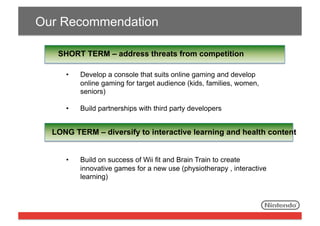

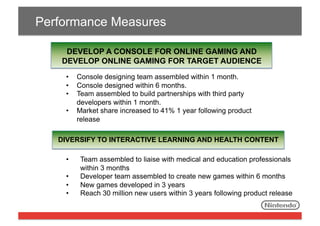

Nintendo is facing challenges maintaining market share with the Wii U not meeting sales expectations. The document proposes short and long term strategic options. In the short term, Nintendo could develop an online gaming console and partnerships. Long term, it could diversify into interactive learning and health games by building on successes like Wii Fit and leveraging R&D, talent, and distribution. The recommendation is to address competition short term while building a new "blue ocean" strategy long term moving gaming into education and healthcare.