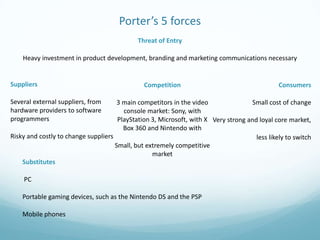

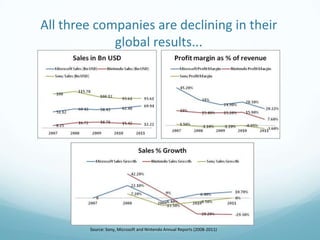

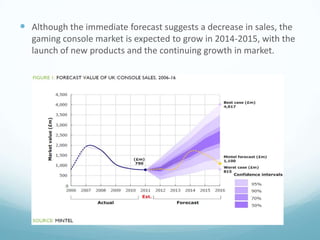

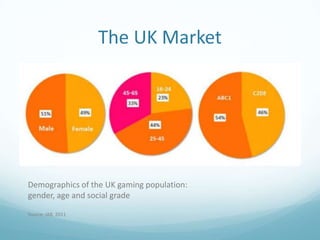

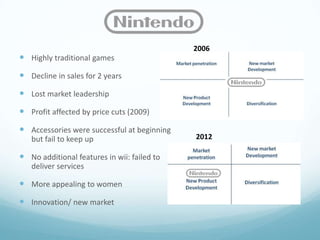

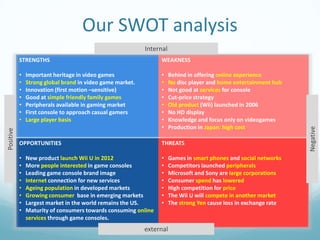

The document discusses the global video game console industry and provides an analysis of Nintendo's position in the market. It notes that while the industry generates $65 billion annually, Nintendo's sales have been declining. The summary analyzes Nintendo's strengths and weaknesses, as well as opportunities and threats. It recommends that Nintendo focus on launching its new Wii U console in 2012 while targeting new audiences through strategic alliances and marketing campaigns centered around online services, education, health, seniors, women, and establishing the console as a family entertainment hub.