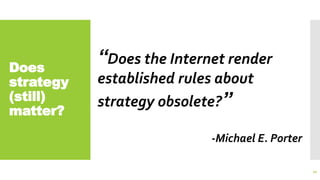

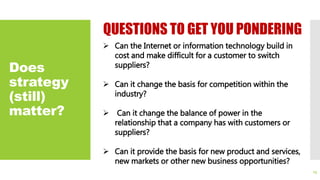

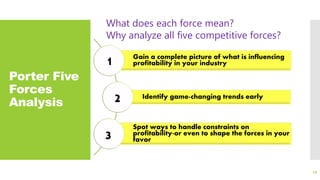

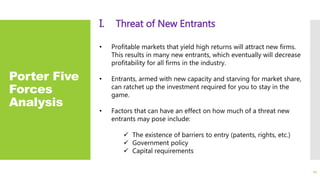

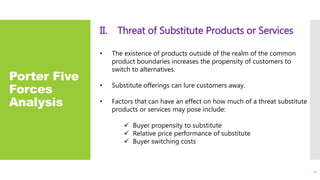

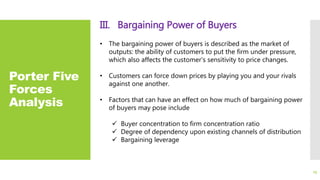

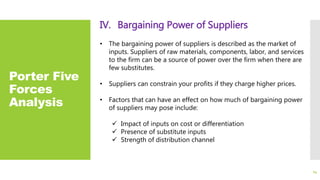

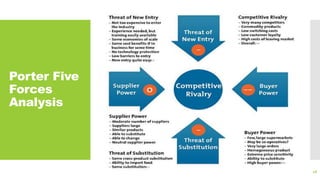

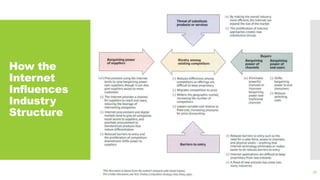

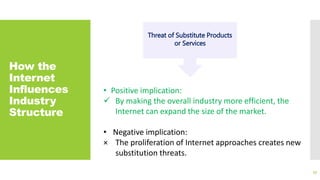

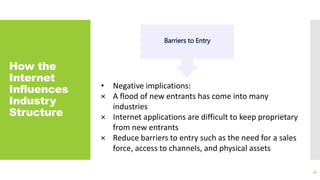

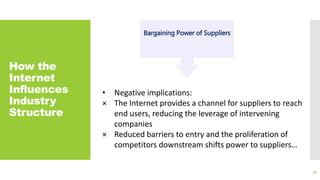

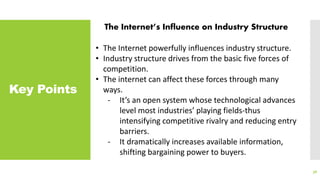

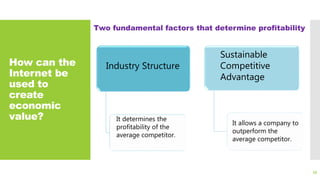

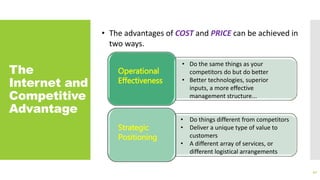

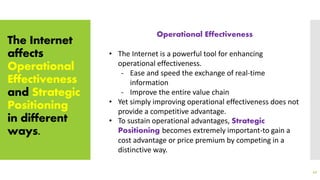

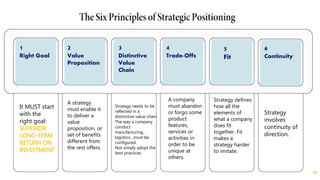

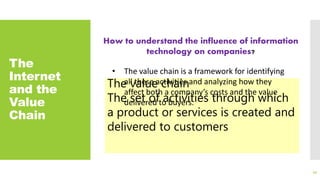

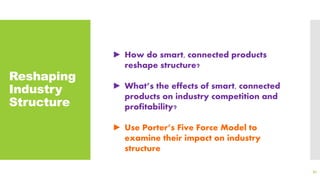

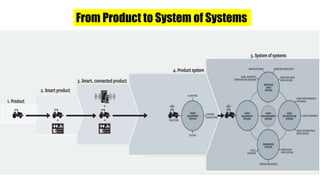

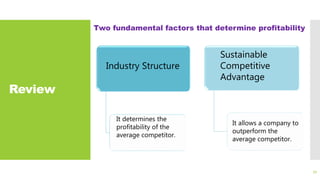

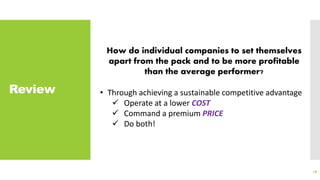

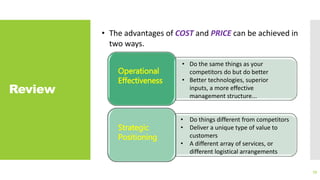

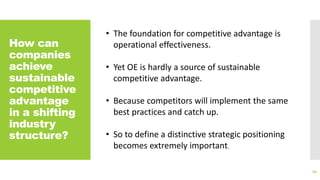

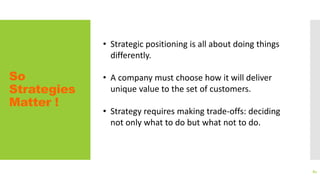

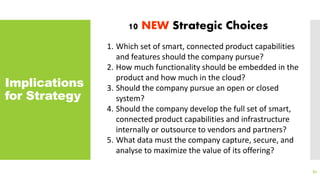

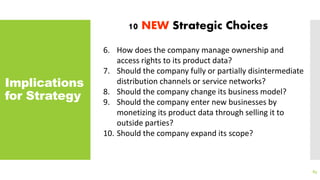

The document discusses how the internet influences industry structure and competitive advantage according to Michael Porter's theories. It outlines three "waves" of information technology from the 1960s to present. Porter argues that strategy is still important in the digital age. The document then summarizes Porter's five forces model and how each force (threat of new entrants, substitute products, bargaining powers of buyers and suppliers, competitive rivalry) can be positively or negatively impacted by the internet. Specifically, the internet can intensify competition but also create new opportunities to gain advantage through lower costs or differentiated products.