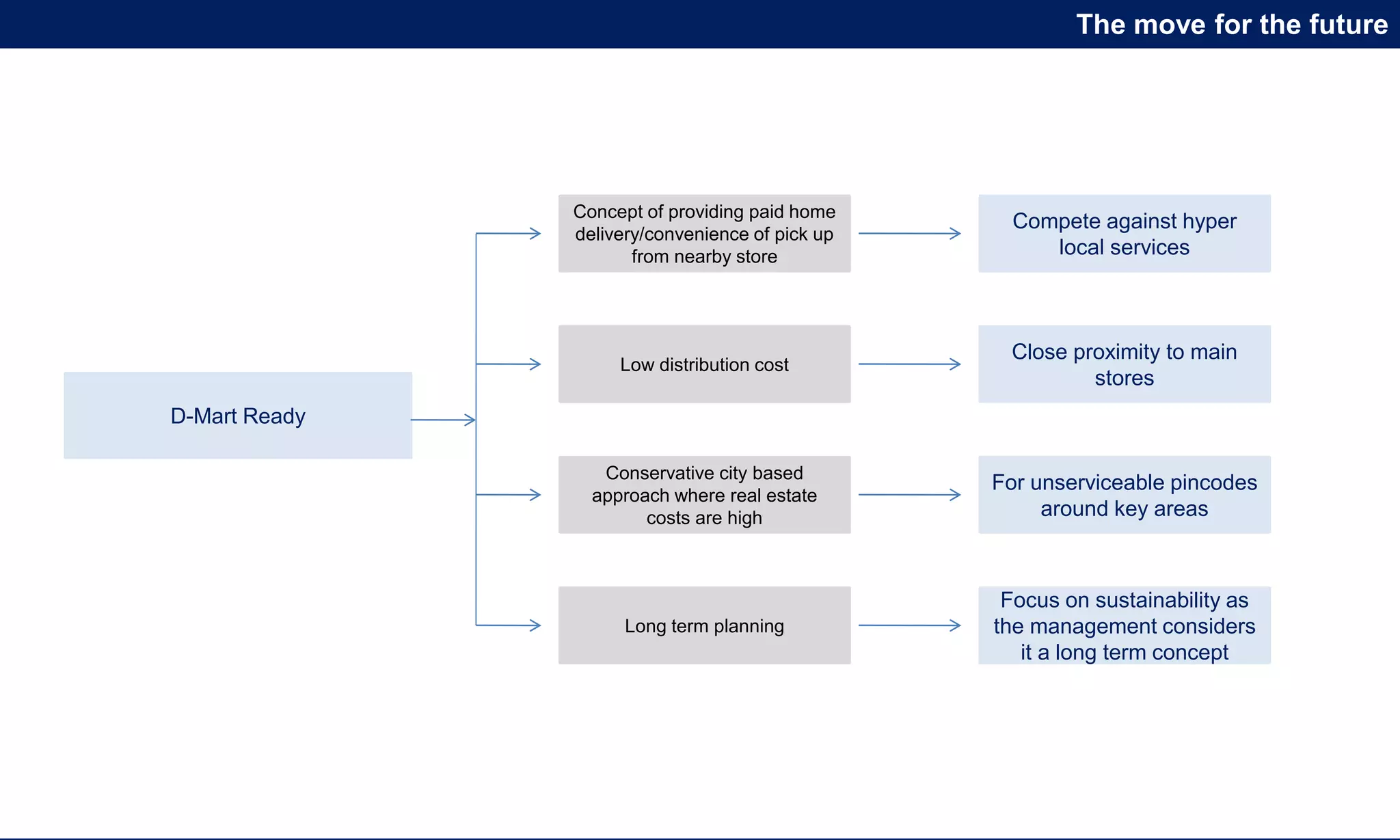

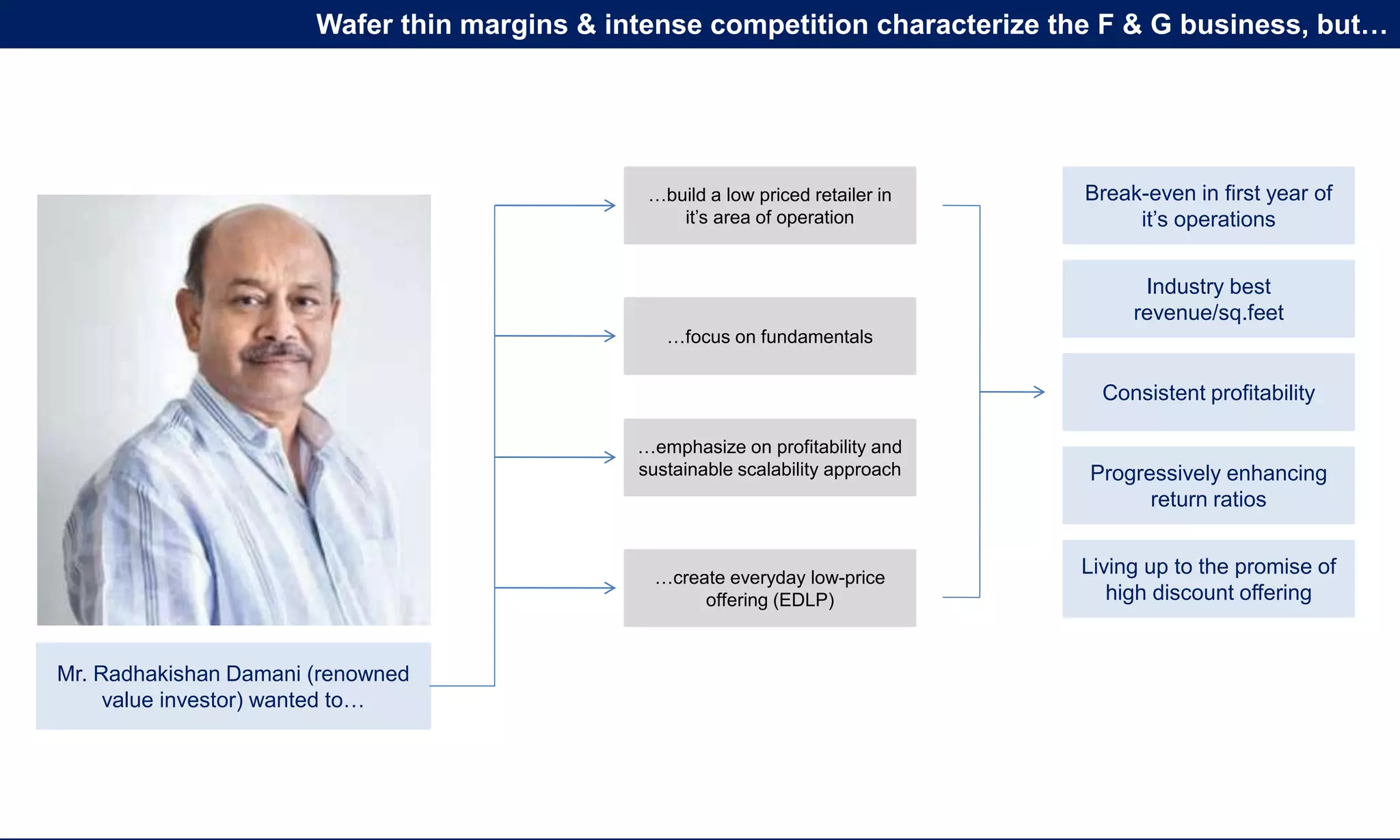

D-Mart focuses on building a sustainable low-priced retail model emphasizing profitability and customer-centricity, targeting value-conscious consumers in suburban areas. Its competitive advantages include a cluster-based expansion strategy, frugal store infrastructure, and strong vendor relations, resulting in impressive financial metrics like a 23% ROCE. The company plans to enhance its services through initiatives like D-Mart Ready for home delivery while maintaining a long-term view on sustainability.

![Cluster based expansion strategy

Deepening penetration in areas where they already have footprints instead of expanding in newer regions.

[Source: ICICI Securities]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-4-2048.jpg)

![Cluster based expansion strategy

Ownership model rather than a

lease model

Regional/local clustering

Protection from unreasonable renewal

hikes that could affect profitability

negatively

Cost benefits on fixed expenses pass

on to consumers

Superior industry specific parameters

(RoCE 23%, Gross fixed asset

turnover of 4.1x)

Conservative new store addition

Opening new stores within radius of

few kms of its operating stores

Higher cost efficiency and visibility due

to concentrated marketing activities &

efficient SCM

On an average, ASL added 21 stores/yr during FY

16 to FY 19

Even faster growth of total

carpet area

Healthy asset turnover ratio Return ratio

[Source: ICICI Securities]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-5-2048.jpg)

![Cracking the consumers’ buying psyche

Targeting value conscious market

Customer loyalty using EDLP

strategy

Product categories: Food, FMCG,

General merchandise & apparel

Location: Sub-urban areas of major

cities; residential places; densely

populated

Target: Lower middle, middle and

aspiring upper middle class (inc. <Rs.

50000 per month)

Cost effective procurement policy

High levels of discounts compared to

peers

27% CAGR in terms of bills issued Improving average bill size

ASL’s revenue break up (Food category contributing to 50%+ revenue)

[Source: ICICI Securities]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-6-2048.jpg)

![Razor sharp product assortments

Stocking

Vendor relations

Limited SKUs of popular brands due to

their high recalls

Local preference orientation and bulk

buying to achieve better neotiation

Conservative approach towards private

labels

Faster credit cycle results in higher

cash discounts from vendors

Accelerated inventory churning

Controlled working capital cycle & low

creditor days

One of the best inventory turnover in the industry

Sustained record of low payable days

[Source: ICICI Securities]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-7-2048.jpg)

![The impact of strategies on the KPIs

[Source: Annual Report 2019, ASL]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-8-2048.jpg)

![The impact of strategies on the KPIs

The strategy of cost efficiencies while

offering best customer value has witnessed

stable performance across financial and

operational parameters.

[Source: Annual Report 2019, ASL]](https://image.slidesharecdn.com/d-martstrategy-200408153500/75/Strategy-analysis-of-D-Mart-9-2048.jpg)