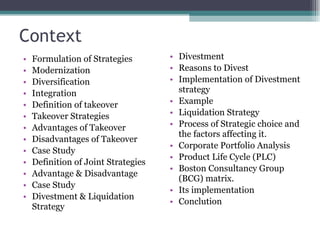

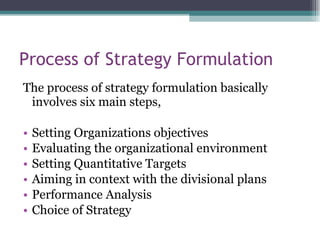

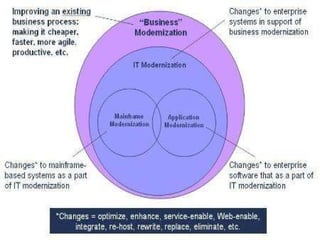

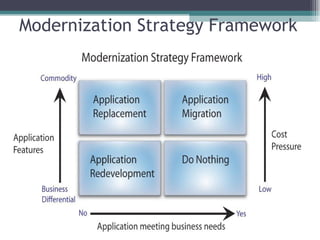

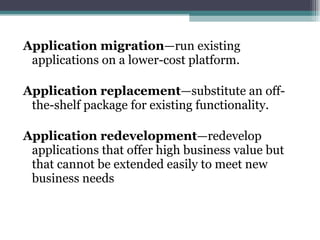

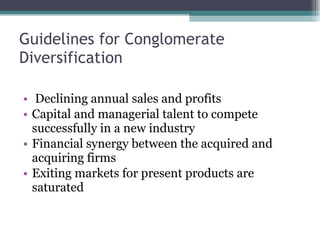

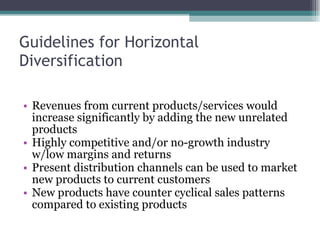

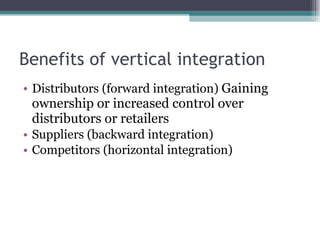

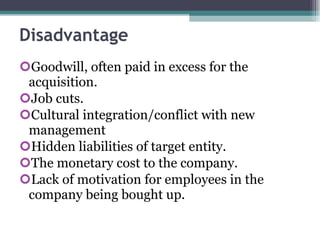

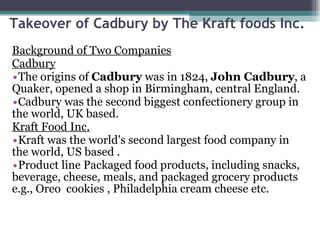

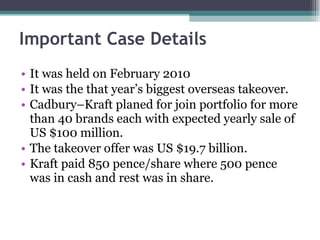

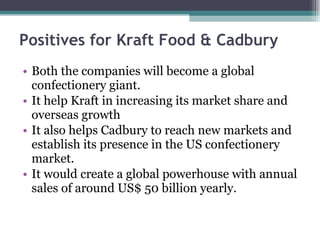

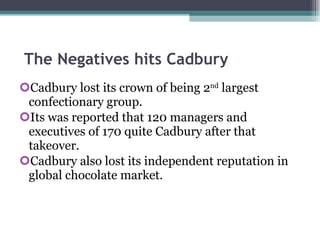

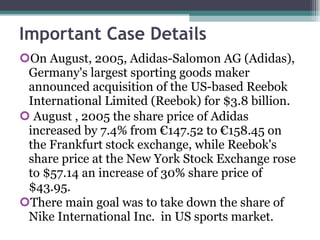

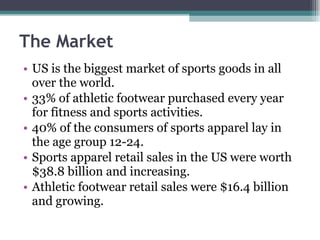

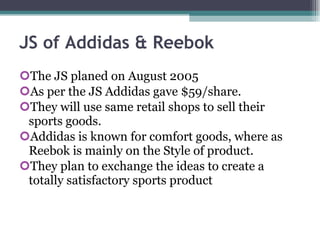

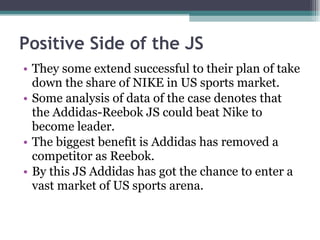

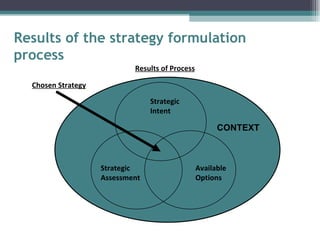

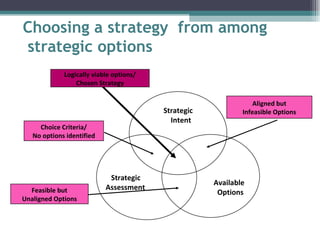

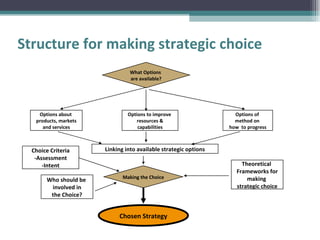

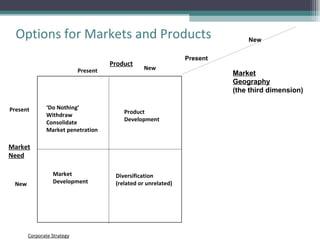

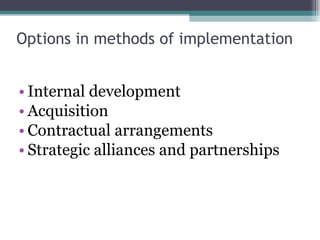

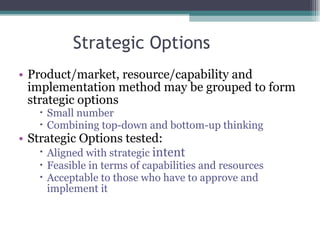

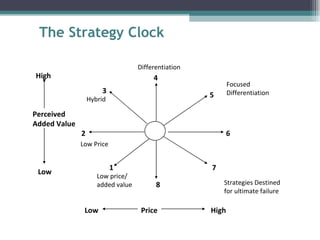

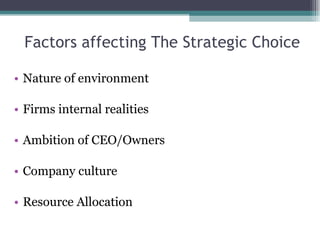

The document discusses various strategic management concepts for tourism including strategy formulation, modernization, diversification, integration, takeovers, joint strategies, divestment, liquidation, and strategic choice. It provides definitions and examples of these concepts. The strategy formulation process involves setting objectives, evaluating the environment, setting targets, analyzing performance, and choosing a strategy. Modernization aims to improve current business processes. Diversification expands into new markets or products. A takeover case study examines Kraft's acquisition of Cadbury. Joint strategies and divestment are discussed as options.