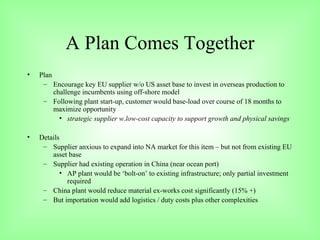

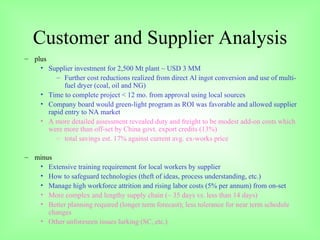

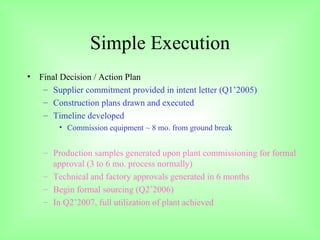

The document discusses two strategic sourcing examples that provided high customer value:

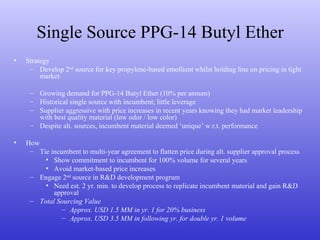

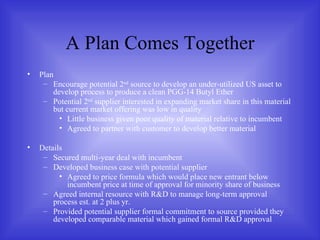

1. Sourcing antiperspirant salt from China through a supplier's new plant. This saved $1.05 million annually and established a long-term strategic supplier.

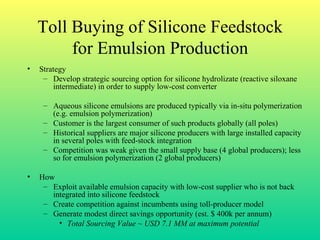

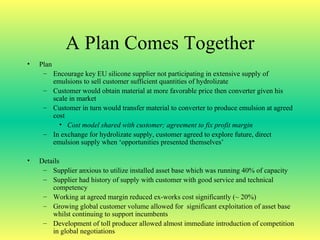

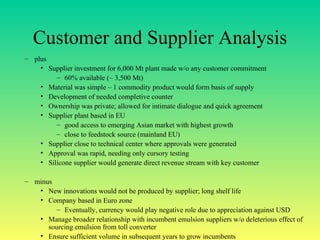

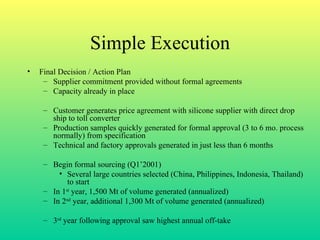

2. Toll buying silicone feedstock from a supplier and shipping to a converter to produce emulsions. This introduced competition and saved $400,000 annually. Both created ongoing value through competitive pricing and security of supply.