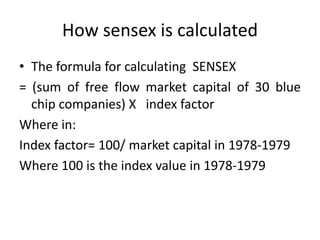

The document discusses share markets and stock market fundamentals. It defines key terms like shares, stock exchanges, indices like Sensex and Nifty, and market types. It also summarizes the different types of investors and investments based on time horizon. Key stock market metrics like market capitalization, outstanding shares, and quarterly results are explained. The document provides an overview of how stock prices change and how indices like Sensex are calculated.