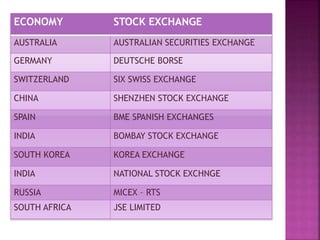

A stock market is a public market for trading company stock and derivatives at agreed prices. Stocks are listed on stock exchanges, which are entities like the New York Stock Exchange. Companies raise money by borrowing or selling shares to investors on the stock market. The key stock exchanges in various economies around the world are listed.