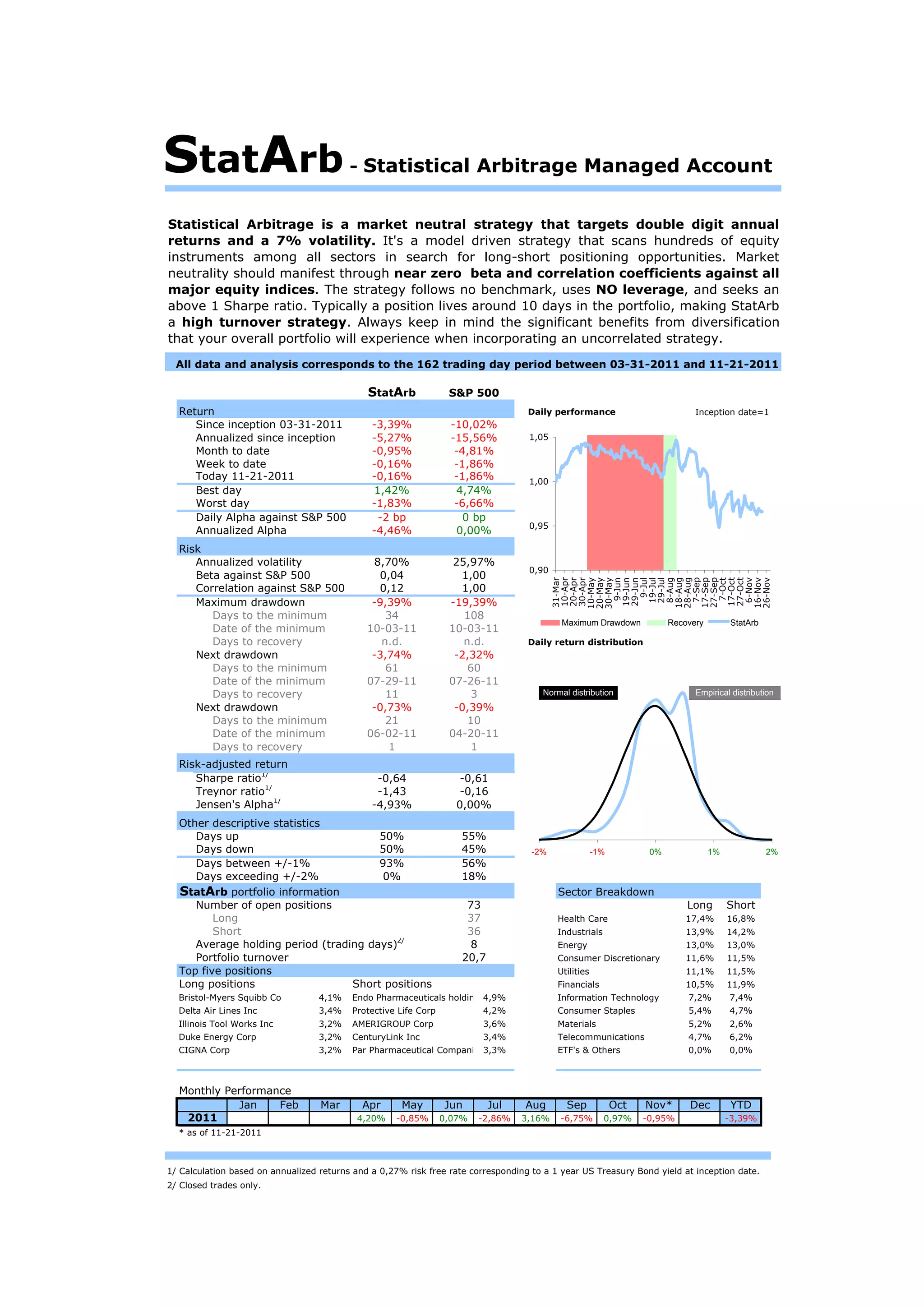

This document summarizes a statistical arbitrage managed account strategy. [1] It targets double digit annual returns with 7% volatility through a model-driven, market neutral strategy that scans hundreds of instruments for long and short opportunities. [2] The strategy has near zero correlation to equity indices, uses no leverage, and seeks a Sharpe ratio above 1. [3] Positions typically last 10 days, making it a high turnover strategy.