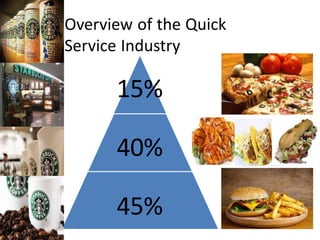

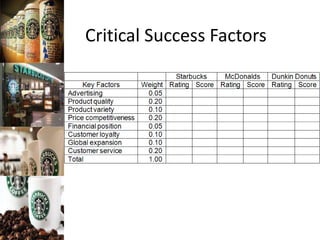

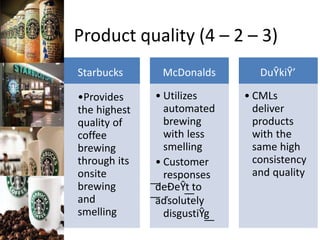

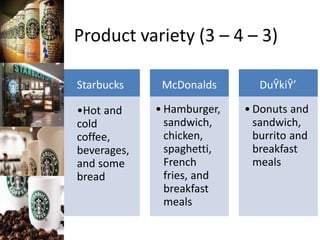

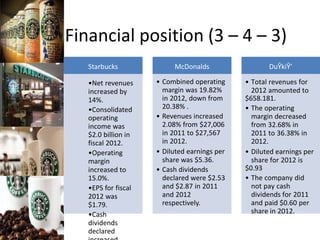

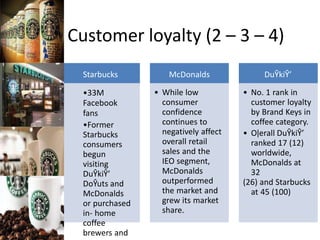

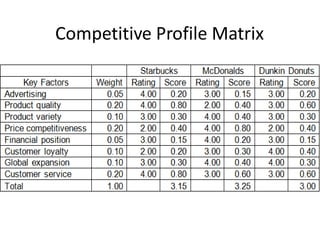

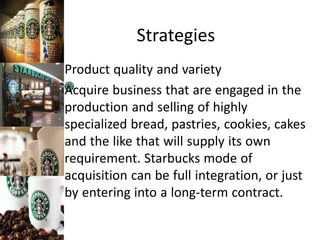

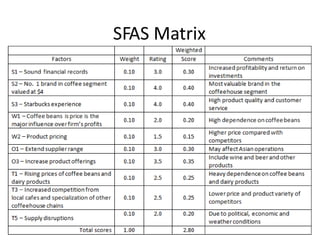

This document analyzes Starbucks and its major competitors McDonald's and Dunkin Donuts. It provides an overview of the quick service industry and discusses critical success factors such as advertising, product quality, variety and competitiveness, financial position, customer loyalty, and global expansion. A competitive profile matrix compares the companies on these factors. The document then outlines strategies for Starbucks to improve product quality and variety, price competitiveness, customer loyalty, and global expansion through partnerships, acquisitions, and expanding into new markets.

![General Strategies

Acquisition or control of brokerage /

logistiĐ firŵs to support StarďuĐk’s

supply chain management.

Acquisition or control or coffee bean

and

dairy product producers. ;]]](https://image.slidesharecdn.com/starbucks-220911102106-8b97015a/85/starbucks-ppt-27-320.jpg)