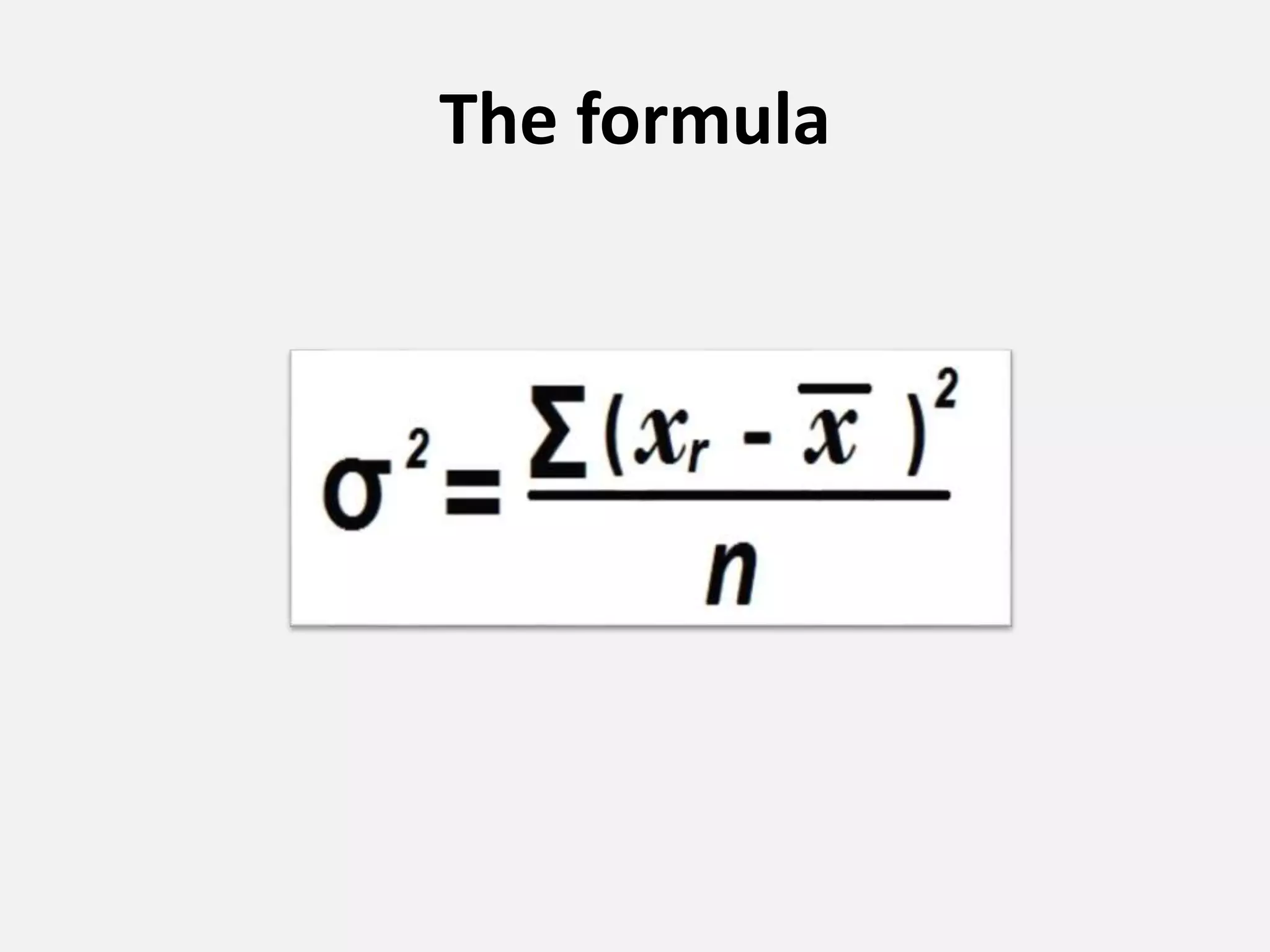

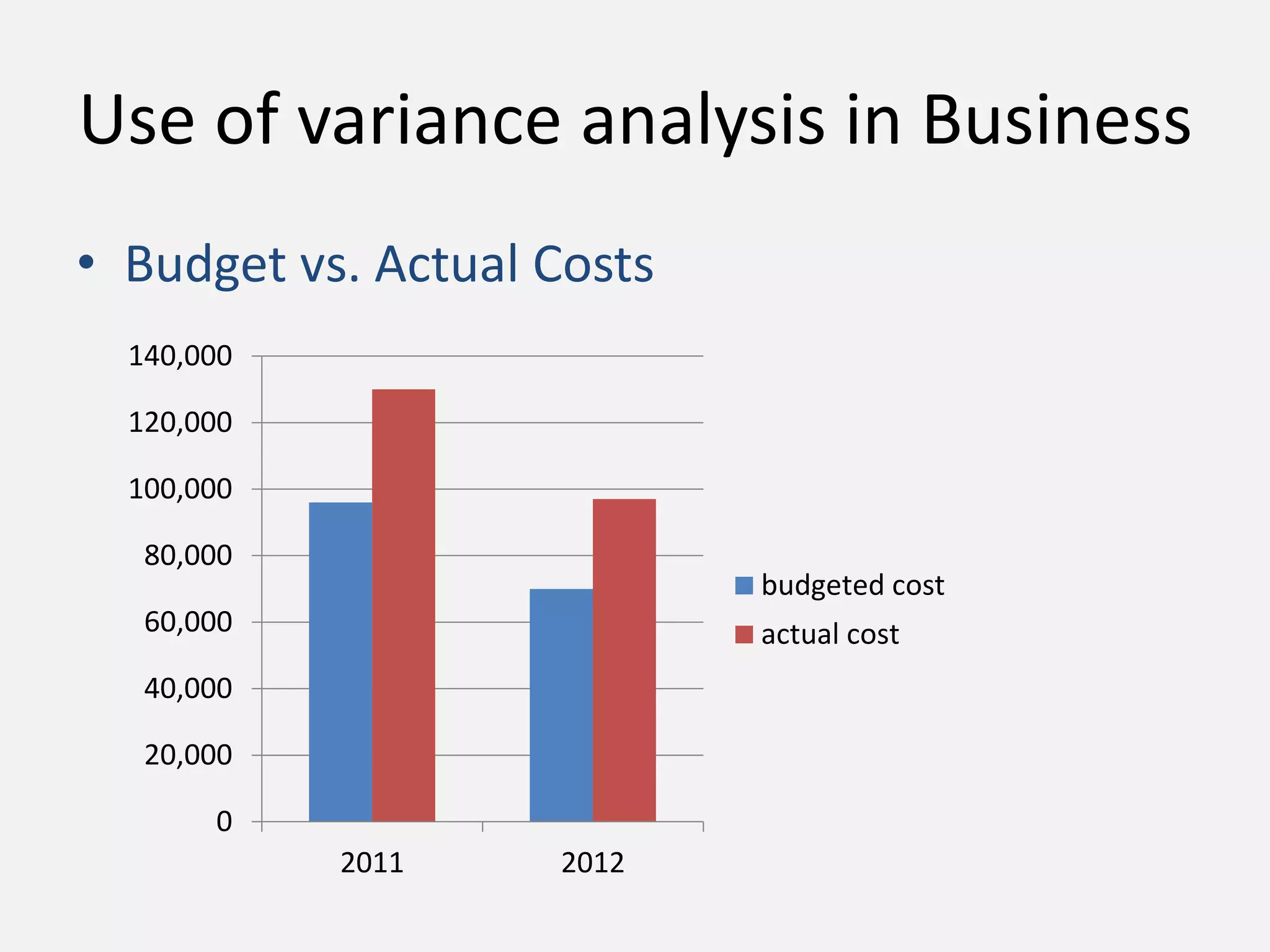

The document discusses the significance of variance analysis in business, introducing its role in evaluating performance through the comparison of budgeted versus actual figures. It emphasizes the importance of variance analysis in managing budgets, forecasting future performance, and gaining a competitive advantage in the market. The concepts of variance and its application in controlling costs and revenue are highlighted as essential tools for effective management.