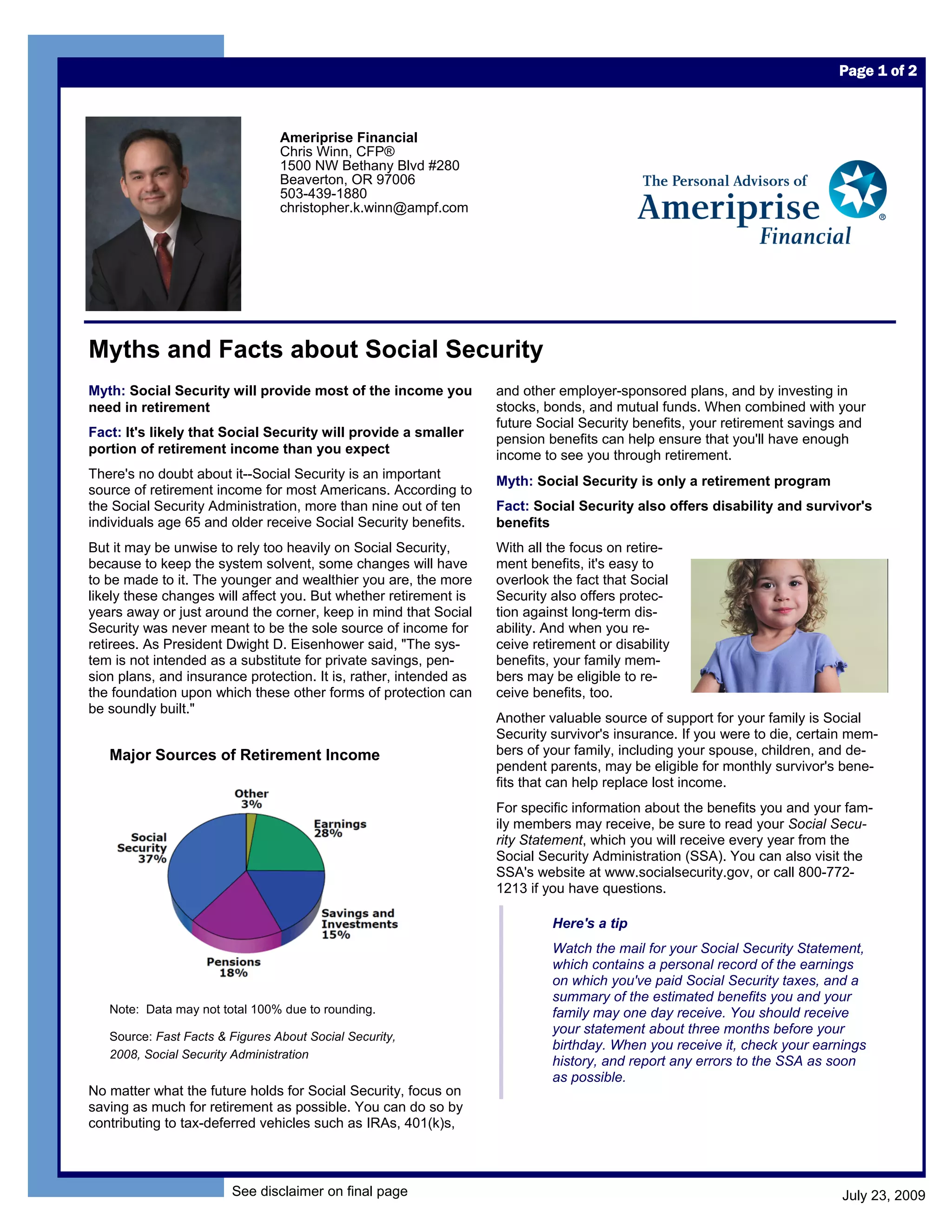

Social Security will likely provide less retirement income than expected. It was intended as a foundation for other savings through pensions, investments, and insurance. While focusing on retirement benefits, Social Security also offers disability and survivor benefits. Earnings after retirement only impact benefits for those below full retirement age. Benefits may be taxable based on other income levels.