This document provides information to help baby boomers answer questions about maximizing their Social Security retirement benefits. It discusses:

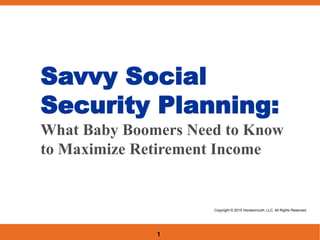

1) Social Security benefits are projected to be able to pay full benefits until 2033 after which payments would be reduced to 77% of scheduled benefits unless reforms are made.

2) An individual's Social Security benefit is based on their lifetime earnings and claiming age. Various calculators can provide estimates but strategies like delaying benefits up to age 70 can substantially increase monthly payments.

3) Spousal, survivor, divorced spousal and other family benefits are available and claiming strategies like "file and suspend" can help maximize benefits for married couples.

4) Social Security is unlikely

![8

Long-term projections:

without reform, benefits fall to 77% in 2033

Source: 2014 OASDI Trustees Report

OASDI Income, Cost and Expenditures as Percentages of Taxable Payroll

[Under Intermediate Assumptions]

Cost: Scheduled but not

fully payable benefits

Income

Expenditures: Payable benefits =

income after trust fund exhaustion

in 2033

Cost: Scheduled and

payable benefits

Payable benefits as percent

of scheduled benefits:

2013-2032: 100%

2033: 77%

2088: 72%

Cost: Scheduled but not

fully payable benefits](https://image.slidesharecdn.com/savvysocialsecurityclientpresentation03132015-150313115656-conversion-gate01/85/Savvy-social-security_client_presentation_03132015-8-320.jpg)