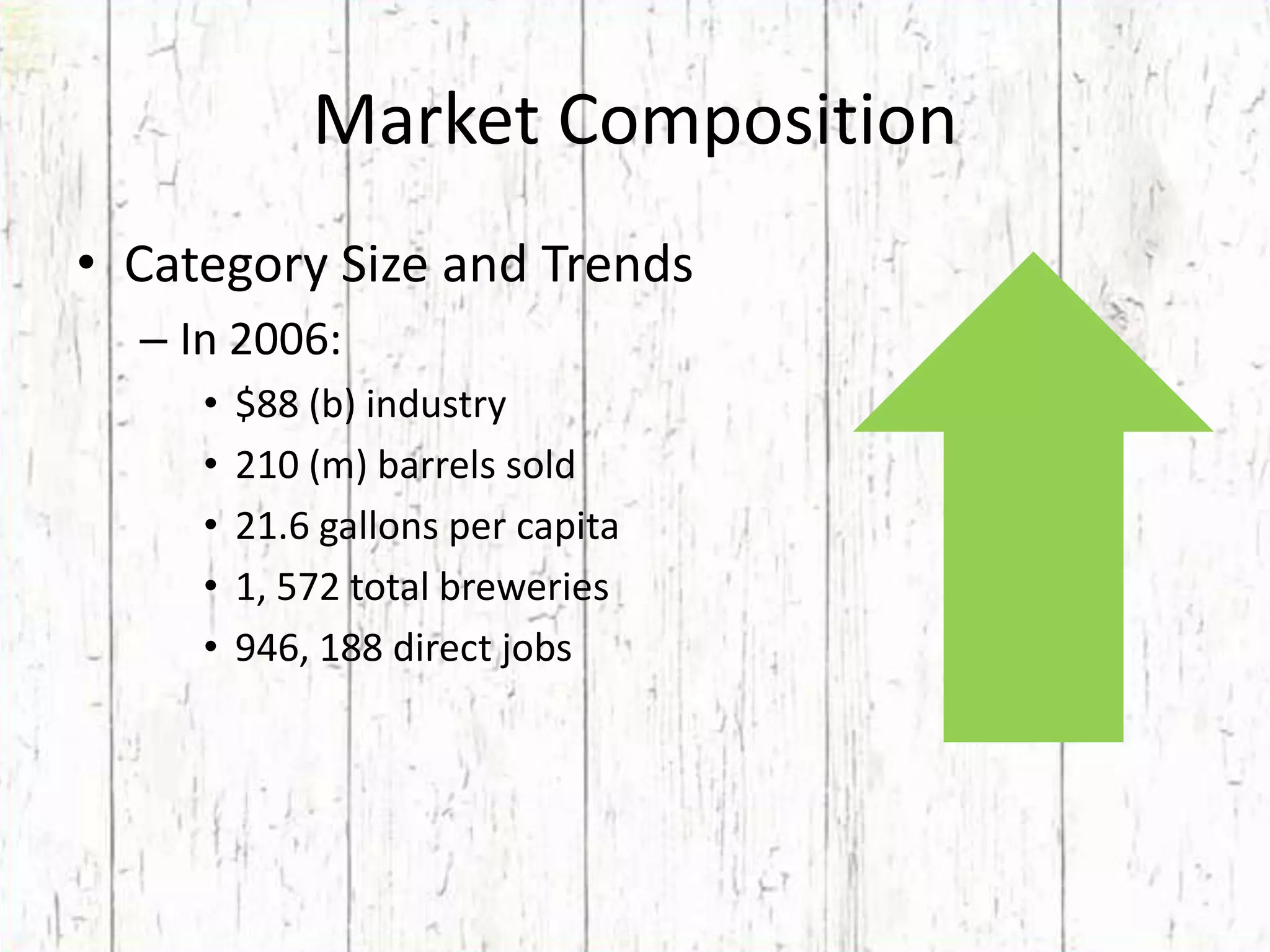

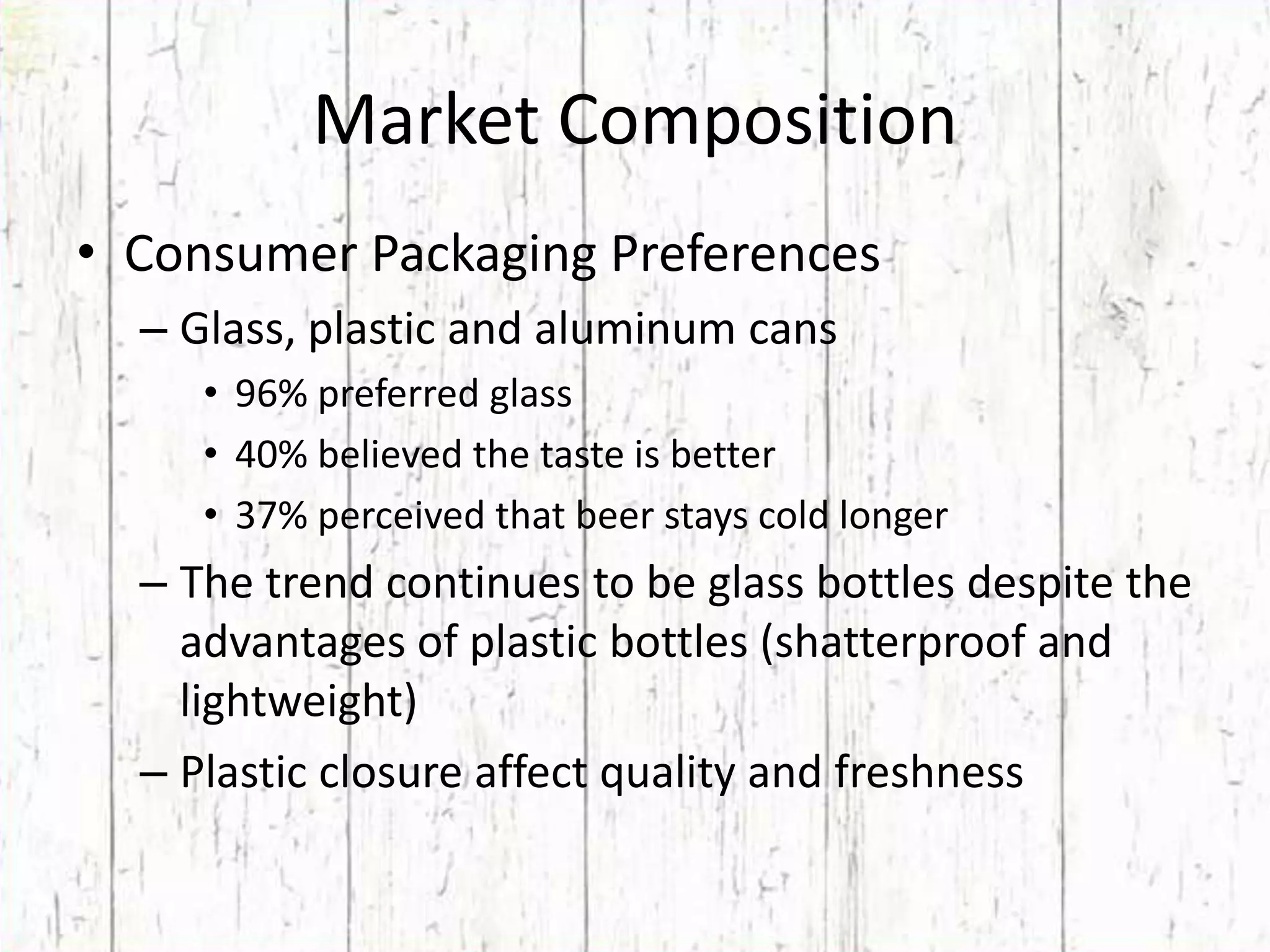

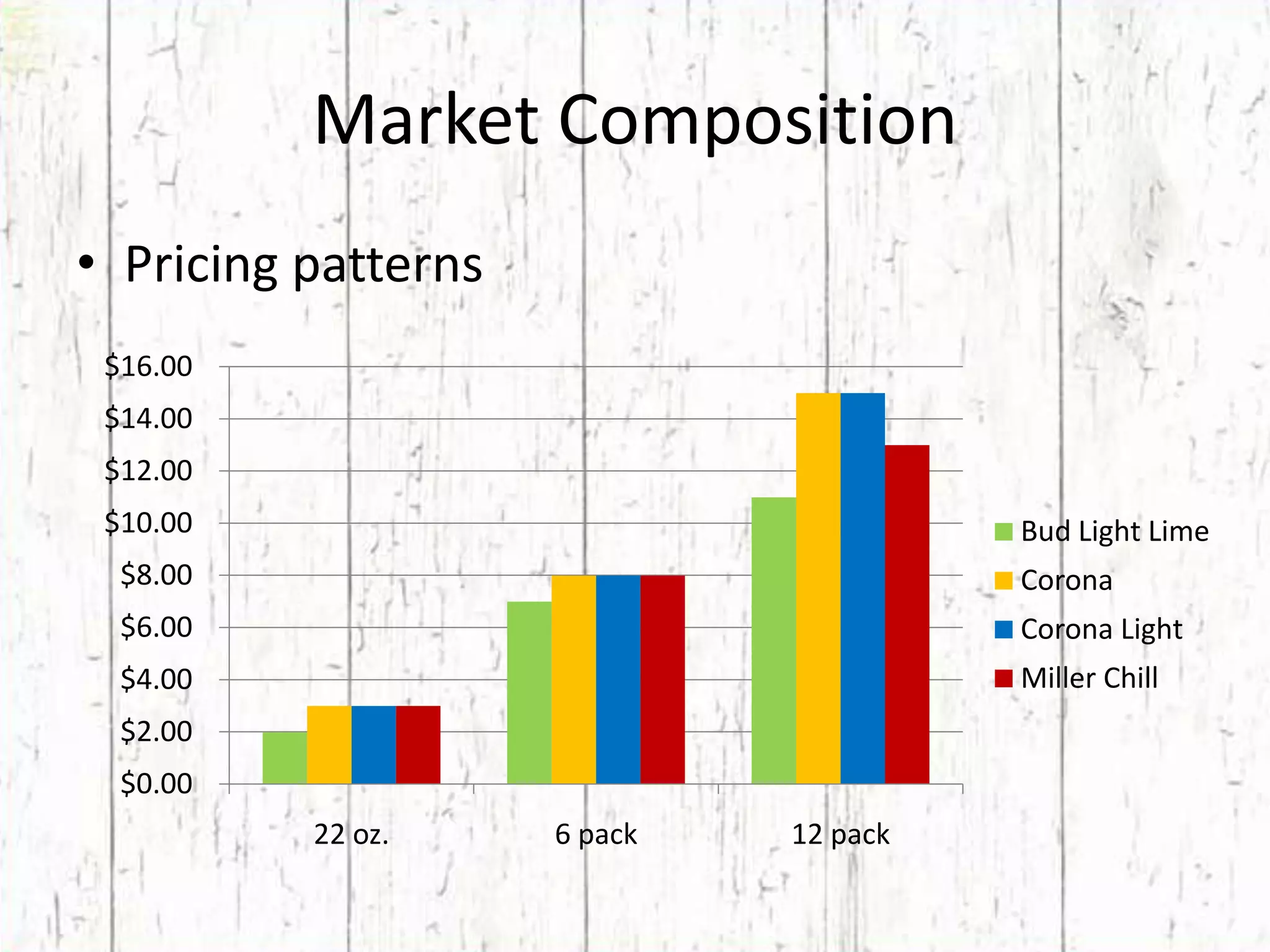

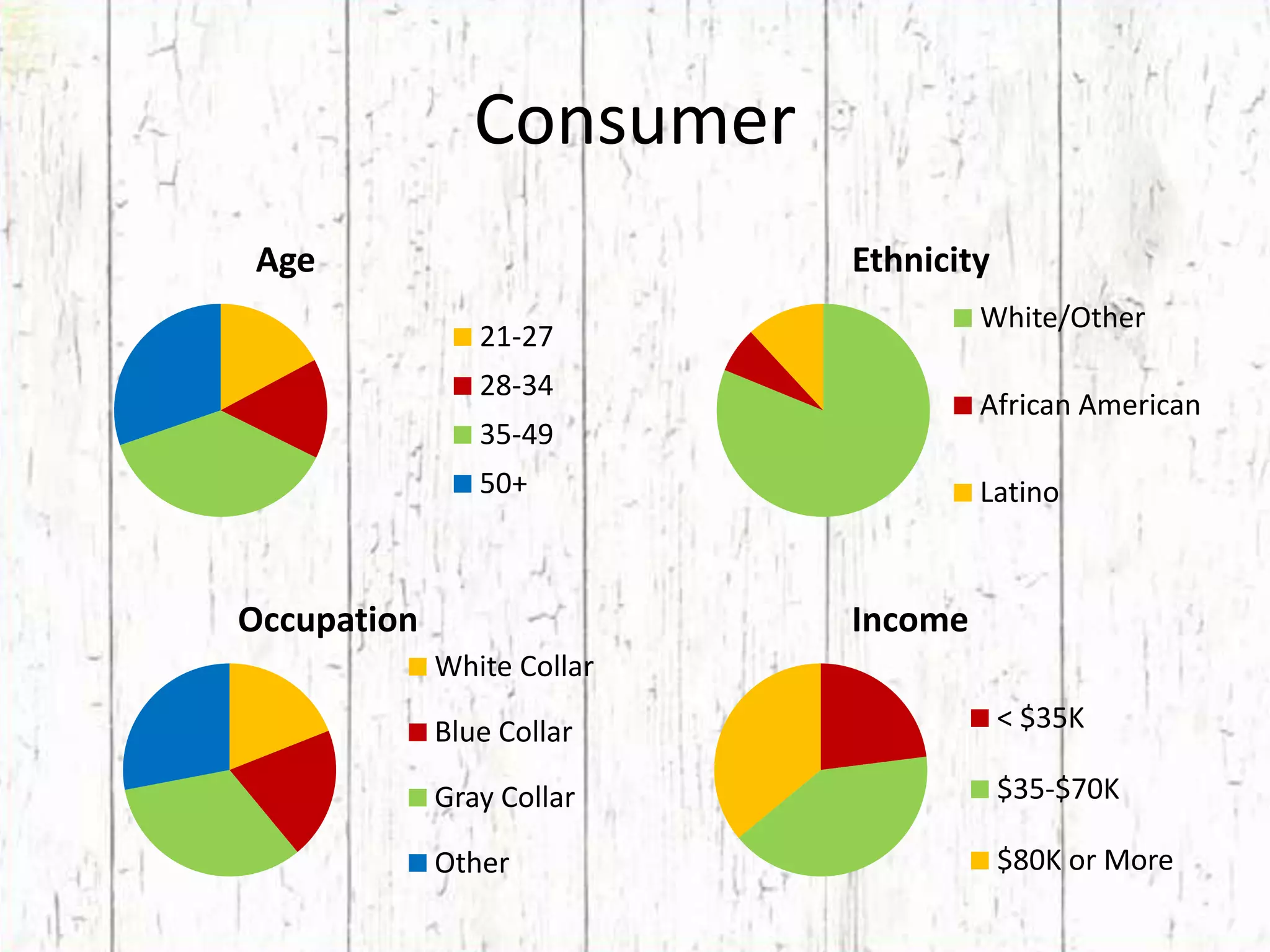

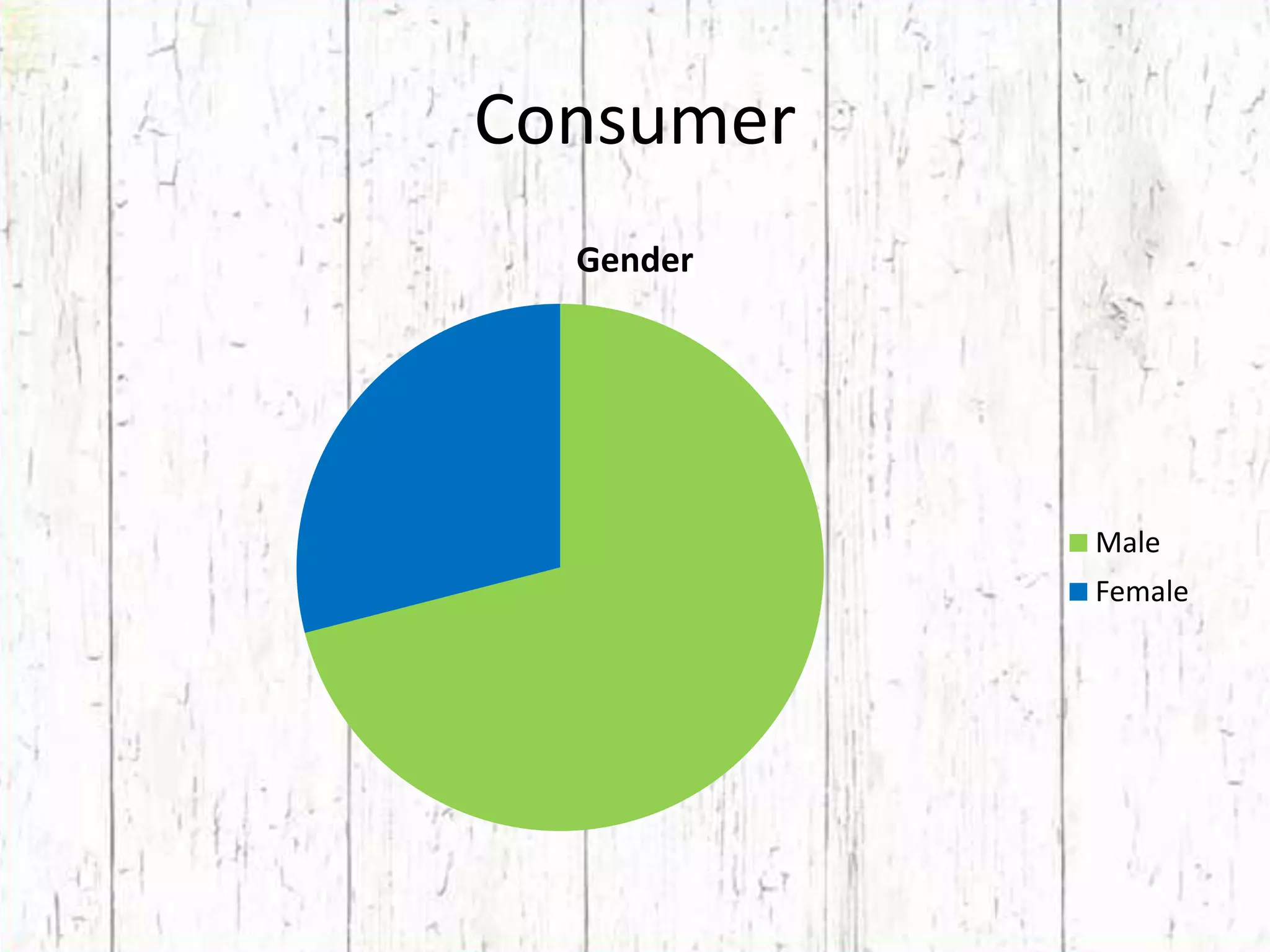

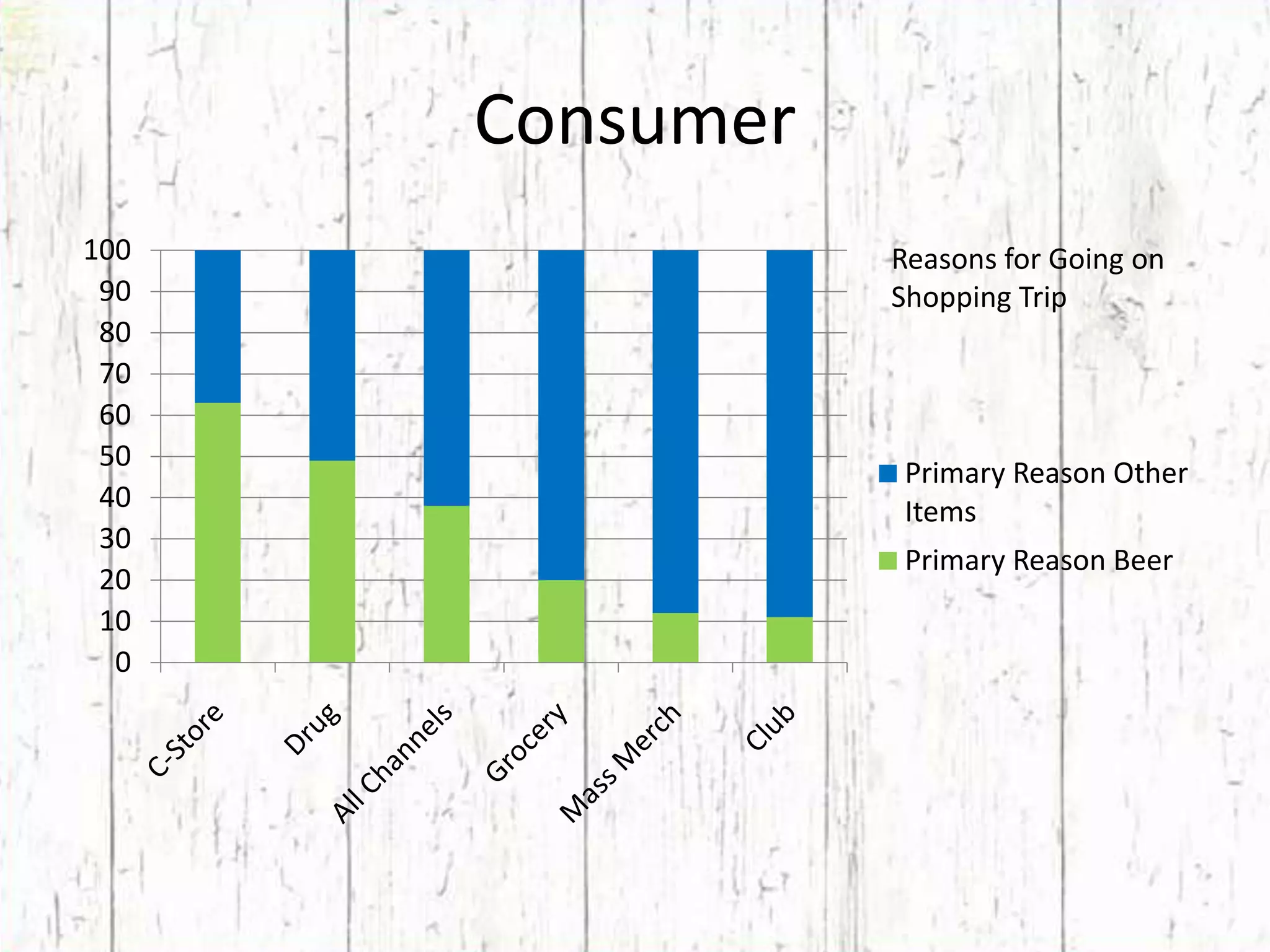

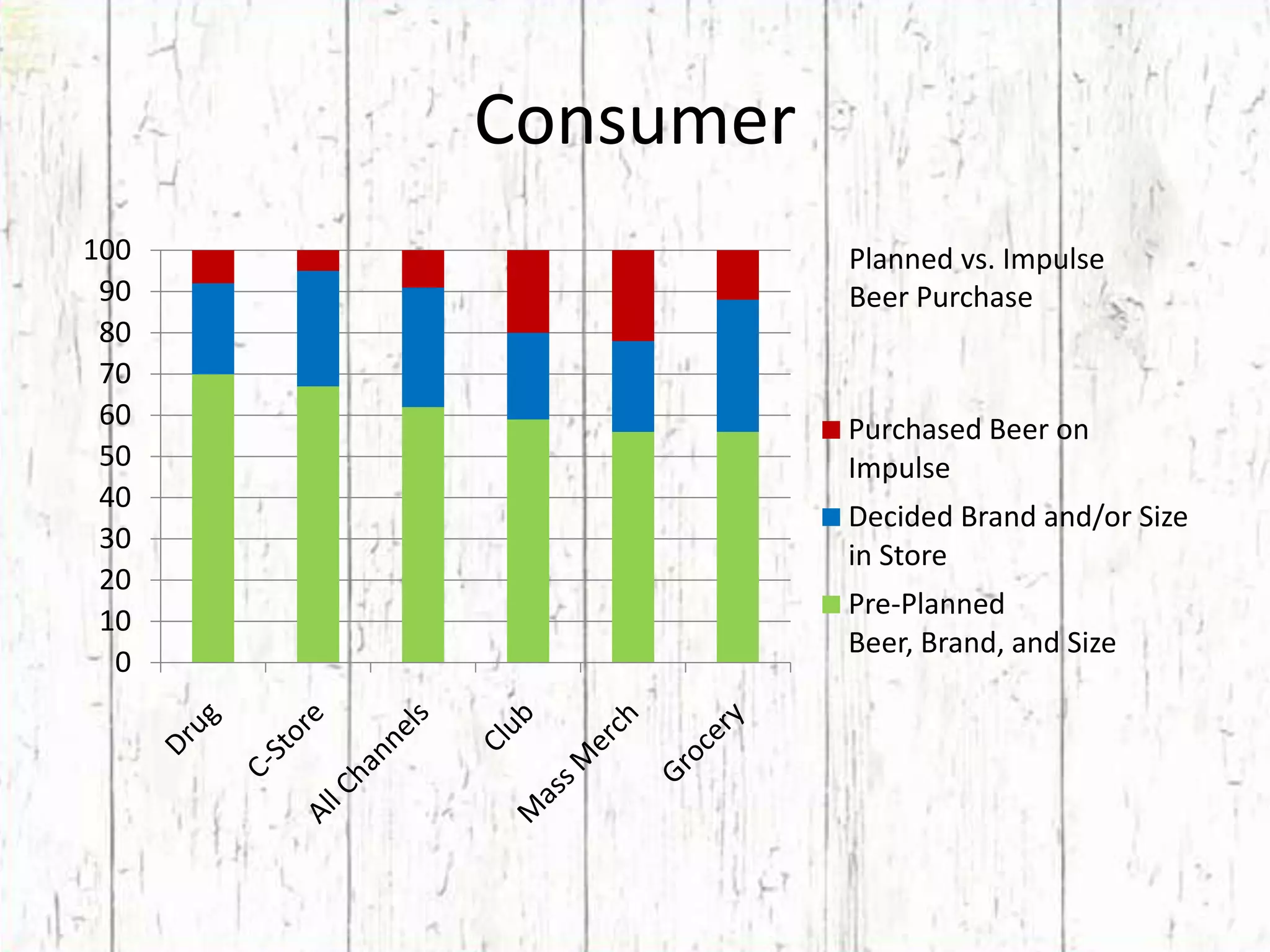

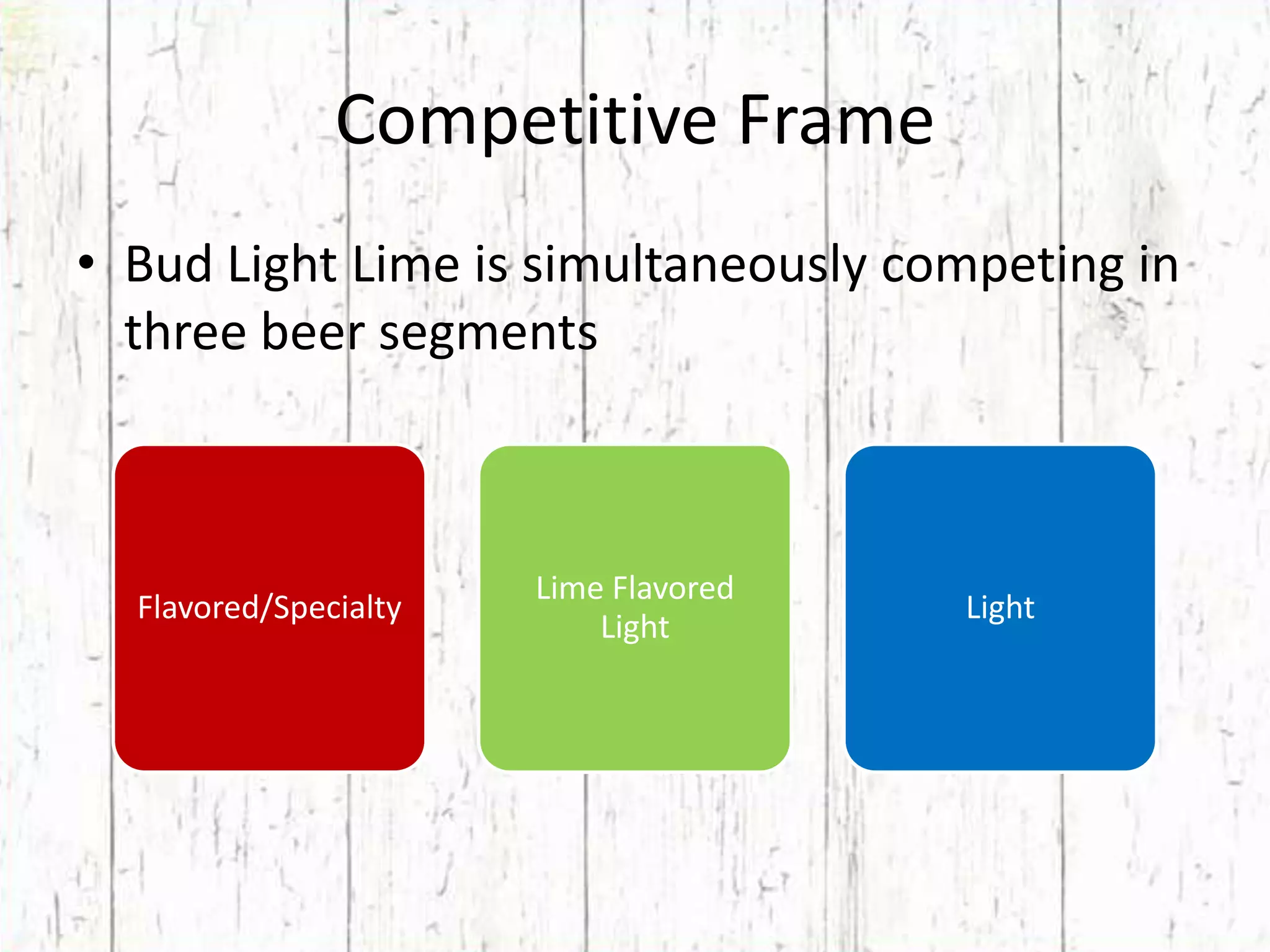

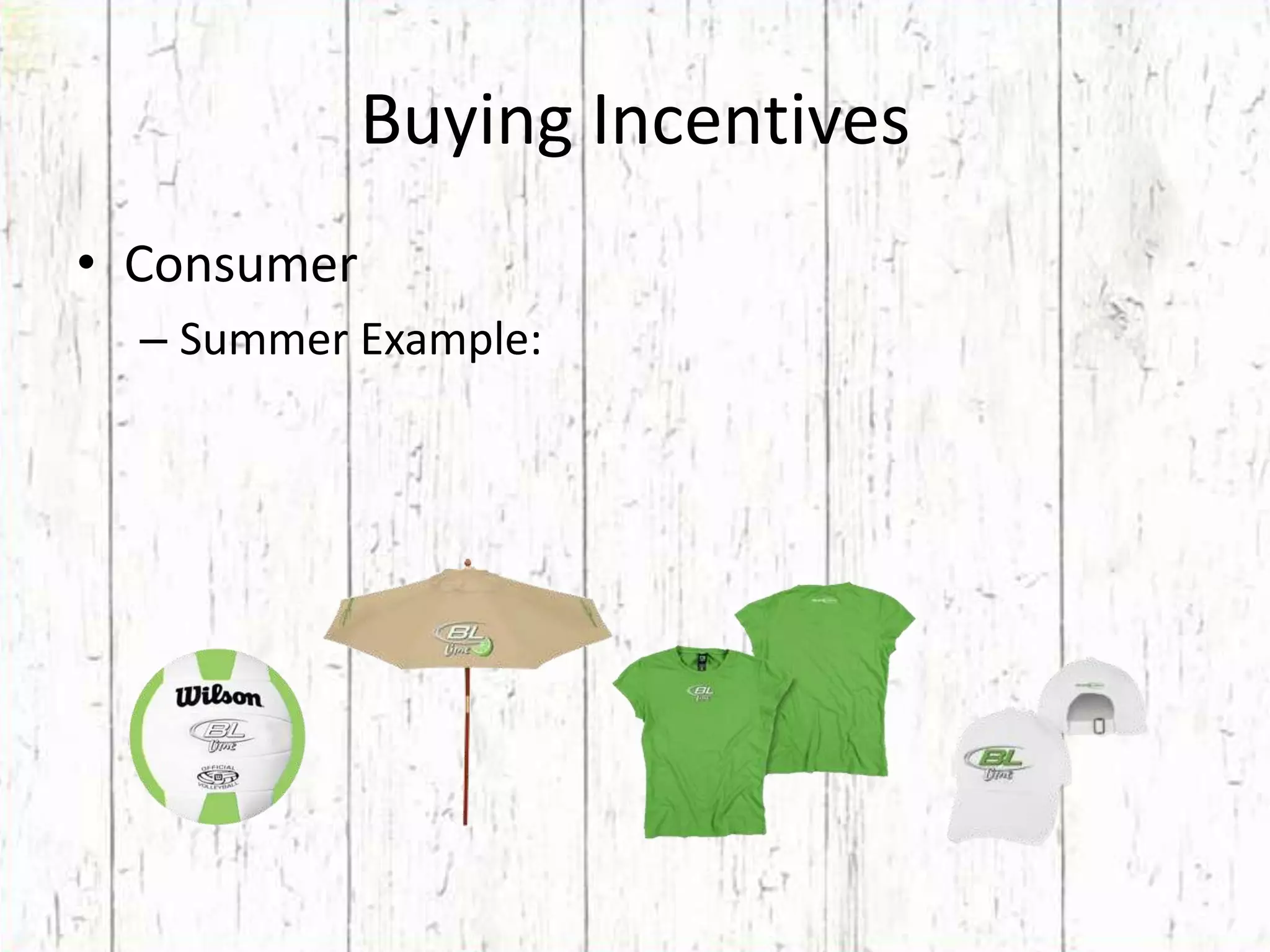

This document discusses Bud Light Lime, a flavored beer produced by Anheuser-Busch. It provides information on the beer market, consumer behavior, competitors, and Bud Light Lime's marketing strategy. The objectives are to increase sales 7% in Q4 2009, gain market share across three categories, and change positioning to year-round drinkability. The target audience is males and females ages 21-27 who want flavored beers. The marketing strategy will utilize various promotions, expand distribution, and increase spending to outpace competitors while maintaining a fun, versatile brand personality across media.