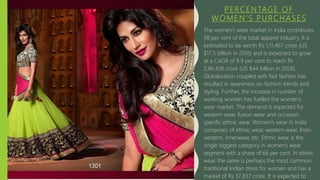

The Indian textiles industry is one of the oldest in India dating back centuries. It is an important part of the Indian economy, with textile exports reaching US$39.2 billion in FY 2017-18. The textiles sector in India ranges from hand-woven textiles to sophisticated capital-intensive mills. It has the capacity to produce a wide variety of products for both domestic and international markets. The garments industry in India is also booming, especially for women's clothing, with demand growing across both metro and smaller cities. E-commerce is playing a major role in the growth and future of the textiles and apparel sector in India.