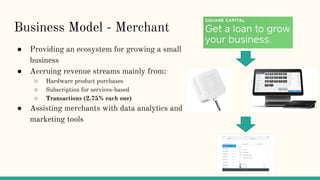

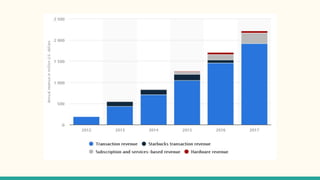

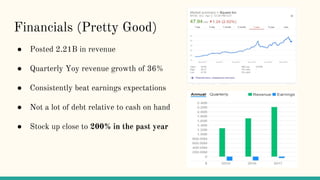

Square provides financial services and payment processing solutions for businesses. Its main products include Square Register for point of sale, Square Cash for personal payments, and Square Reader for accepting card payments on mobile devices. Square makes money from hardware sales, subscription services, and transaction fees of around 2.75% per payment. Founded in 2009, Square now has a diverse ecosystem and was valued at $2.9 billion after its 2015 IPO. It posted $2.21 billion in annual revenue and consistently beats earnings estimates, while maintaining a strong financial position with low debt. Square faces competition from other payment processors but has an intuitive design and was an early leader in the mobile payments space. With experienced leadership and multiple revenue streams, Square is