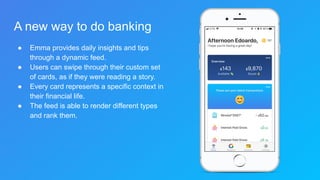

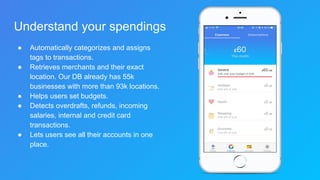

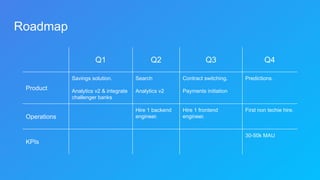

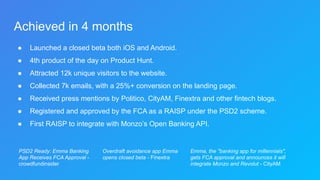

Emma is a financial management app designed to help users navigate their finances, focusing on insights, budgeting, and tracking expenses. With features like automatic categorization of transactions and subscription management, it aims to support users in managing their money effectively, especially those with multiple accounts and debts. The app has gained traction in the market, receiving FCA approval and positive user feedback for its intuitive interface and comprehensive financial insights.