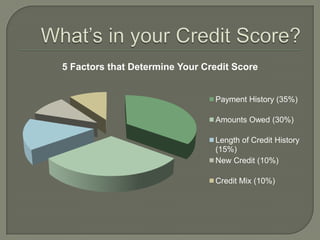

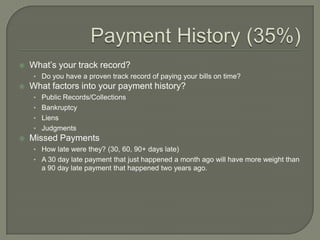

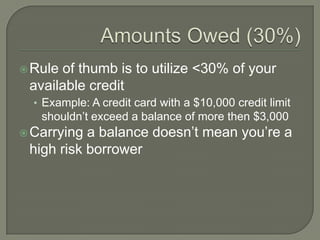

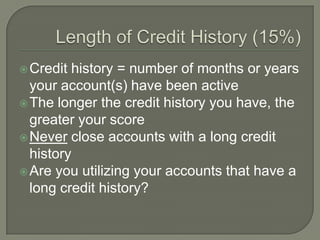

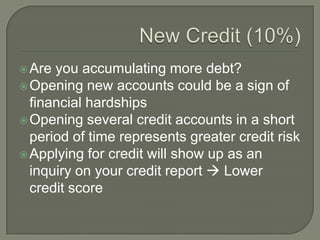

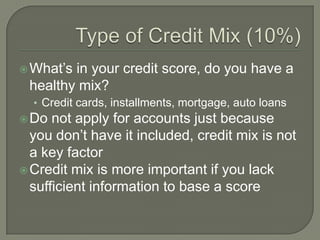

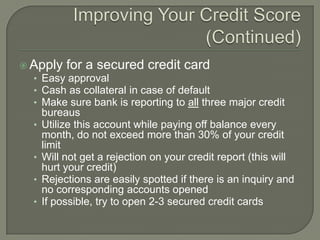

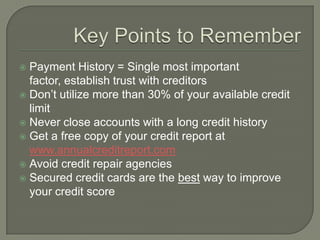

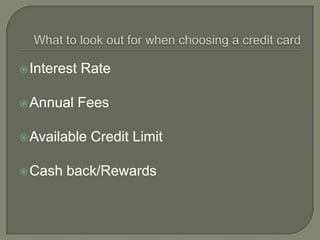

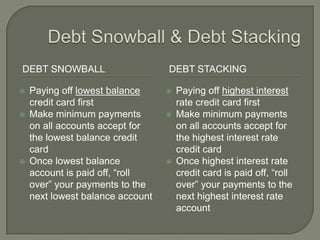

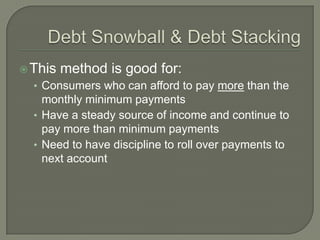

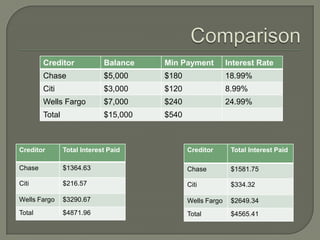

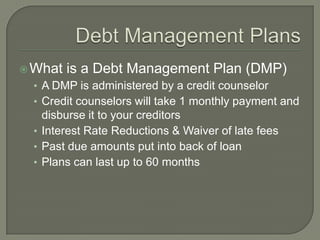

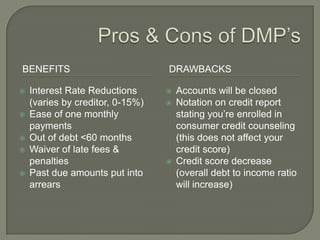

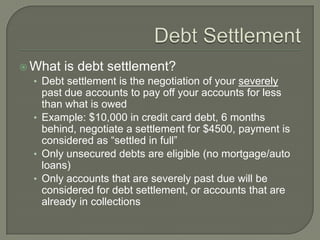

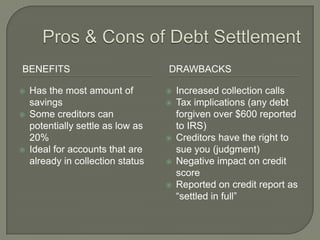

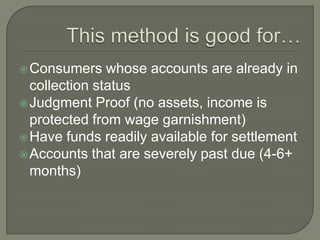

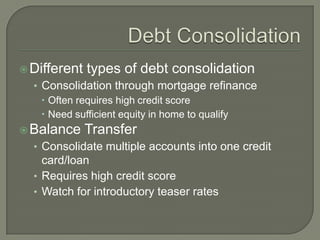

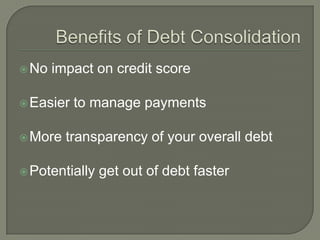

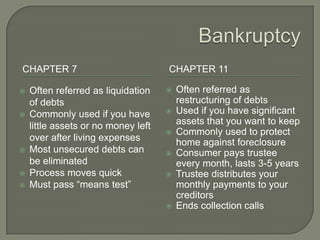

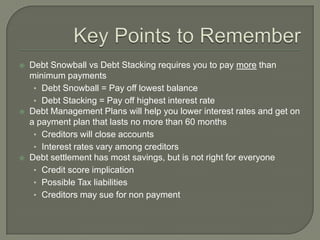

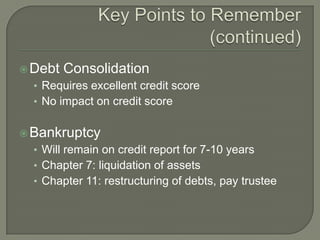

The document provides an extensive guide on understanding credit scores, their importance, and various methods for improving them, including managing payment history and utilizing secured credit cards. It discusses debt relief options such as debt snowball, debt management plans, debt settlement, and debt consolidation, highlighting their benefits and drawbacks. Additionally, it emphasizes responsible credit usage and the importance of maintaining a healthy credit mix while avoiding common pitfalls.