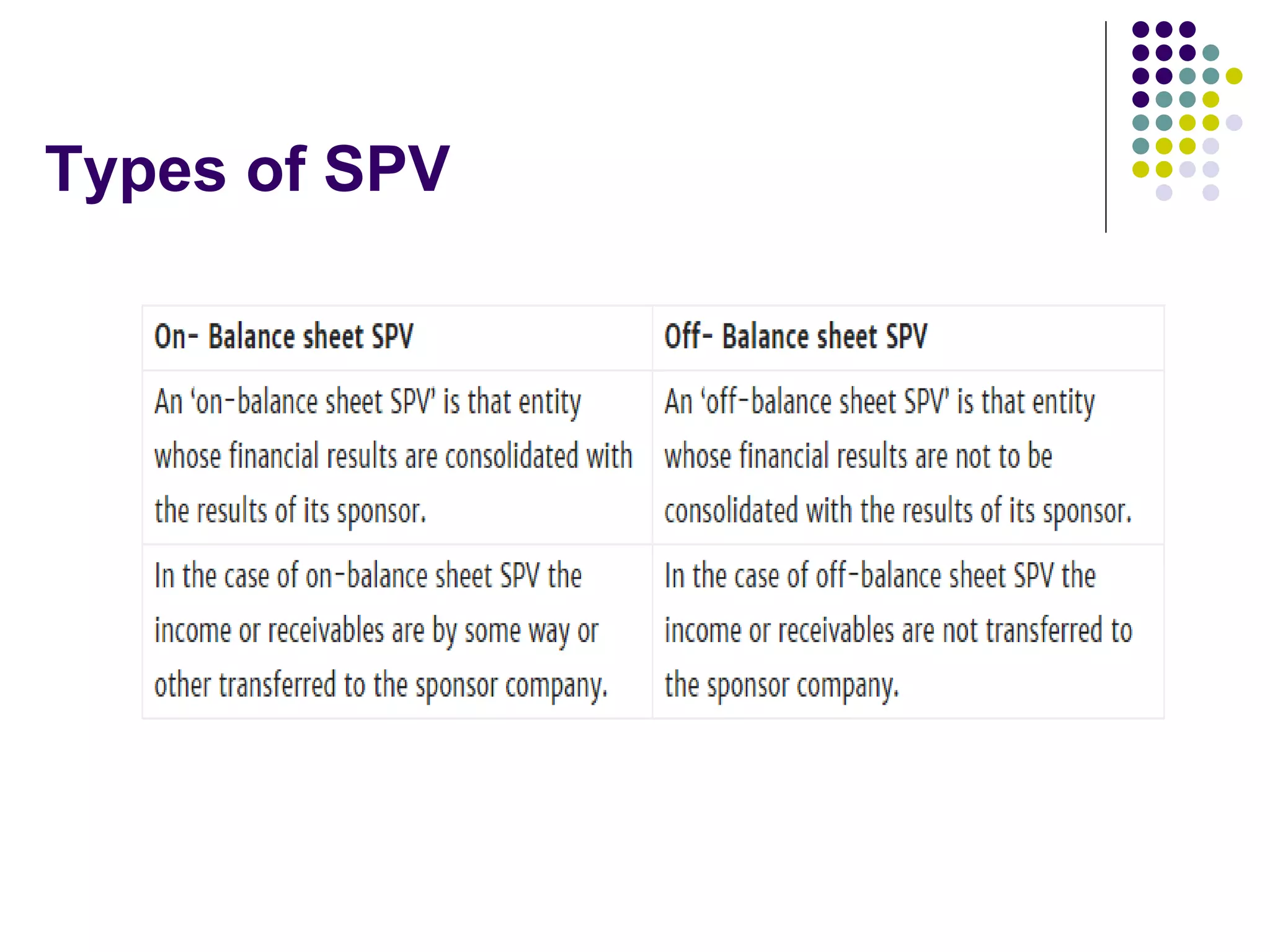

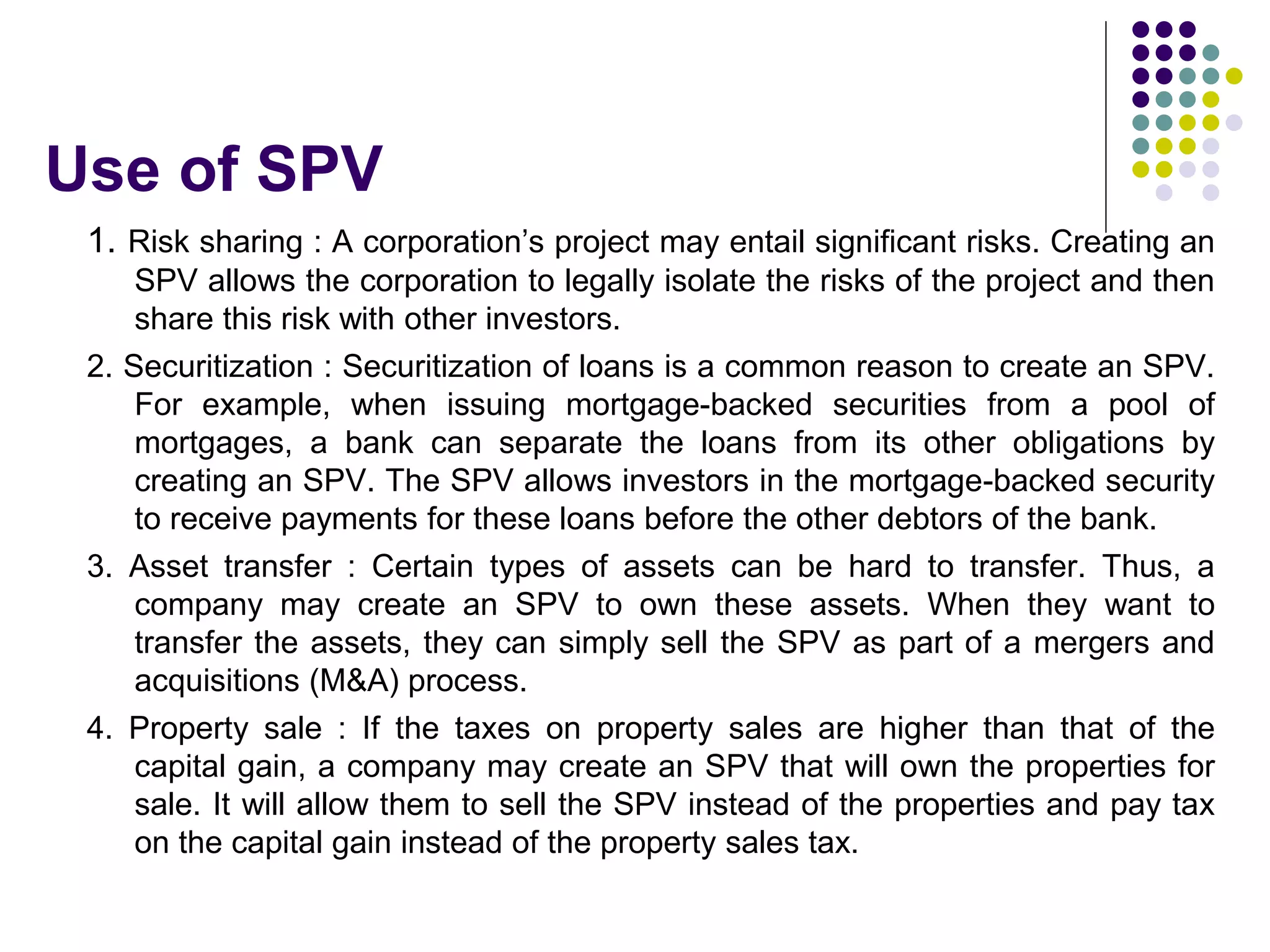

An SPV is a separate legal entity created by a sponsoring firm to fulfill a temporary objective. SPVs are typically used to isolate financial and legal risk from the parent company. Common types of SPVs include those used for risk sharing, securitization of loans, asset transfers, and property sales for tax benefits. While SPVs provide benefits like isolated risk and tax savings, they also have disadvantages such as lower access to capital and potential regulatory and accounting issues. An example is Patna Highway Projects, an SPV created by Gammon India to construct a highway project while isolating risks from the parent company.