Embed presentation

Download to read offline

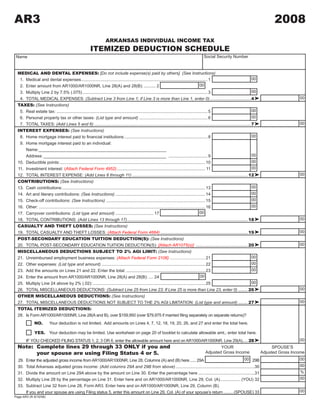

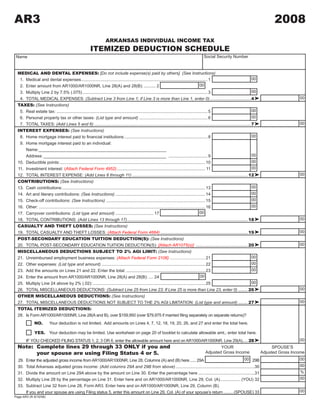

This document is an itemized deduction schedule for an Arkansas individual income tax return. It lists various types of itemized deductions a taxpayer can claim, including medical expenses, taxes, interest expenses, contributions, casualty/theft losses, education tuition, and miscellaneous deductions. For each deduction category, it provides lines and fields to input the relevant dollar amounts. The total itemized deductions are calculated at the end by adding together amounts from each category, with limitations applying if the taxpayer's income exceeds certain thresholds.