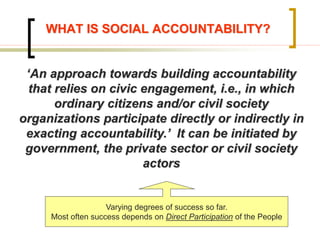

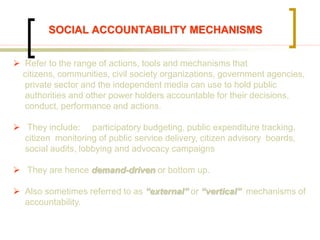

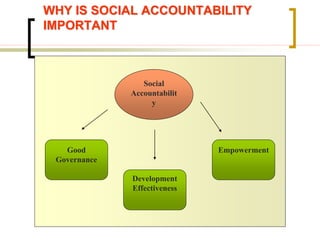

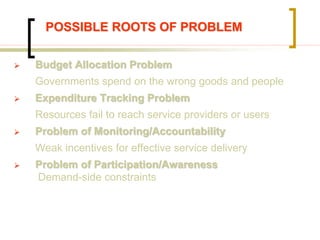

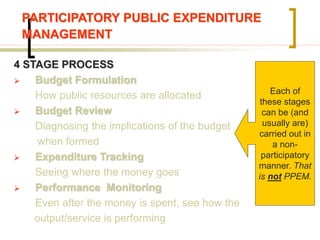

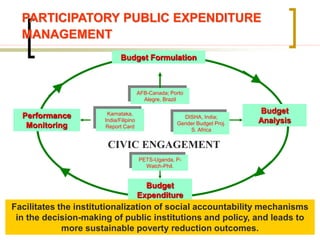

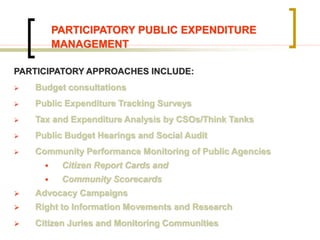

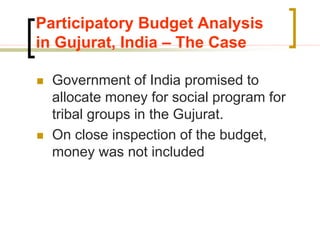

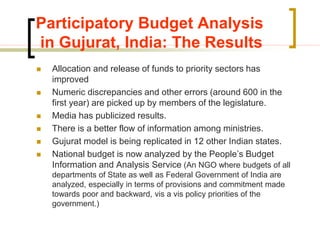

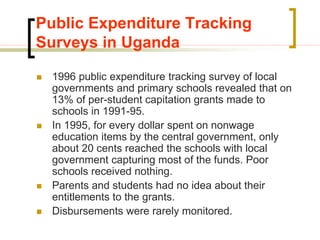

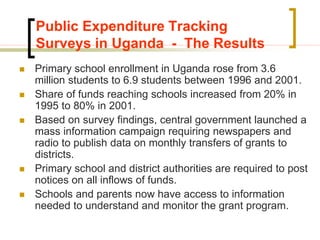

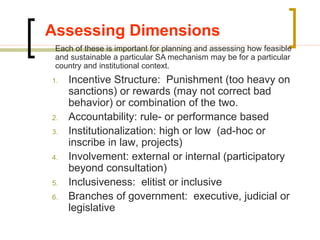

This document discusses concepts and tools related to social accountability and participatory public expenditure management. It defines social accountability as an approach that relies on civic engagement where citizens and civil society organizations directly or indirectly exact accountability. Some key social accountability mechanisms mentioned include participatory budgeting, public expenditure tracking, citizen monitoring, and advocacy campaigns. The document also provides examples of these tools being implemented successfully in various countries like participatory budgeting in Porto Alegre, Brazil and public expenditure tracking surveys in Uganda.