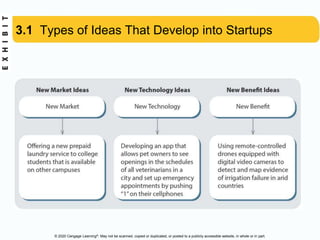

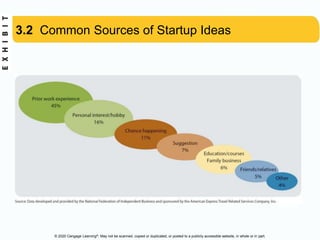

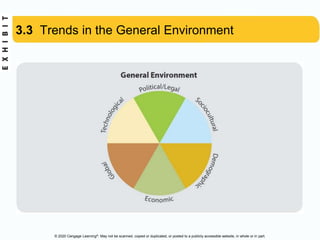

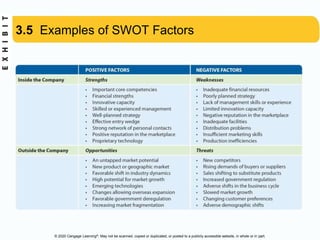

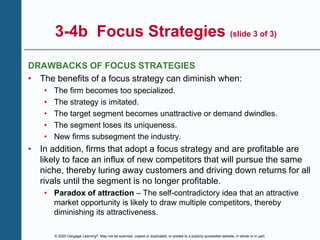

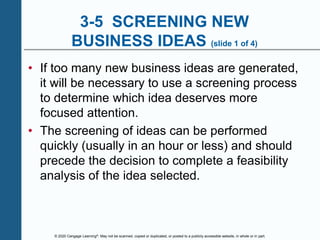

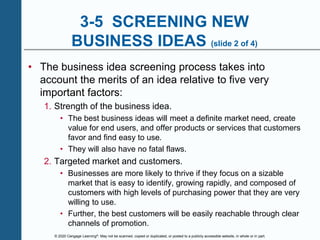

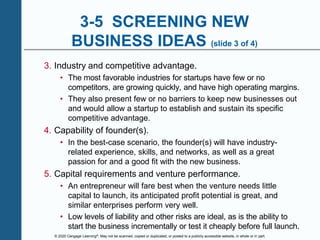

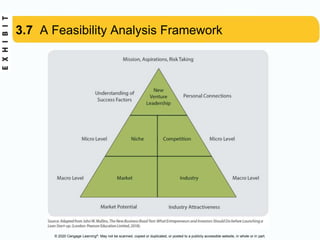

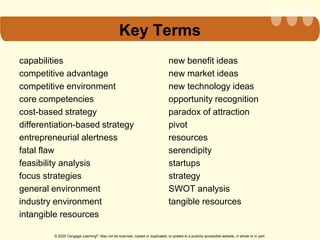

This document provides an overview of chapter 3 from a textbook on starting a small business. The chapter discusses developing startup ideas, including different types of ideas and common sources of ideas. It also covers using innovative thinking to generate ideas and analyzing ideas both from an outside-in and inside-out perspective. The chapter describes integrating internal and external analyses using a SWOT analysis and selecting strategies to capture opportunities, including broad-based and focus strategies. The overall chapter aims to guide entrepreneurs through the process of developing, analyzing, and selecting startup business ideas.