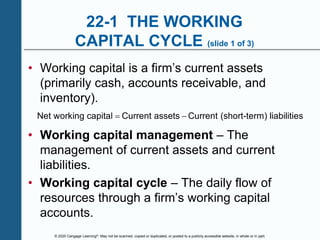

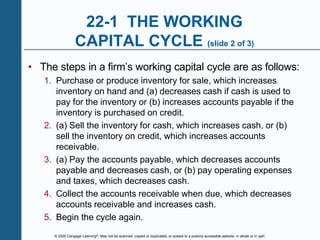

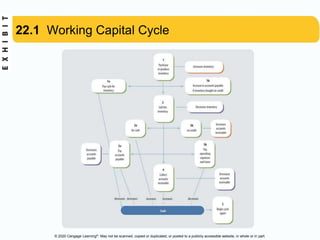

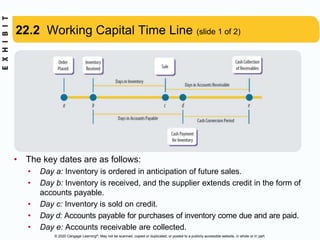

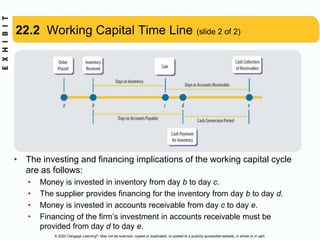

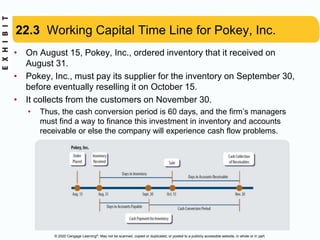

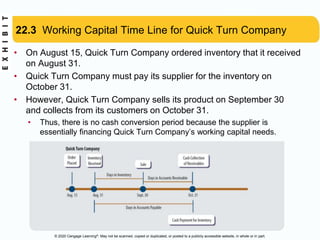

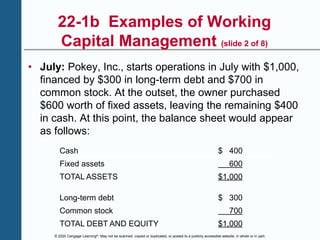

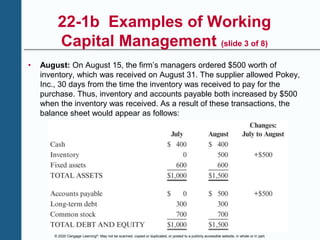

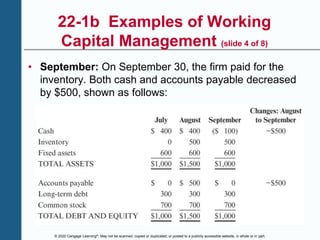

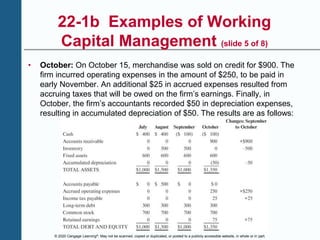

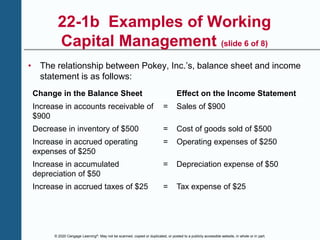

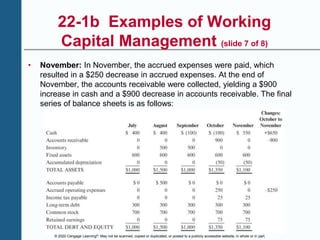

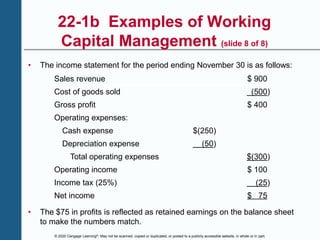

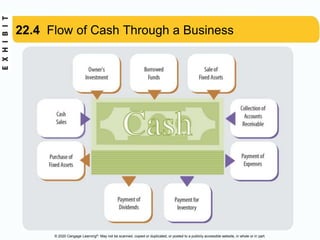

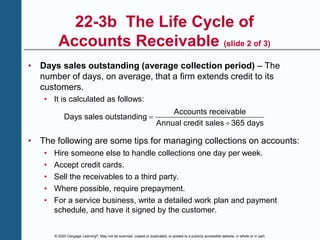

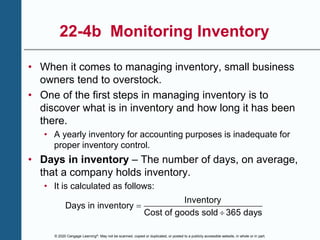

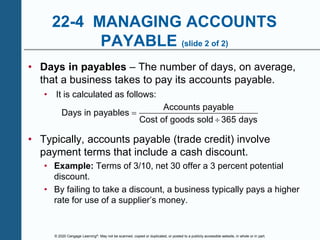

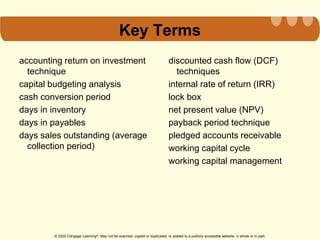

This document discusses managing working capital and cash flows for small businesses. It defines key terms like working capital, the working capital cycle, accounts receivable, inventory, and cash conversion period. The document uses examples to illustrate how these concepts impact a company's balance sheet and cash flows over time. Effective working capital management is important for small businesses to meet operating needs and avoid cash flow problems.