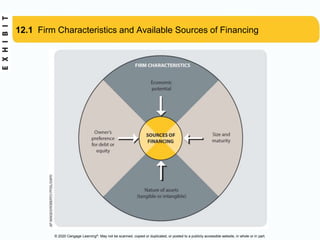

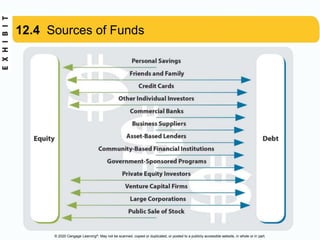

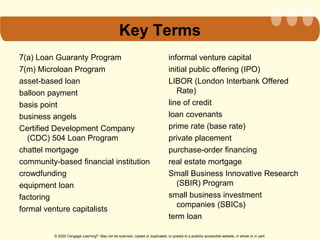

This document discusses various sources of financing for small businesses, including:

- Personal savings, friends and family, credit cards are common early sources of equity financing.

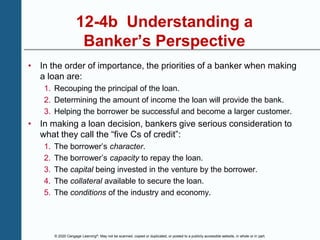

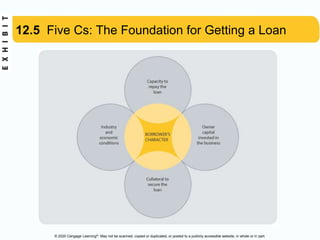

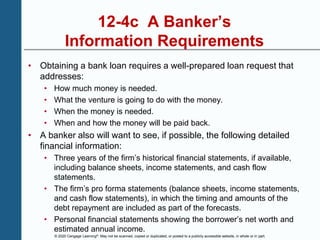

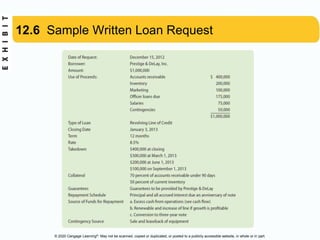

- Banks are a primary source of debt financing but are reluctant to finance startups without proven track records. Bank loans come as lines of credit, term loans, or mortgages.

- Business suppliers provide trade credit through accounts payable and may offer equipment loans or leases using the equipment as collateral.

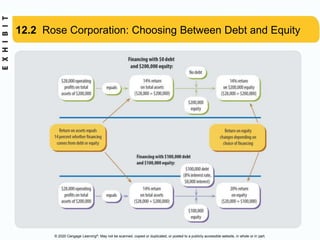

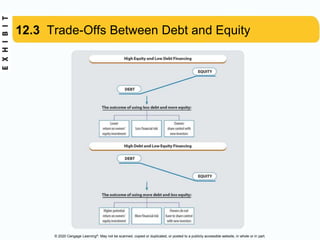

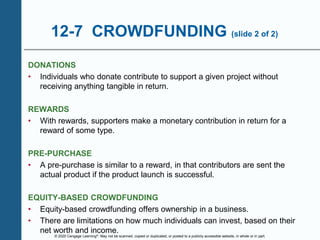

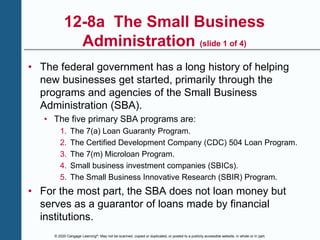

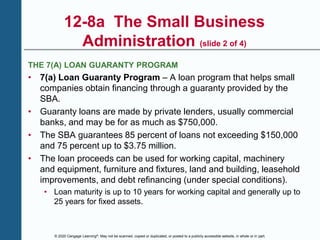

- Other potential sources of financing discussed include private equity investors, crowdfunding, government loan programs, large corporations, and public stock offerings. The document examines factors influencing choices between debt and equity financing.