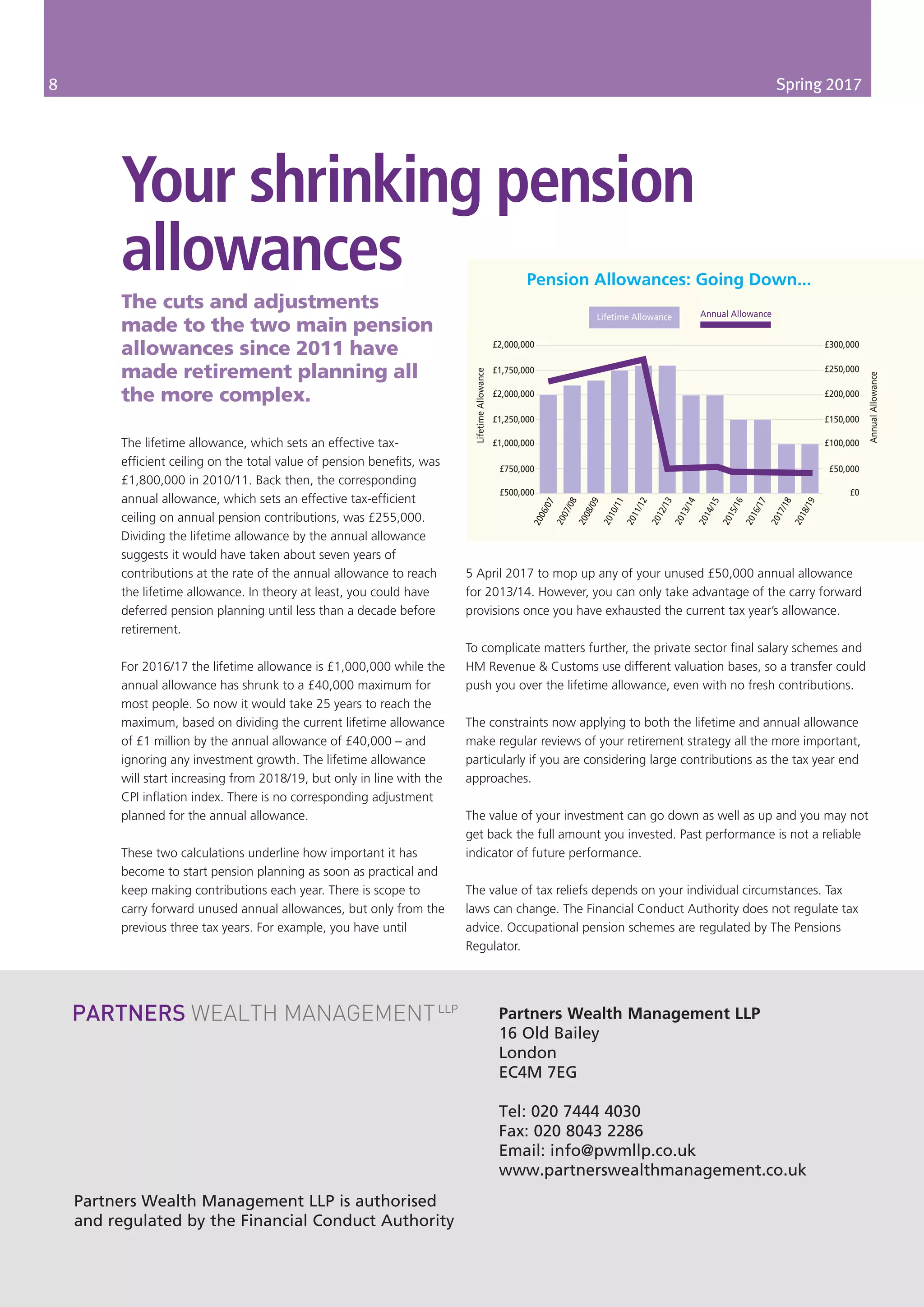

The Spring 2017 document discusses year-end financial planning, emphasizing estate planning, pension policies, and new tax measures affecting buy-to-let investors. It outlines the benefits of leaving pensions untapped until age 75 for tax efficiency and highlights significant recent tax changes, including reduced tax relief on pension savings and alterations to buy-to-let income taxation. The newsletter serves as a general guide for individuals to consider their financial strategies before the impending budget announcements.