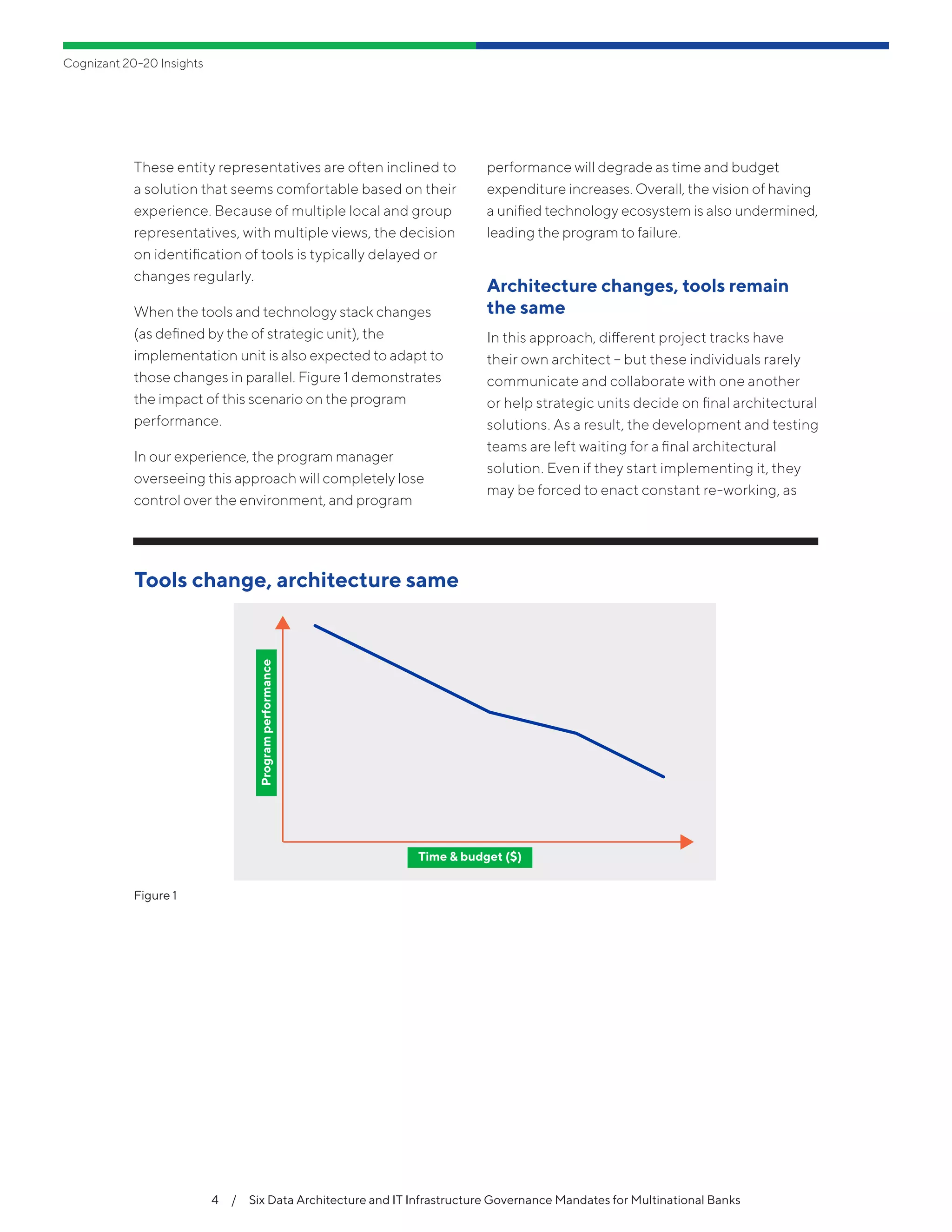

The document outlines six mandates for data architecture and IT infrastructure governance specific to multinational banks, emphasizing the need for alignment with regulatory frameworks like BCBS 239 to enhance digital transformation efforts. It identifies common pitfalls in technology decision-making that can lead to project failures and emphasizes the importance of establishing robust governance structures and clear roles early in project planning to ensure successful implementation and compliance. Overall, it advocates for a unified technological ecosystem to improve performance and reporting accuracy across multiple jurisdictions.