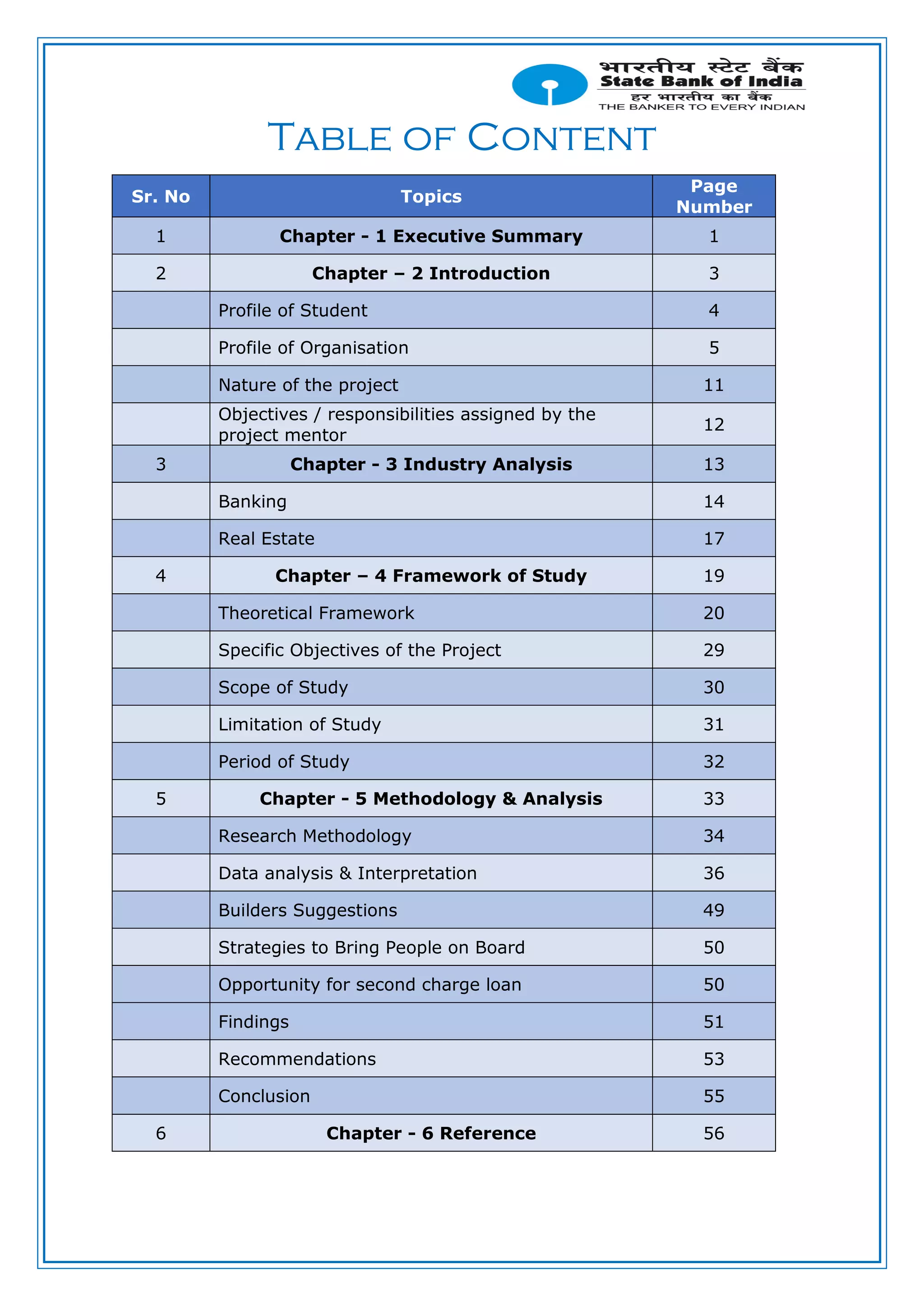

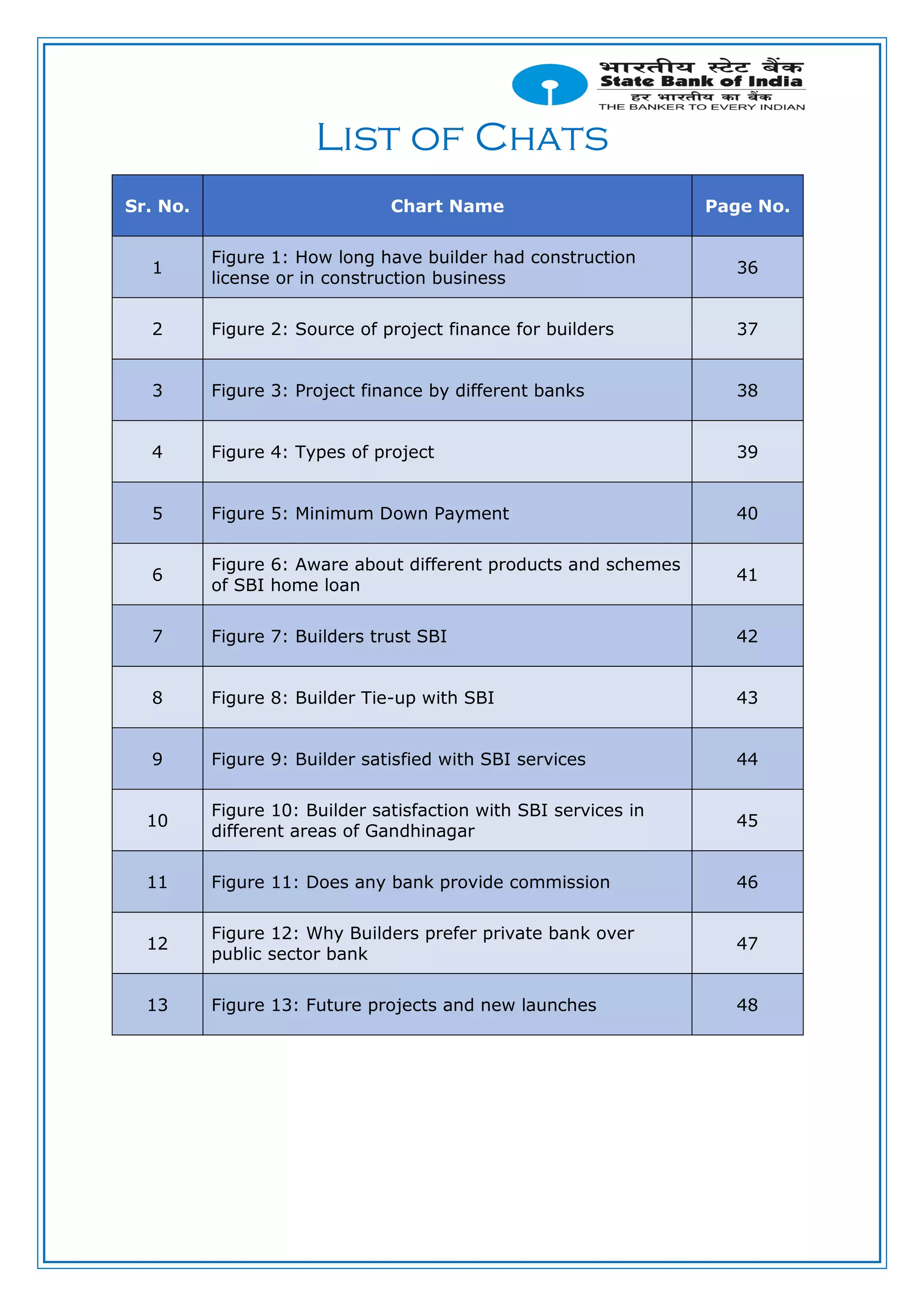

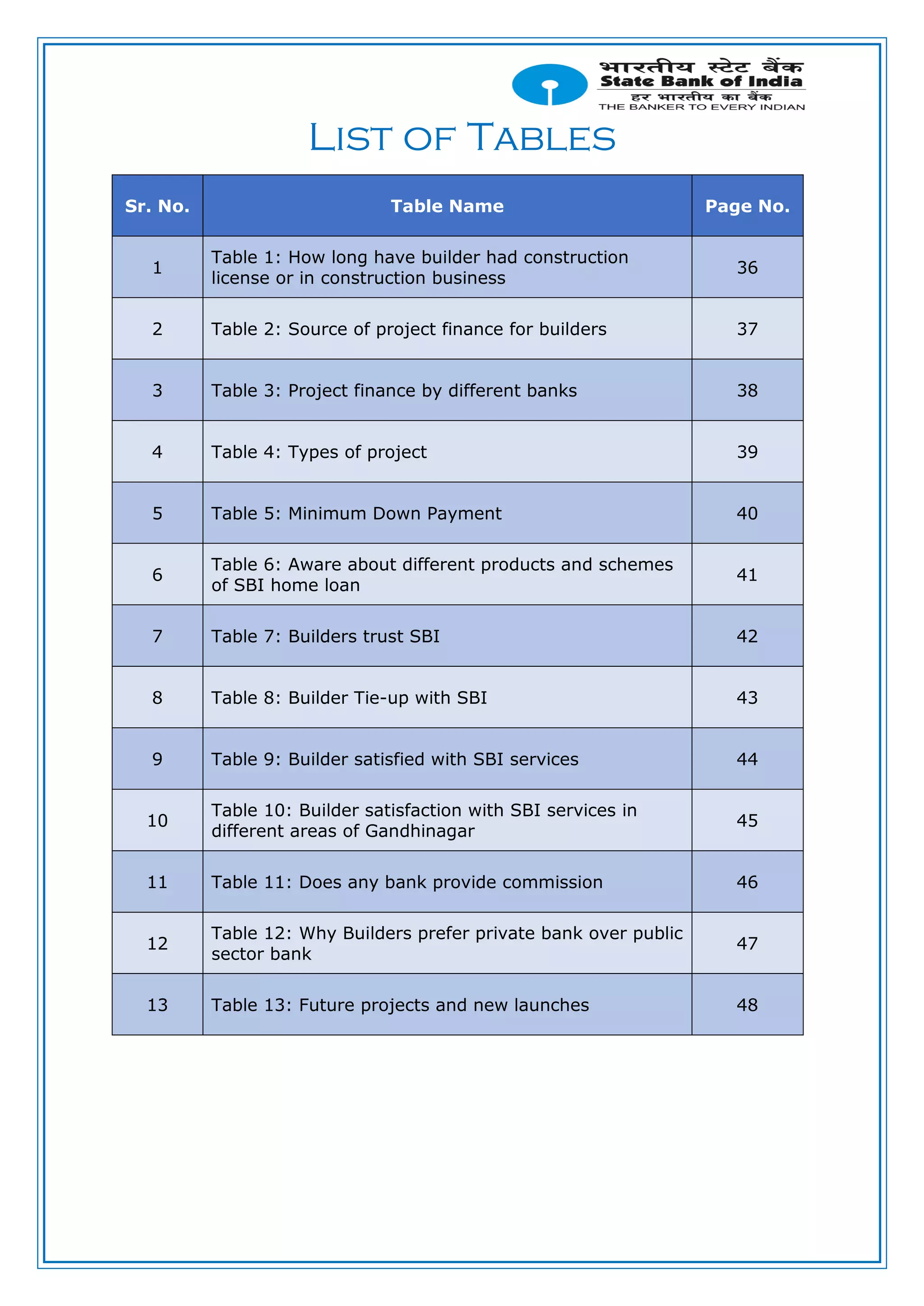

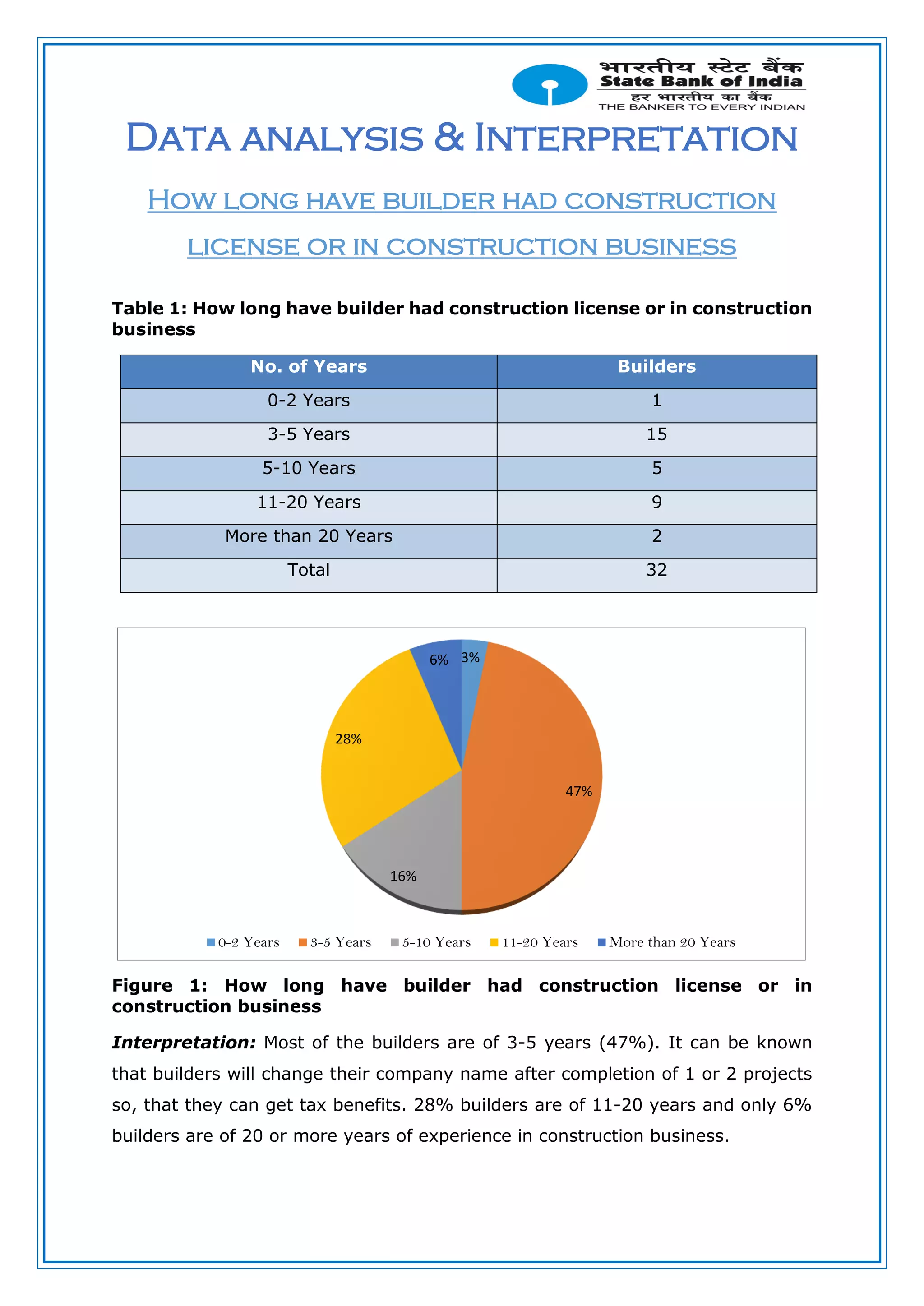

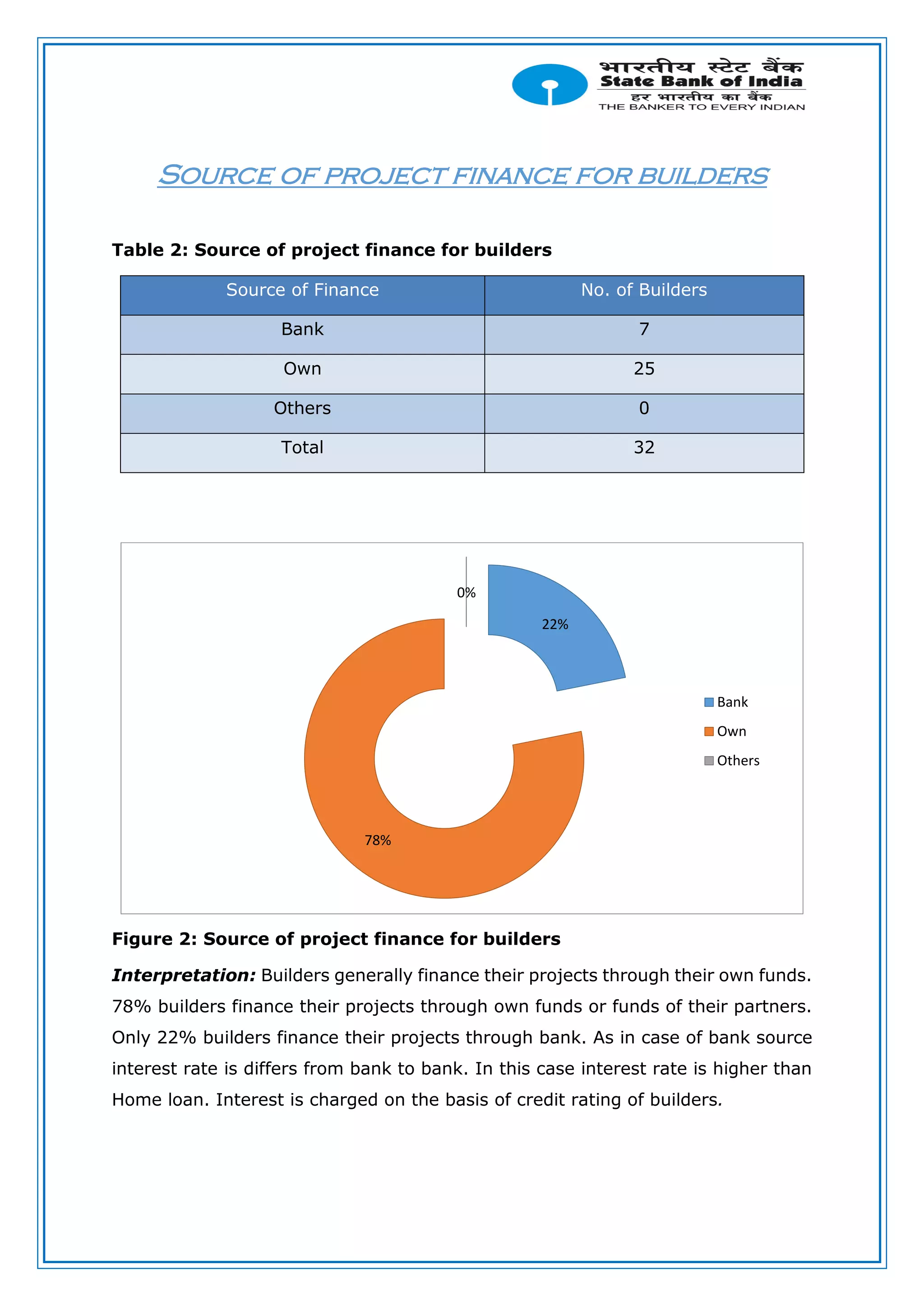

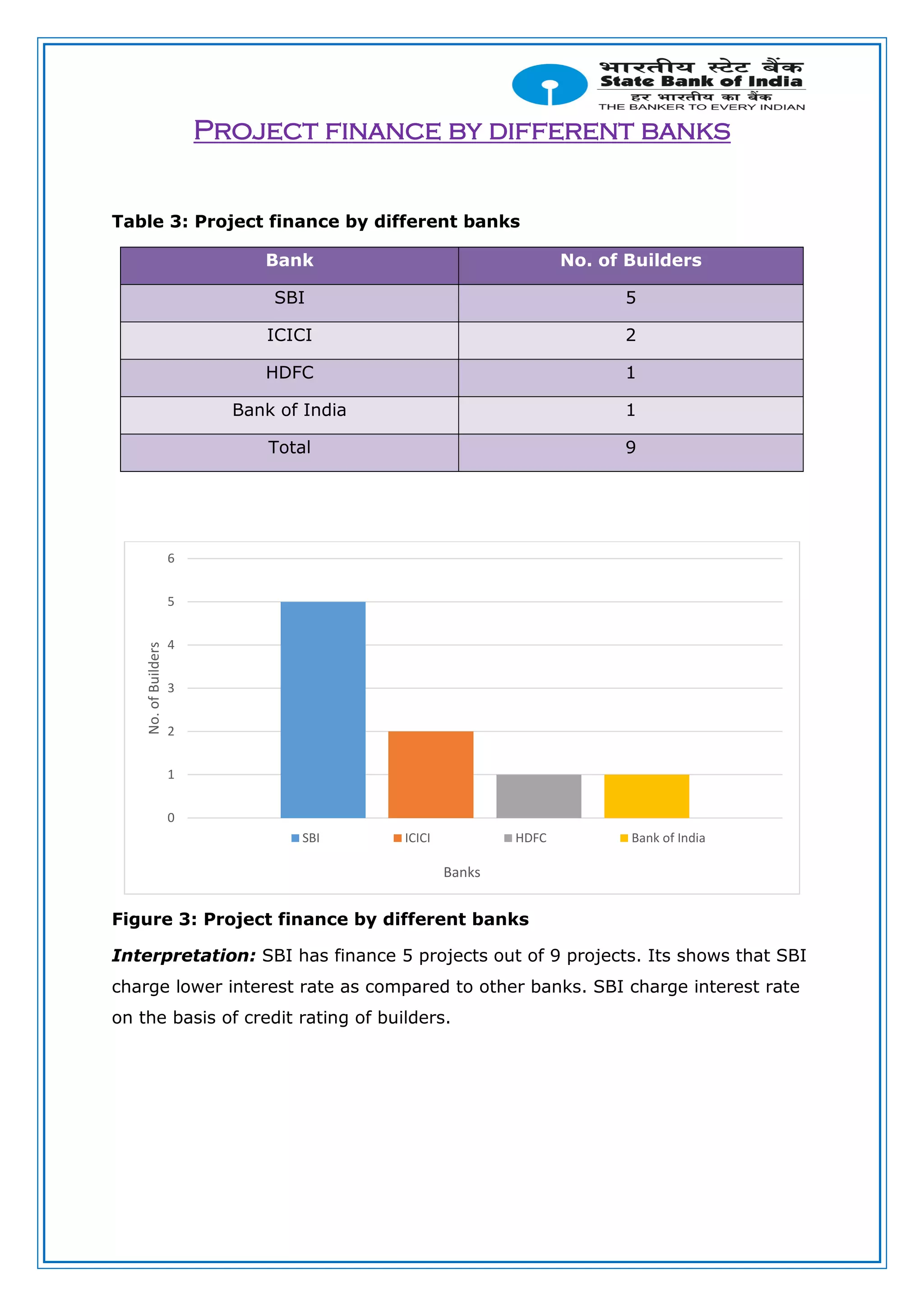

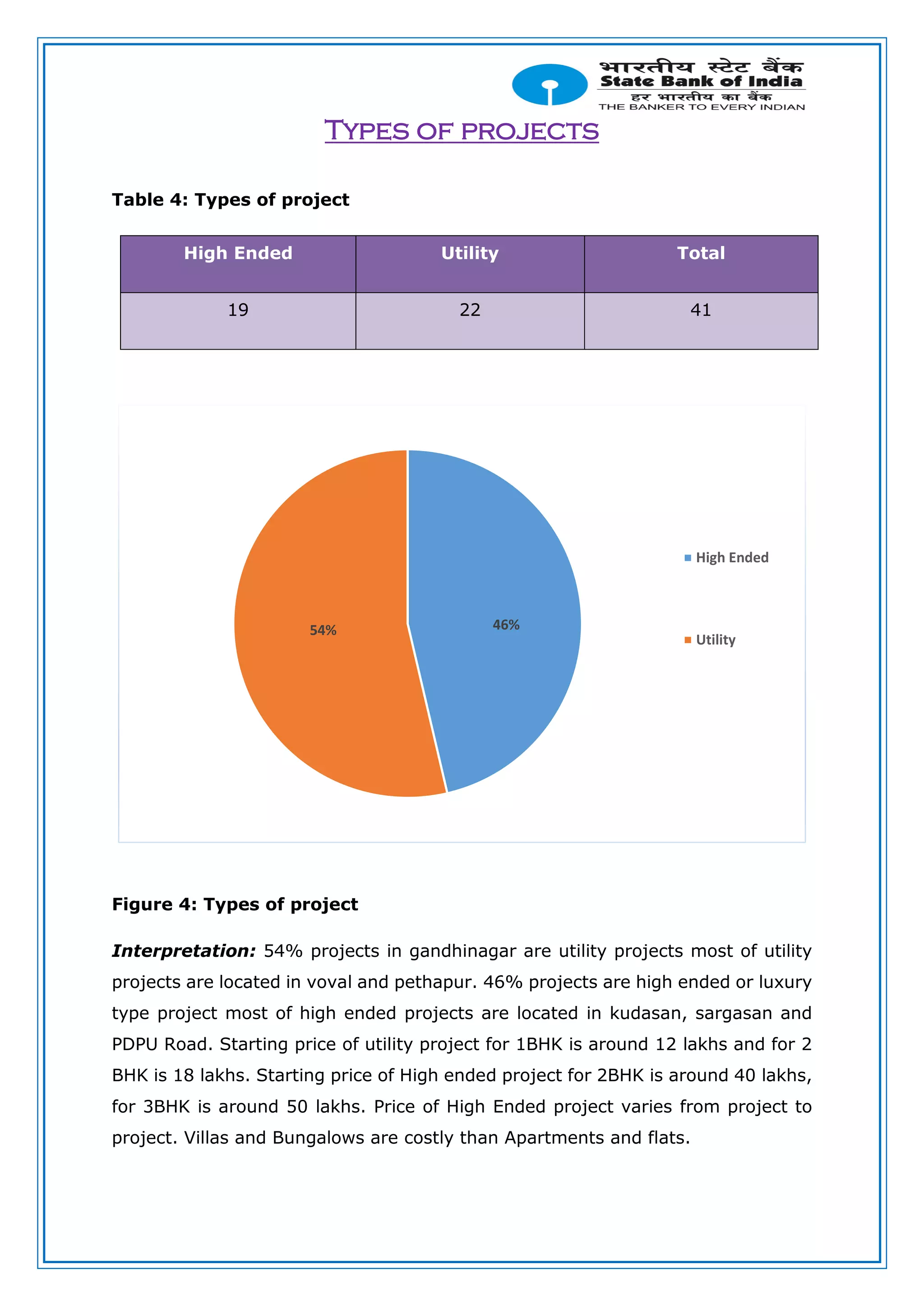

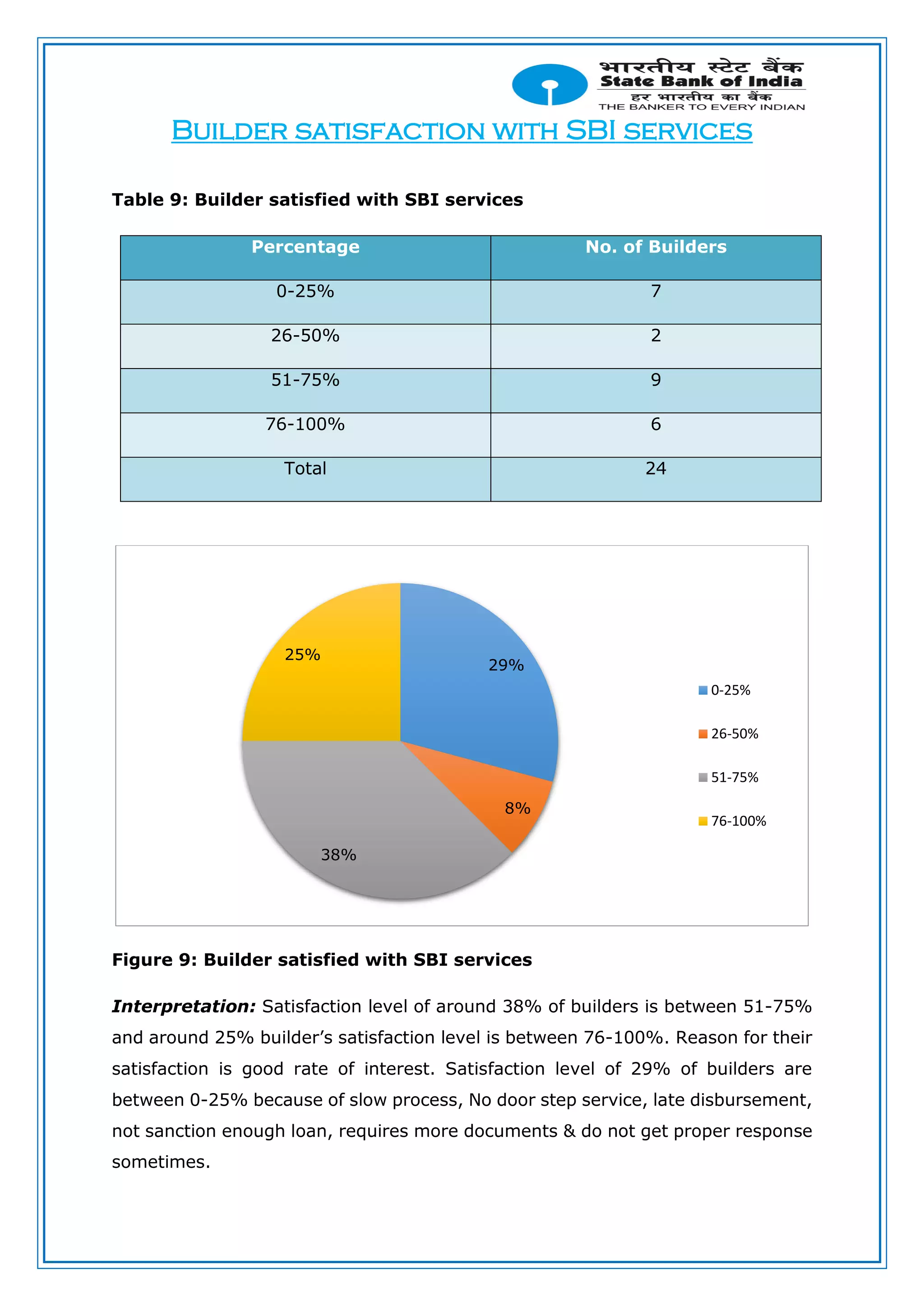

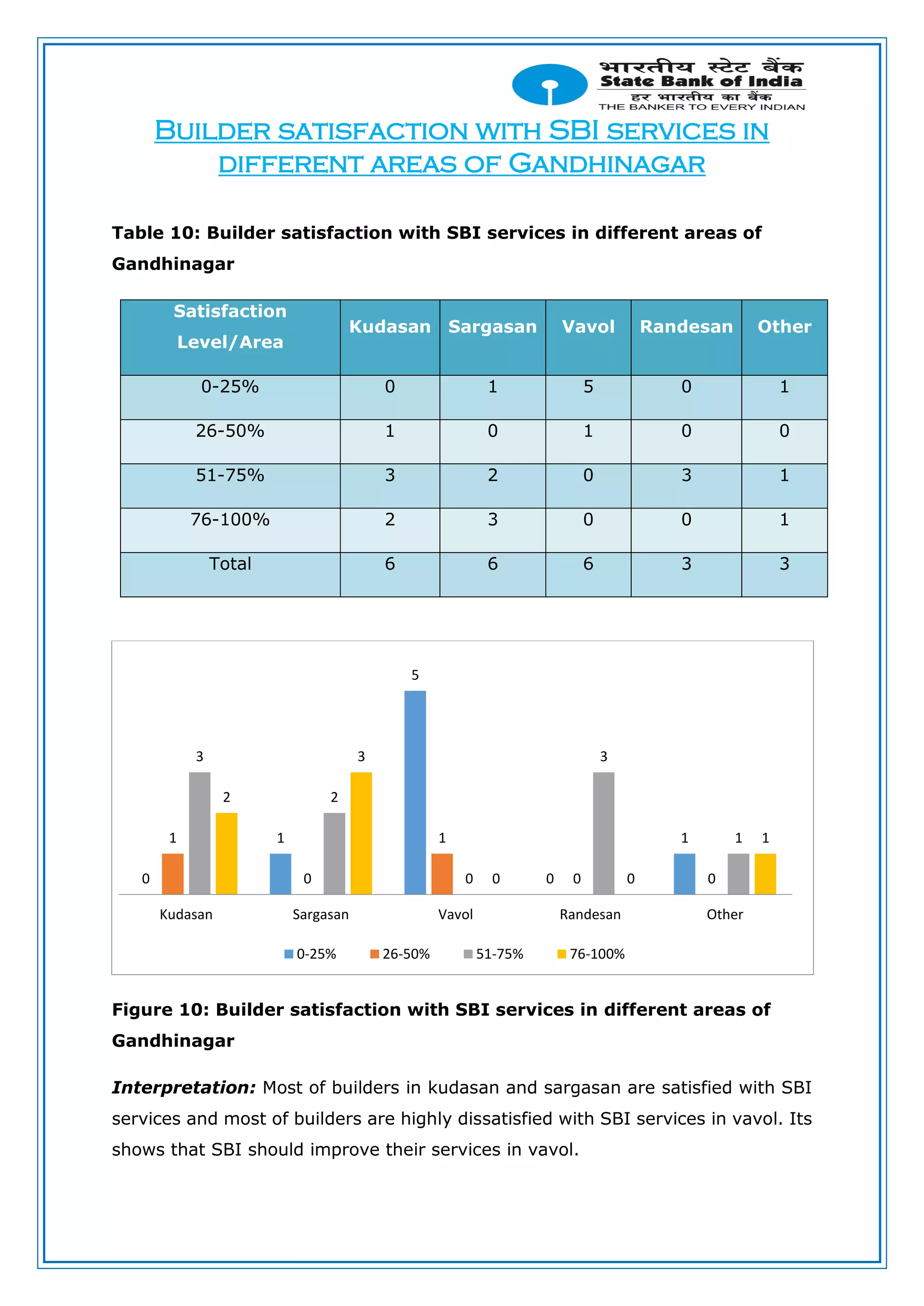

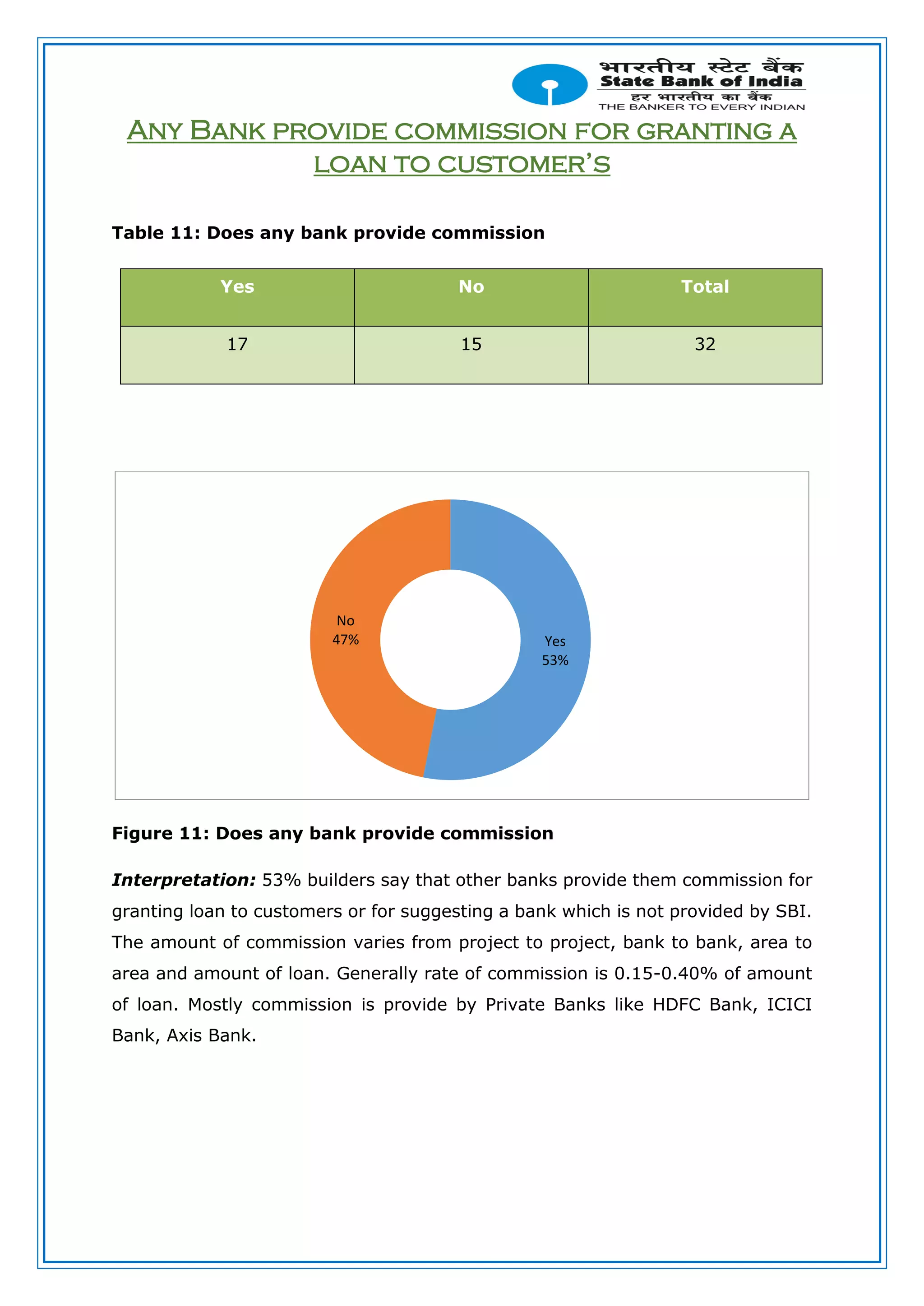

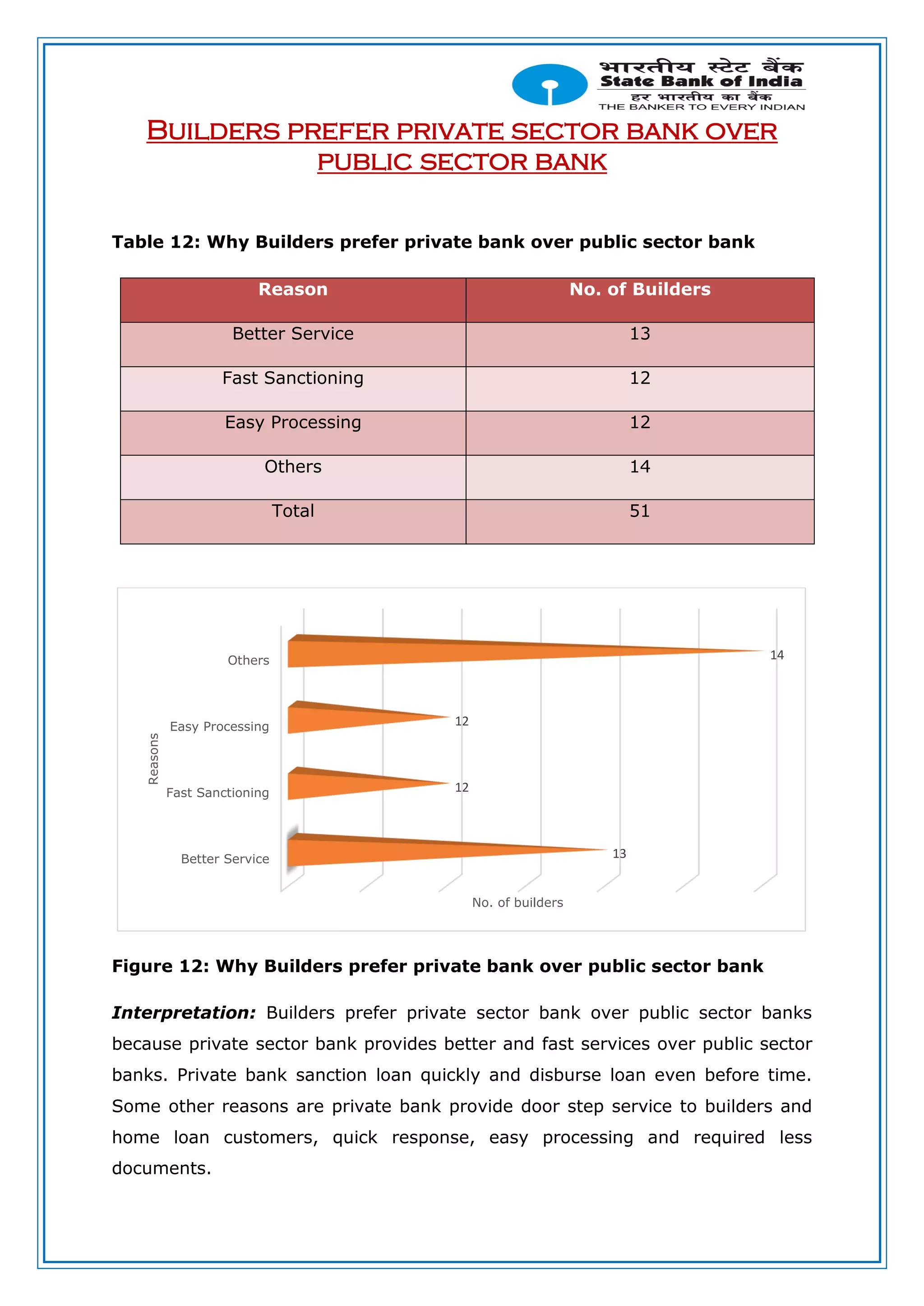

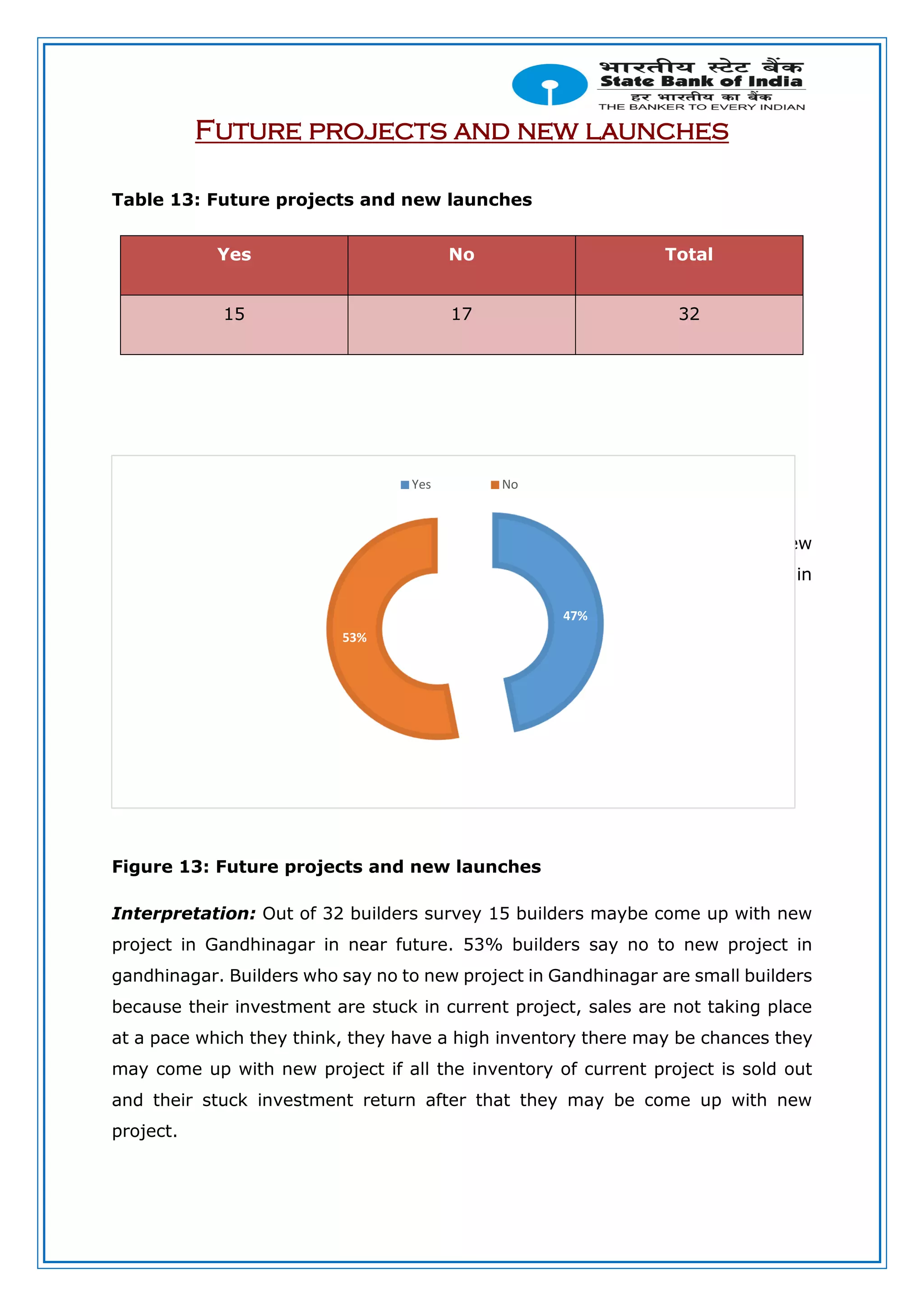

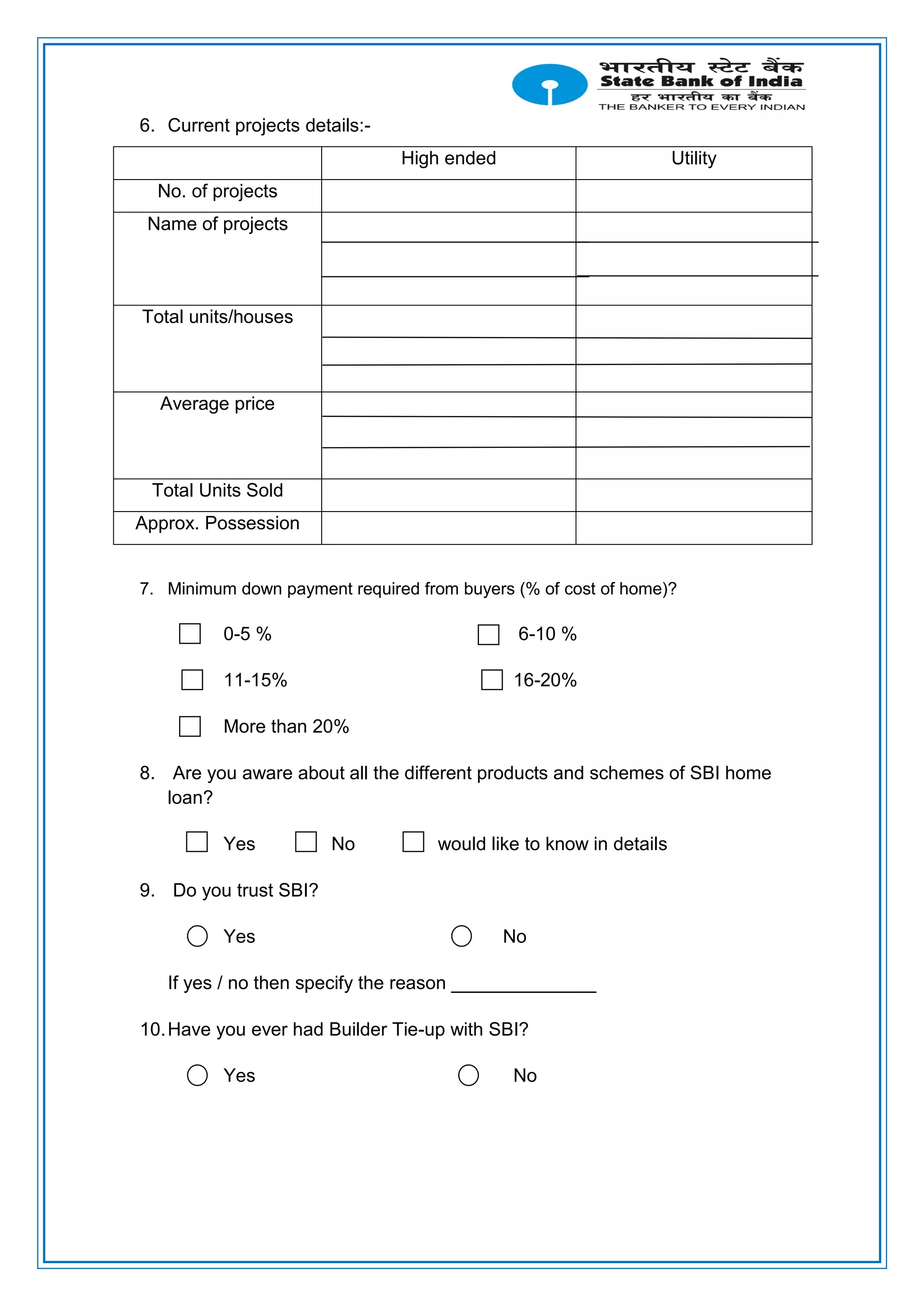

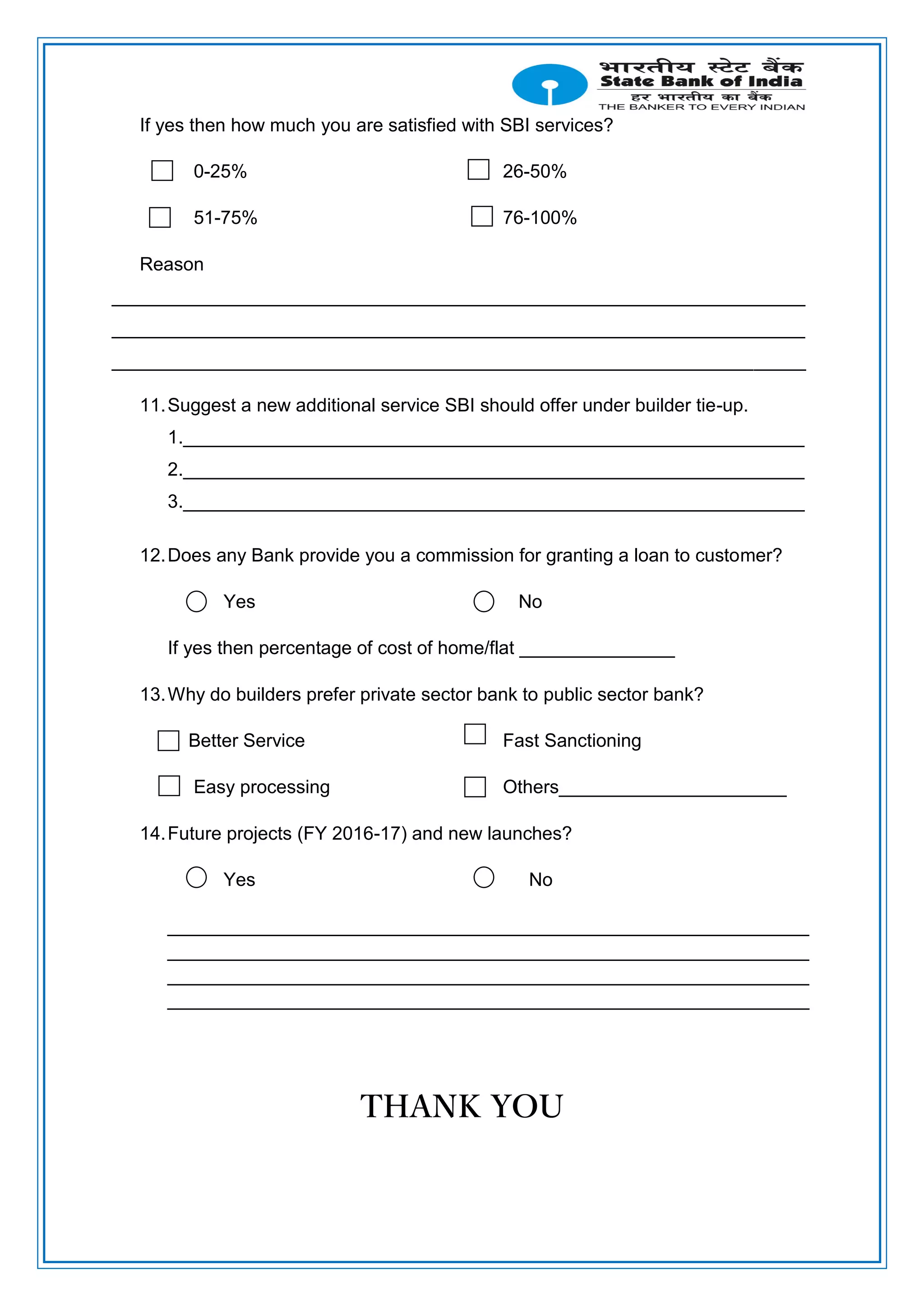

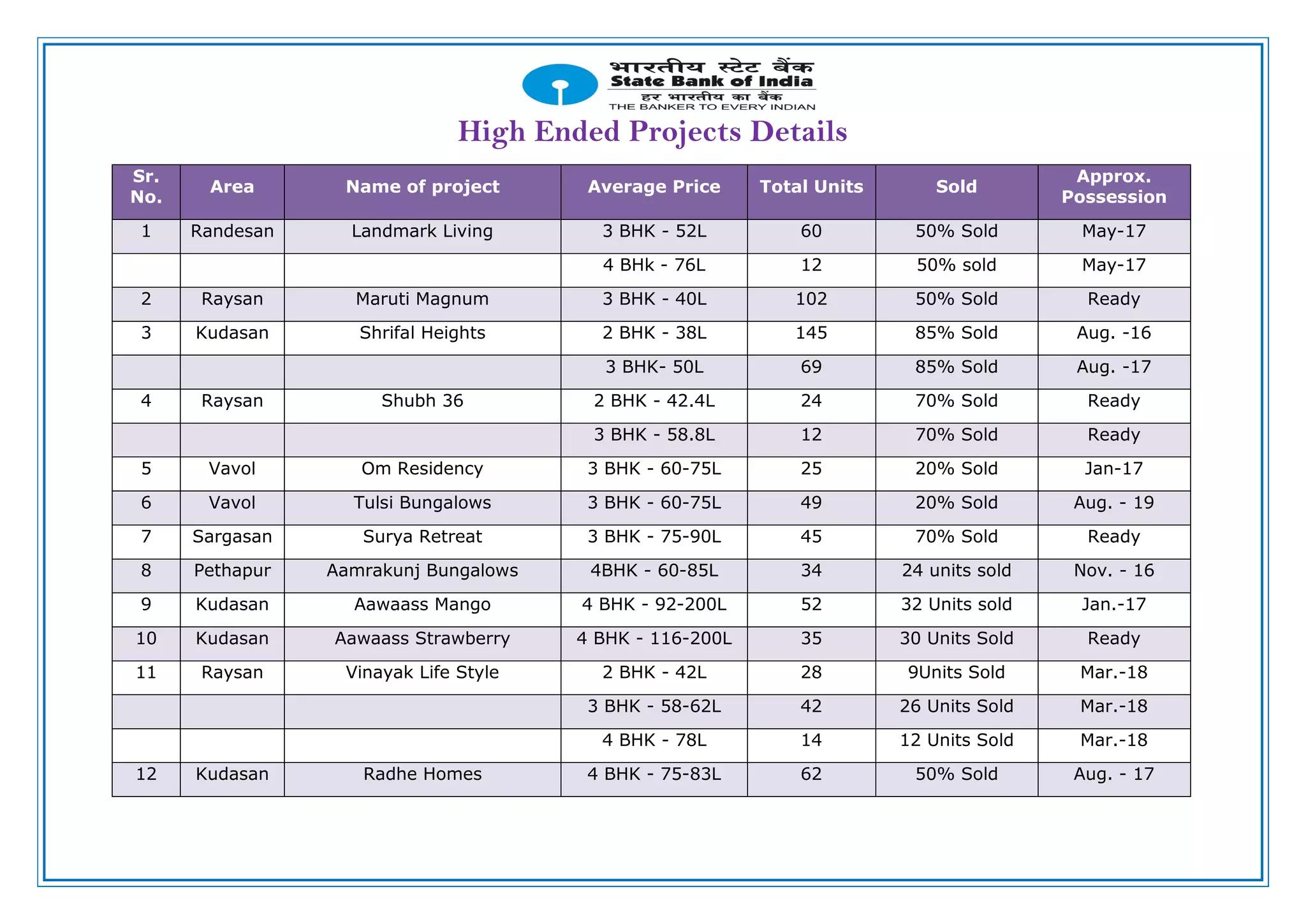

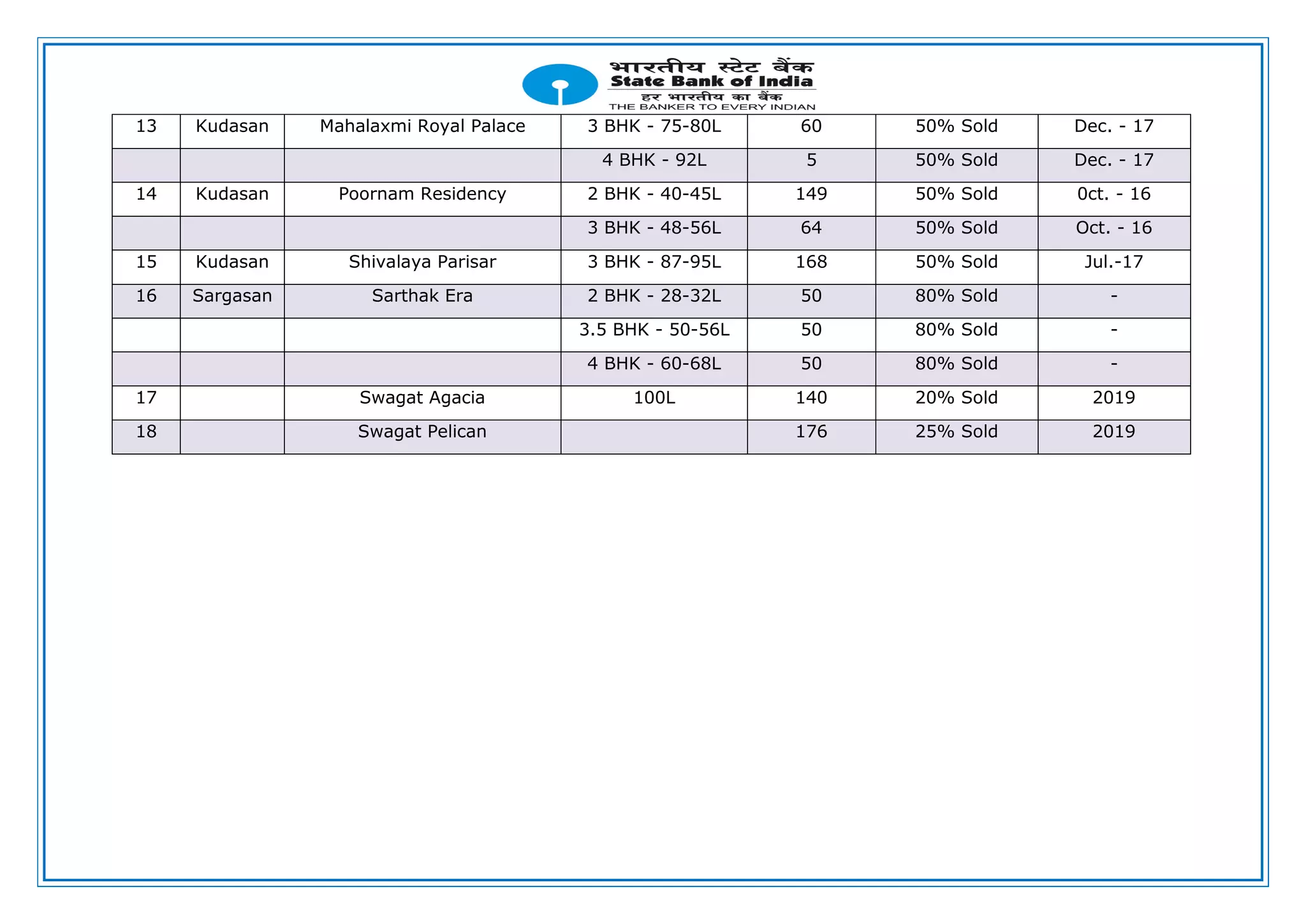

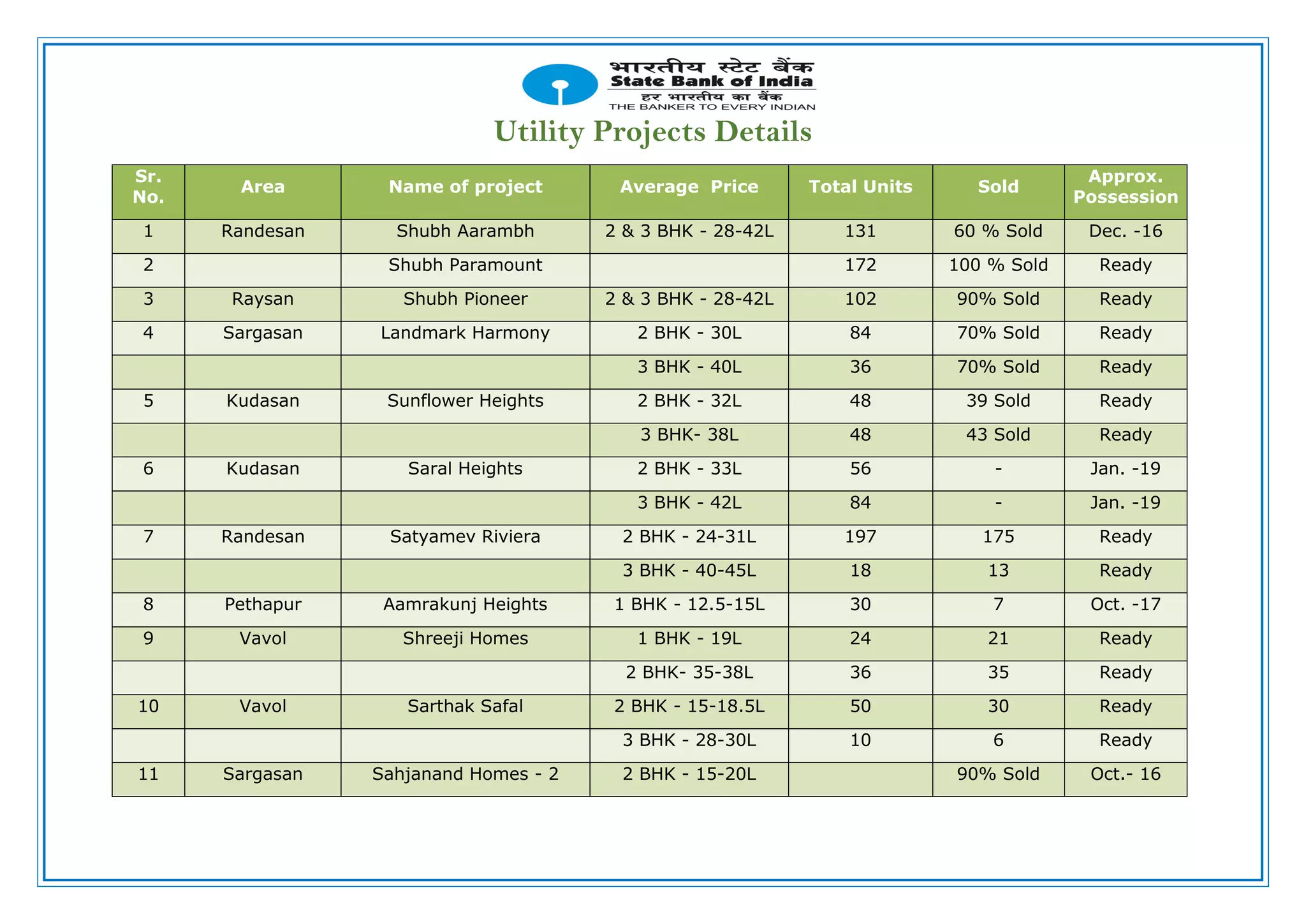

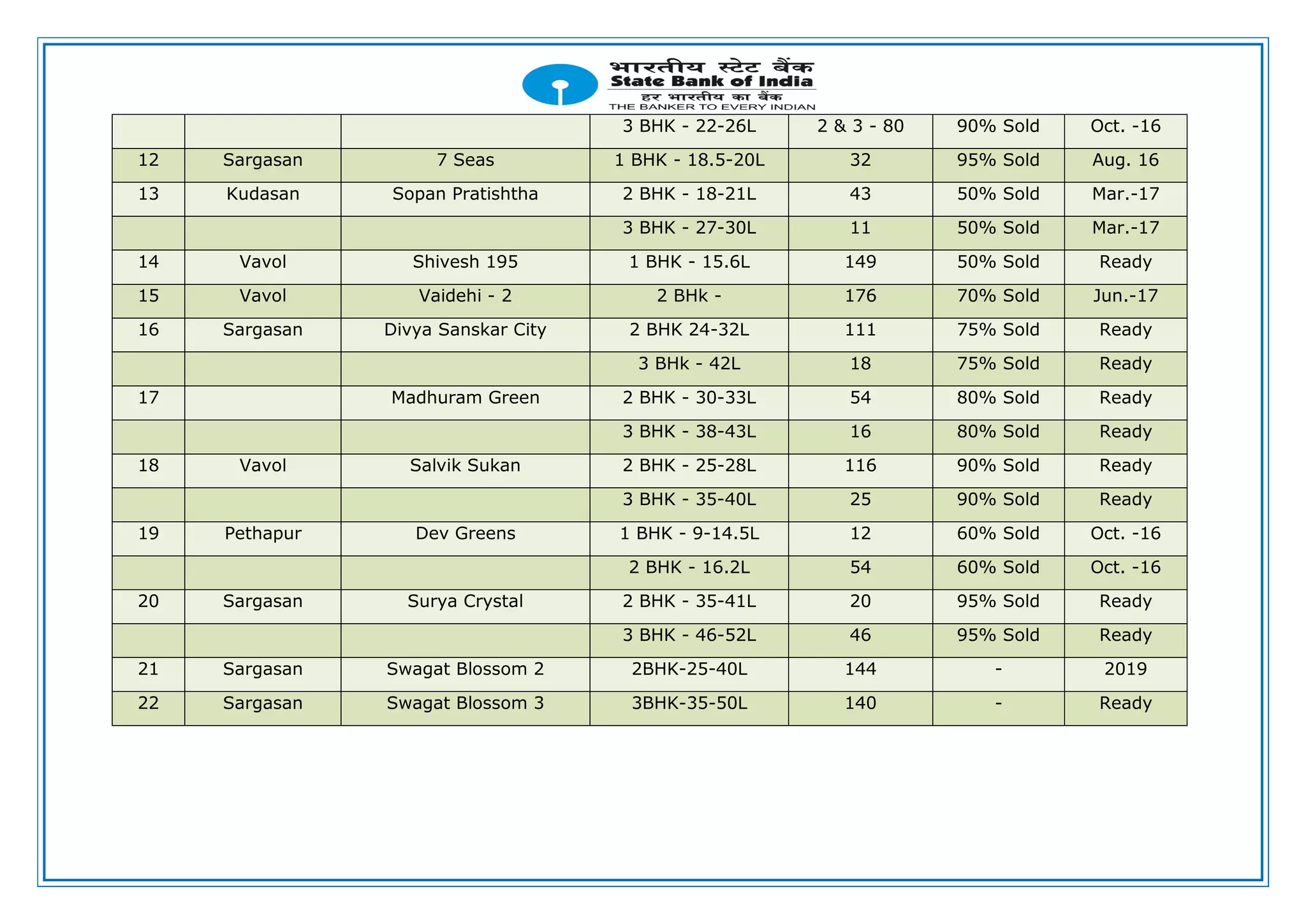

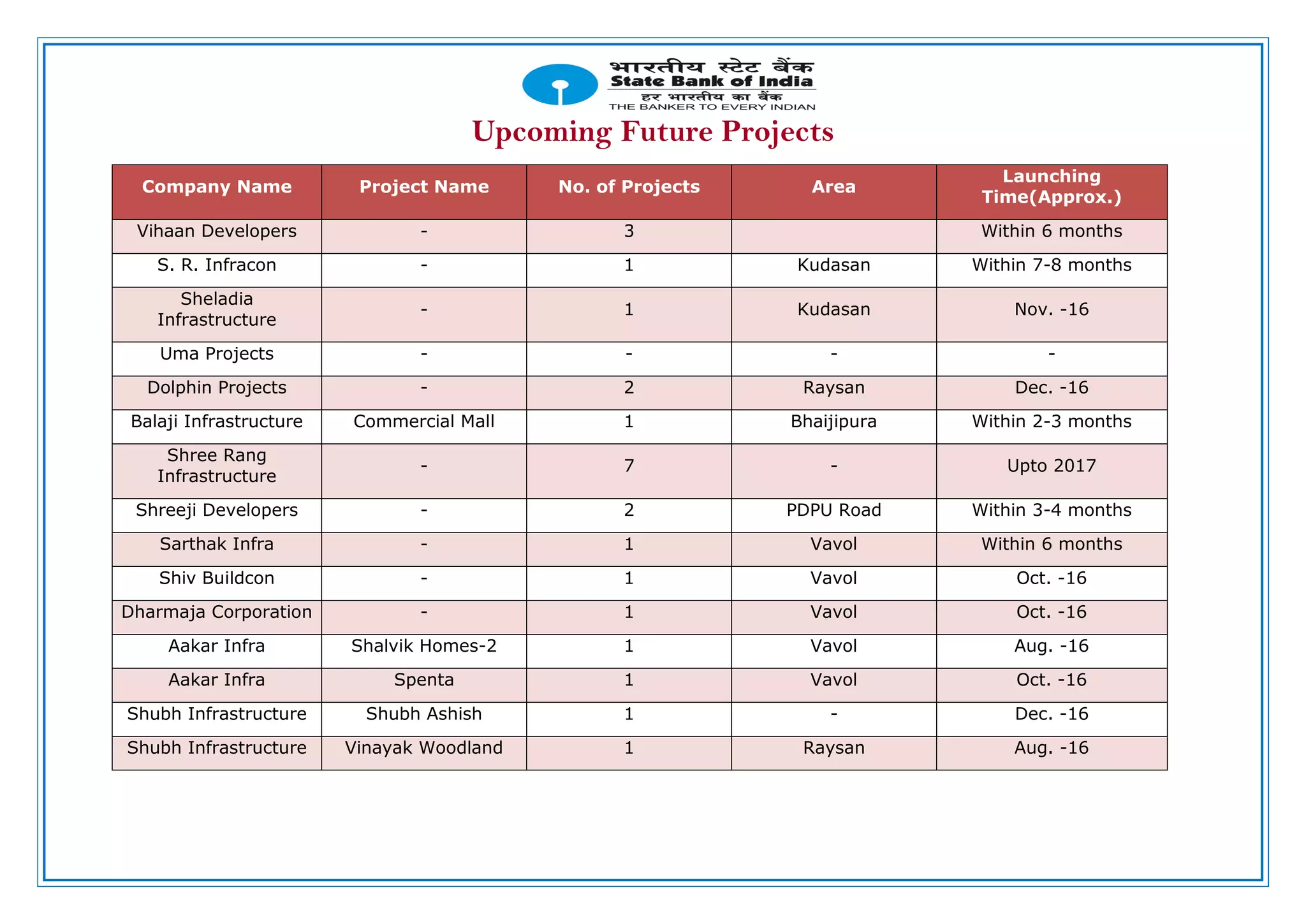

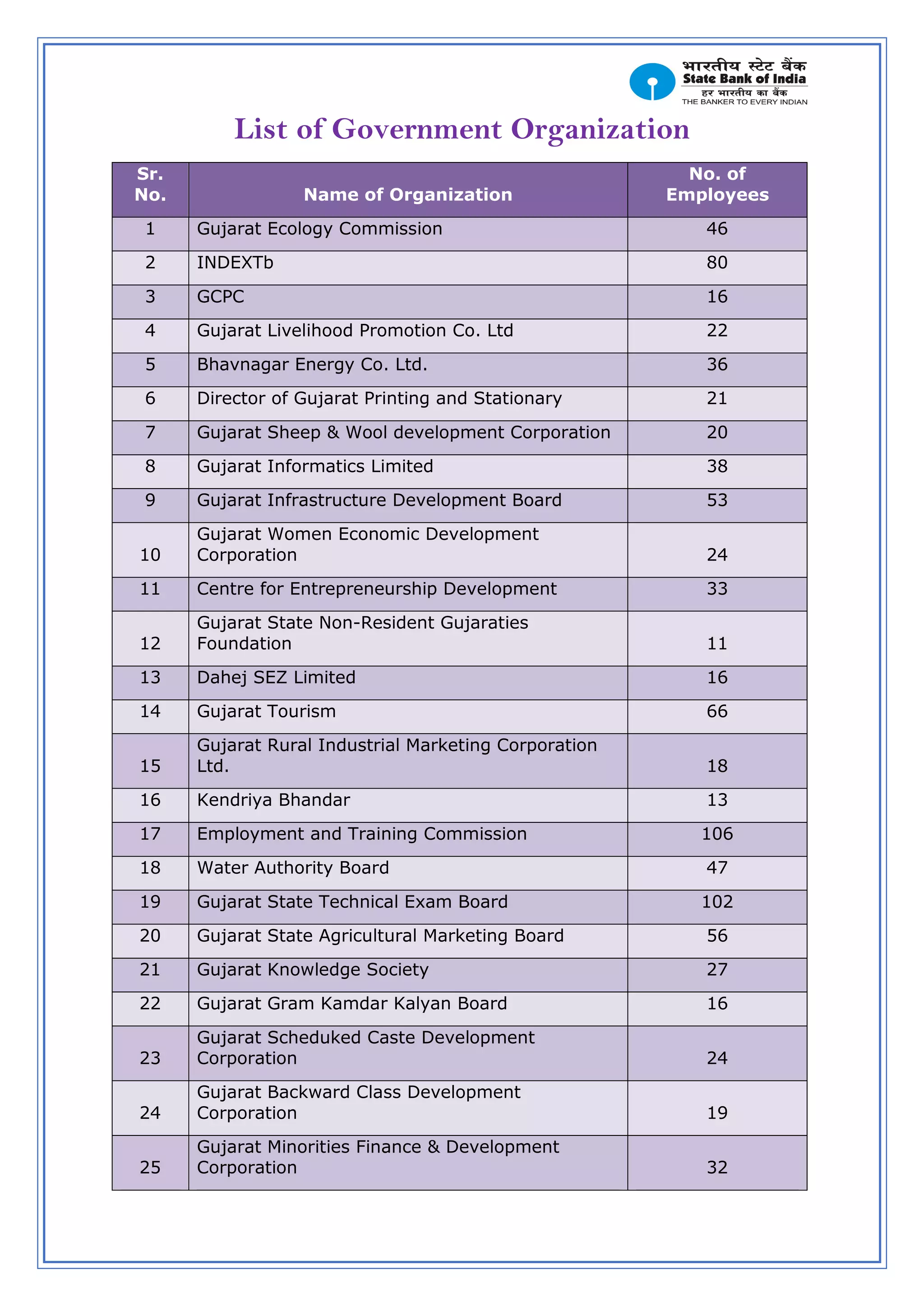

The document is Yogesh Rathod's SIP project report submitted to K. S. School of Business Management in partial fulfillment of an MBA degree. The report examines home loans and builders tie-ups for State Bank of India. It includes an introduction to SBI and the student, analysis of the banking and real estate industries, methodology used in primary research with builders, findings on builders' perceptions and satisfaction with SBI services, and recommendations.