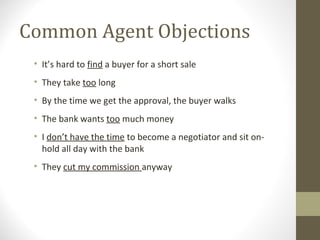

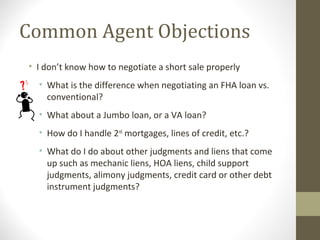

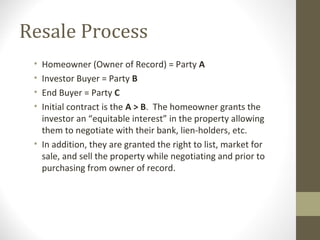

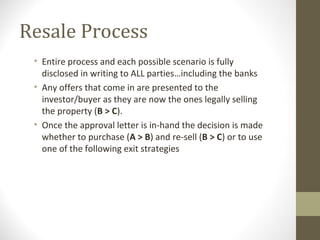

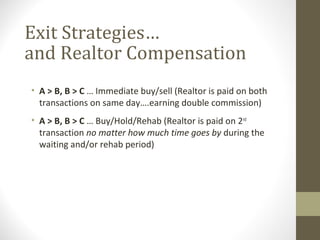

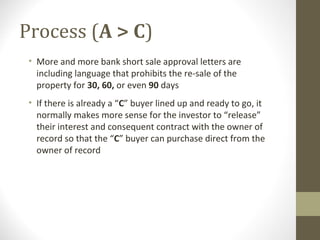

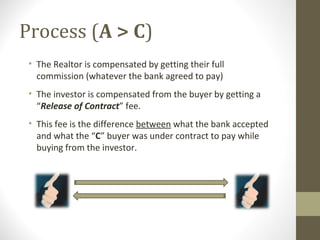

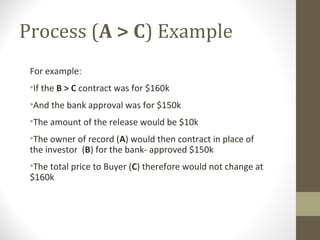

This document discusses how real estate agents can profit from short sales by partnering with investors who have experience negotiating short sales. It notes that short sales will continue to be prevalent in 2013 and outlines common agent objections to handling short sales. It then describes how an investor-based solution addresses these objections by having investors submit cash offers, negotiate with banks, and handle various scenarios that may arise. The document explains different processes for investor purchase and resale of short sale properties and how agents can be compensated through these arrangements.