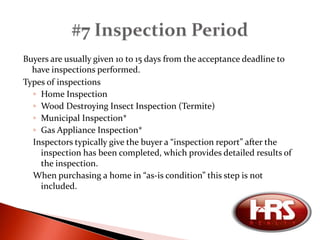

This document provides a step-by-step guide for purchasing a home. It outlines 11 steps: 1) Contacting a real estate agent, 2) Getting prequalified for a loan, 3) Searching for a home, 4) Making an offer and submitting a sales contract, 5) Providing earnest money, 6) Negotiating the contract terms, 7) Performing inspections, 8) Requesting and negotiating repairs, 9) Getting an appraisal, 10) Final walkthrough before closing, 11) Closing and funding the purchase. The guide offers advice at each step and explains the key documents and processes involved in buying a home.