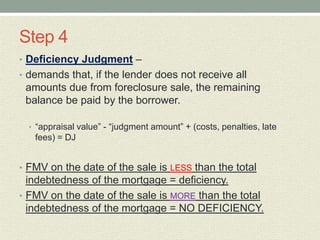

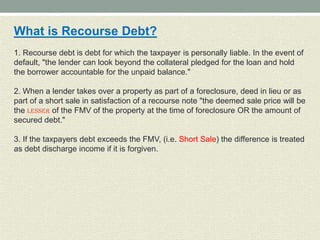

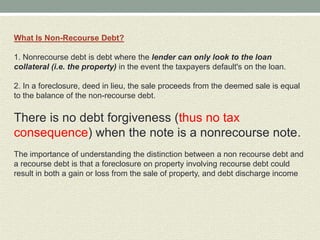

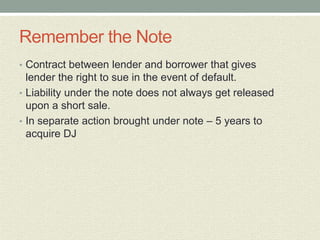

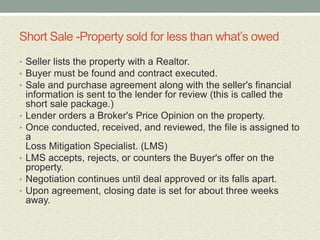

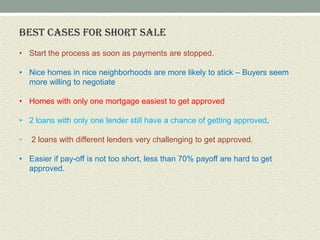

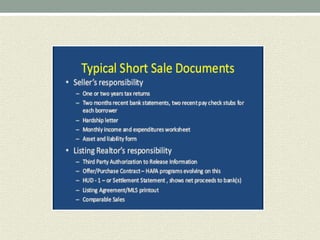

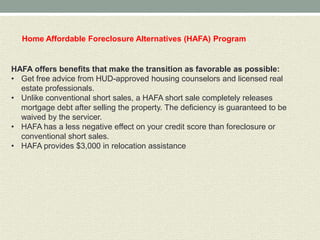

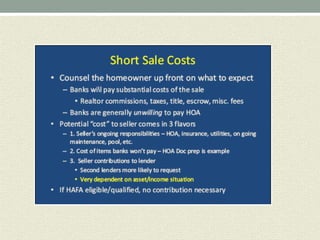

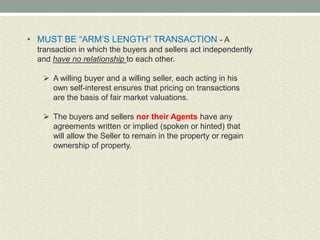

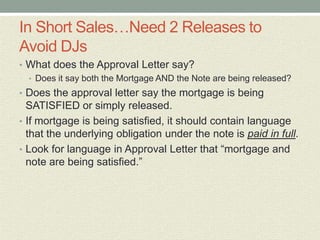

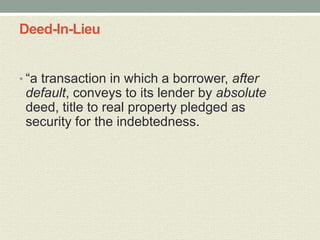

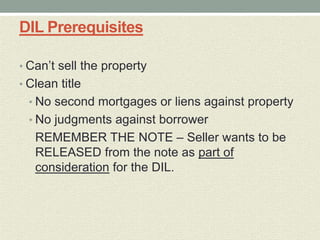

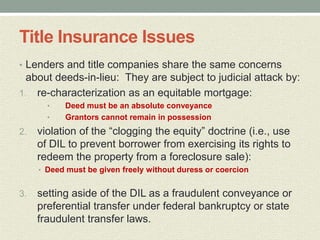

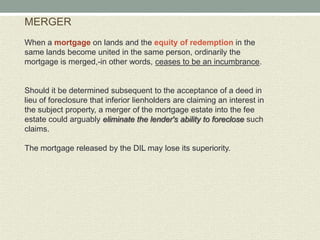

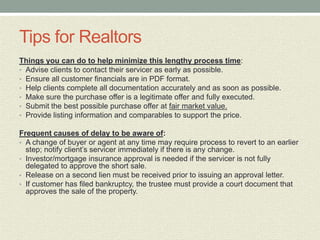

The document outlines the process and consequences of mortgage default, including foreclosure and deficiency judgments. It explains the steps involved, such as complaint filing, foreclosure sales, and the implications of recourse versus non-recourse debt. Additionally, it discusses the tax implications of canceled debt and offers guidance on short sales and deeds-in-lieu, emphasizing the importance of proper documentation and communication with lenders.