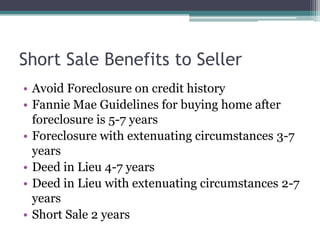

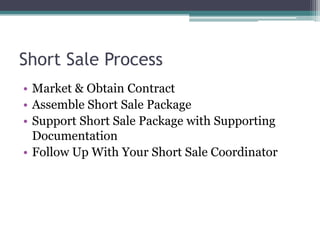

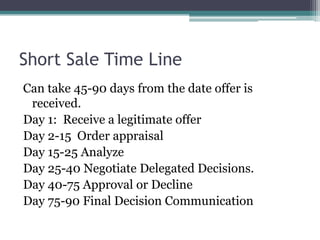

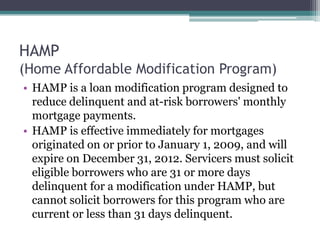

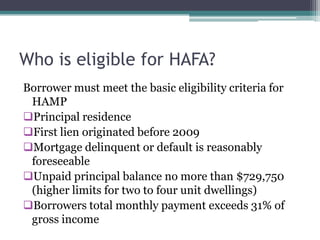

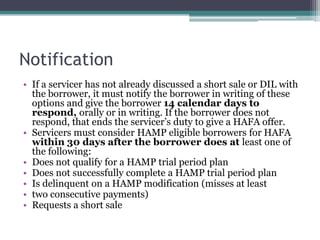

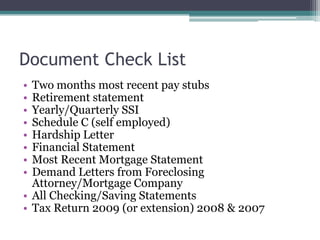

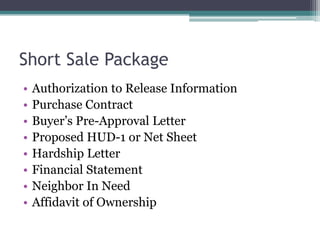

This document provides information about the foreclosure process, homeowner options to avoid foreclosure like loan modifications and short sales, and the benefits and process of pursuing a short sale. It outlines the typical short sale timeline of 45-90 days and the documentation required for a short sale package. It also summarizes programs like HAMP and HAFA that provide guidelines and incentives for loan modifications and short sales. Special protections for active military members in foreclosure are mentioned as well.