FHA/VA - Handout slides

•Download as PPTX, PDF•

0 likes•351 views

The document discusses the requirements for the FHA Pre-Foreclosure Sale (PFS) program and VA Compromise Sale Program (VACSP). Key points include: 1) For FHA PFS, the home must be listed at the appraised value for at least 90 days with a real estate broker. If sold within 90 days, the seller receives a $1000 incentive. 2) Financial hardship must be demonstrated for both programs. For VA loans before 1989, the seller must sign a promissory note. 3) Net sale proceeds must meet minimum thresholds (88% of value for first 30 days for FHA). Closing costs must be reasonable and customary. 4)

Report

Share

Report

Share

Recommended

FHA CE Class

The document compares conventional loans and FHA loans. Some key differences include:

- Conventional loans require a minimum 10% down payment while FHA loans require only 3.5% down.

- FHA loans have more flexible credit requirements and allow gifts, unpaid collections up to $5k, and non-occupant co-borrowers.

- Conventional loans have tiered pricing based on credit score while FHA pricing is the same regardless of score.

FHA VA Loans What Agents Need To Know

Example of one of the professional powerpoints provided by the Performance School of real Estate and part of the educate2earn marketing plan.

Camp oamp webinar fha updates thru ml 10-29 sept (2)

The document summarizes changes to FHA programs from 2010 and prior. Key points include:

1) HERA in 2008 permanently increased loan limits and banned seller-assisted down payments. Minimum required investment is now 3.5% of value.

2) The ARRA in 2009 temporarily extended higher loan limits until December 2010. Condo requirements were updated, allowing smaller projects and site condos without approval.

3) Starting in 2010, appraiser independence rules prohibit commission-based selections. Validity periods changed to 120 days for all appraisals. Short sales now treated as foreclosures for 3 years.

Fh Arealtors November2008

The document discusses changes to FHA loan programs and limits for 2008, including:

1) New higher loan limits up to $729,750 due to economic stimulus packages that aim to stimulate the struggling housing market.

2) Reforms to FHA including lower down payment requirements of 3.5%, more flexible underwriting, and a 12-month moratorium on risk-based mortgage insurance premiums.

3) Key differences between FHA and conventional loans through FNMA/FHLMC, with FHA generally being more flexible regarding low down payments, lower credit scores, and other factors.

Alg Calhfa Ppt

This document provides an overview and agenda for a CALHFA program training offered through Affinity Lending Group. It discusses CalHFA eligibility guidelines including income limits, sales price limits, and underwriting standards. It also outlines CalHFA's first mortgage and down payment assistance programs, as well as Affinity Lending Group's support services.

Fha Loans Ppt

The document provides an overview of various FHA loan programs offered through Affinity Lending Group including standard FHA, FHA jumbo, FHA streamline, and FHA secure programs. It outlines eligibility guidelines, underwriting guidelines, and other details of the programs. Affinity Lending Group has been assisting first-time homebuyers and those needing down payment assistance since 2003 through these FHA loan options.

The Mortgage Process

The mortgage process involves several key steps:

1. Getting pre-approved for a mortgage to determine how much you can borrow and protect the interest rate for up to 120 days.

2. Shopping for a home with your pre-approved mortgage amount.

3. Submitting a mortgage application including documents like pay stubs, bank statements, and information about the property.

4. Having conditions like an appraisal met before finalizing the mortgage.

5. Signing legal documents to transfer title and finalize the mortgage.

1.A (8.5) All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's DPA programs. It includes:

1. A training series outline covering Chenoa Fund programs, underwriting, locks, documents, and servicing.

2. An overview of Chenoa Fund's general DPA programs including eligible property types, underwriting by the lender, and reimbursement when the first mortgage is sold to CBC Mortgage Agency.

3. Summaries of Chenoa Fund's specific DPA programs including details on eligible borrowers, loan terms, income limits, minimum credit scores, maximum DTI, and other requirements. Programs include Rate Advantage, DPA Edge Repayable Second, DPA Edge Soft Second

Recommended

FHA CE Class

The document compares conventional loans and FHA loans. Some key differences include:

- Conventional loans require a minimum 10% down payment while FHA loans require only 3.5% down.

- FHA loans have more flexible credit requirements and allow gifts, unpaid collections up to $5k, and non-occupant co-borrowers.

- Conventional loans have tiered pricing based on credit score while FHA pricing is the same regardless of score.

FHA VA Loans What Agents Need To Know

Example of one of the professional powerpoints provided by the Performance School of real Estate and part of the educate2earn marketing plan.

Camp oamp webinar fha updates thru ml 10-29 sept (2)

The document summarizes changes to FHA programs from 2010 and prior. Key points include:

1) HERA in 2008 permanently increased loan limits and banned seller-assisted down payments. Minimum required investment is now 3.5% of value.

2) The ARRA in 2009 temporarily extended higher loan limits until December 2010. Condo requirements were updated, allowing smaller projects and site condos without approval.

3) Starting in 2010, appraiser independence rules prohibit commission-based selections. Validity periods changed to 120 days for all appraisals. Short sales now treated as foreclosures for 3 years.

Fh Arealtors November2008

The document discusses changes to FHA loan programs and limits for 2008, including:

1) New higher loan limits up to $729,750 due to economic stimulus packages that aim to stimulate the struggling housing market.

2) Reforms to FHA including lower down payment requirements of 3.5%, more flexible underwriting, and a 12-month moratorium on risk-based mortgage insurance premiums.

3) Key differences between FHA and conventional loans through FNMA/FHLMC, with FHA generally being more flexible regarding low down payments, lower credit scores, and other factors.

Alg Calhfa Ppt

This document provides an overview and agenda for a CALHFA program training offered through Affinity Lending Group. It discusses CalHFA eligibility guidelines including income limits, sales price limits, and underwriting standards. It also outlines CalHFA's first mortgage and down payment assistance programs, as well as Affinity Lending Group's support services.

Fha Loans Ppt

The document provides an overview of various FHA loan programs offered through Affinity Lending Group including standard FHA, FHA jumbo, FHA streamline, and FHA secure programs. It outlines eligibility guidelines, underwriting guidelines, and other details of the programs. Affinity Lending Group has been assisting first-time homebuyers and those needing down payment assistance since 2003 through these FHA loan options.

The Mortgage Process

The mortgage process involves several key steps:

1. Getting pre-approved for a mortgage to determine how much you can borrow and protect the interest rate for up to 120 days.

2. Shopping for a home with your pre-approved mortgage amount.

3. Submitting a mortgage application including documents like pay stubs, bank statements, and information about the property.

4. Having conditions like an appraisal met before finalizing the mortgage.

5. Signing legal documents to transfer title and finalize the mortgage.

1.A (8.5) All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's DPA programs. It includes:

1. A training series outline covering Chenoa Fund programs, underwriting, locks, documents, and servicing.

2. An overview of Chenoa Fund's general DPA programs including eligible property types, underwriting by the lender, and reimbursement when the first mortgage is sold to CBC Mortgage Agency.

3. Summaries of Chenoa Fund's specific DPA programs including details on eligible borrowers, loan terms, income limits, minimum credit scores, maximum DTI, and other requirements. Programs include Rate Advantage, DPA Edge Repayable Second, DPA Edge Soft Second

1.C (8.5) Conventional Chenoa Fund Programs Overview

This document provides an overview and details of CBCMA's training program for lenders. The training includes 13 modules that cover topics like Chenoa Fund programs, income limits, the loan application process, underwriting, locking loans, down payment assistance approvals, document drawing, and loan servicing. Product details are also provided for conventional 97% LTV loans and HomeReady loans, including requirements for down payment assistance, income limits, minimum credit scores, loan terms, and more. Clarifications are also included around lender fees, verification of housing expenses, and maximum origination fees.

FHA and VA LOan changes

The document summarizes FHA and VA loan programs that can help buyers with lower credit scores or who have faced prior bankruptcies or foreclosures. Key points include:

- FHA allows lower down payments of 3.5%, higher debt ratios, prior bankruptcies only 2 years old, and gift funds can cover down payment and closing costs. Maximum loan amount is $697,500.

- VA offers zero down payment, prior bankruptcies allowed after 2 years, and gift funds can cover closing costs. Maximum loan amount is $417,000 with no down payment required.

- Both programs accept alternative credit documentation for buyers with credit scores below 620 and allow prior fore

1.C Conventional Chenoa Fund Programs Overview (9.1)

This document provides an overview and details of CBCMA's training program for lenders. The training includes 13 modules that cover topics such as Chenoa Fund programs, underwriting, locking loans, and servicing. Product details are also outlined for HomeReady and 97% LTV conventional loans, including eligibility requirements and terms. Guidelines are clarified for verifying housing expenses, fees, rate sheets, and maximum origination fees.

Foreclosure PreveSlide show: What you need to know about foreclosure prevention

A detailed explanation of the foreclosure process with examples of the short–term and long-term options available to avoid foreclosure.

1.a (v8.3) all chenoa fund programs overview

This document provides an overview and summary of Chenoa Fund programs offered by CBC Mortgage Agency, including:

1. Chenoa Fund offers down payment assistance programs in the form of second mortgages for conventional and FHA loans.

2. Eligible property types include single family homes, condos, townhomes, and manufactured homes. Income limits, minimum credit scores, loan terms and forgiveness terms vary by specific program.

3. The document reviews the key details and requirements of specific Chenoa Fund programs, including Rate Advantage, DPA Edge Repayable Second, DPA Edge Soft Second, Conventional Standard 97%, and HomeReady. It also provides a quick comparison matrix of the programs

1.a (v8.2) all chenoa fund programs overview

This document provides an overview and summary of Chenoa Fund programs offered by CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. Key details summarized include:

1. The training covers Chenoa Fund programs, how to calculate AMI, the loan registration process, underwriting, locking loans, securing down payment assistance approvals, and the purchase clearing process.

2. Chenoa Fund offers 3.5% for down payment and closing cost assistance through second mortgages. Programs are available in all states except New York. First mortgages must be sold to CBC Mortgage Agency.

3. Product options include FHA Rate Advantage, FHA DPA Edge repayable

Wells Fargo HAFA Guidelines

Wells Fargo HAFA Guidelines: For more info visit us at http://shortsale.practicallist.com/wells-fargo-short-sale/

1.A All Chenoa Fund Programs Overview

This document provides an overview and details of Chenoa Fund programs offered by CBC Mortgage Agency. It includes 13 training topics that cover all aspects of the programs from initial registration to loan servicing. The programs offered are Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), DPA Edge: Soft Second (FHA), Conventional Standard 97% LTV Loans, and HomeReady® (Conventional). Each program is described in 1-2 paragraphs outlining key details such as eligible property types, minimum credit score, income limits, loan terms, and down payment assistance amount.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. Key details summarized include eligible property types, minimum credit scores, income limits, DTI requirements, terms of the secondary financing, and documentation requirements for verifying housing expenses and credit.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's DPA programs, including FHA and conventional loan options. It outlines the key details of 13 different down payment assistance programs such as eligible property types, minimum credit scores, income limits, loan terms, repayment requirements, and more. The training includes modules on calculating AMI, the URLA, underwriting, locking loans, securing approvals, document drawing, purchase clearing conditions, and servicing.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. It outlines the key details of each program such as eligible property types, minimum credit scores, income limits, loan terms, down payment assistance percentages, and other requirements. The summary also includes a comparison matrix and FAQs to help lenders understand program guidelines and determine which options may work best for different borrower situations.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including details on their down payment assistance options for both conventional and FHA loans. The summary includes descriptions of the Rate Advantage, DPA Edge, and conventional standard 97% LTV loan programs, outlining key details such as eligible property types, minimum credit scores, income limits, loan terms, and down payment assistance percentages. Requirements for borrowers with credit scores between 620-659 are also outlined.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's down payment assistance programs, including:

- Details on 13 training topics covering Chenoa Fund programs, underwriting, locks, documents, and servicing.

- An overview of Chenoa Fund's suite of DPA products offered in all states except New York, including details on approved property types, loan types, fees, underwriting, and more.

- Summaries of Chenoa Fund's specific DPA programs, including Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), DPA Edge: Soft Second (FHA), Conventional Standard 97% LTV Loans, and HomeReady® (Conventional

1.A All Chenoa Fund Programs Overview (10.0)

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including details on their down payment assistance options for both conventional and FHA loans. The summary includes descriptions of the Rate Advantage, DPA Edge, and conventional standard 97% LTV loan programs, outlining key details such as eligible property types, minimum credit scores, income limits, loan terms, and down payment assistance percentages. Requirements for borrowers with credit scores between 620-659 are also outlined.

1.C Conventional Chenoa Fund Programs Overview (v9.2)

This document provides an overview and instructions for Chenoa Fund's training series on their down payment assistance programs. The training covers all aspects of originating and processing loans using Chenoa Fund's conventional and FHA down payment assistance, including program guidelines, underwriting, document drawing, and servicing. Specific topics covered include AMI calculations, the 1003 application, underwriting, locking loans, securing down payment assistance approvals, and post-closing loan purchasing.

HAFA: Sounds Simple, But The Devil Is In The Details

The document provides an overview of the Home Affordable Foreclosure Alternatives (HAFA) program, which aims to standardize the short sale process. It outlines key terms, eligibility requirements, and steps in the HAFA short sale process. This includes borrower qualification, determining if a short sale or deed-in-lieu is offered, signing a short sale agreement, listing and marketing the property, submitting a purchase agreement, and satisfying liens. The document notes some challenges in implementation, such as lenders meeting timelines and subordinate lien holders accepting payment amounts.

1.F FHA Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs, including:

1. Chenoa Fund offers down payment assistance programs in all states except New York, including Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), and DPA Edge: Soft Second (FHA).

2. The programs provide 3.5% assistance for down payments and closing costs, with various terms for repayment. The first mortgage must be sold to CBC Mortgage Agency.

3. Eligibility requirements include minimum credit scores and debt-to-income ratios. The document reviews guidelines for each program and requirements for borrowers with credit scores between 620-639.

1.F FHA Chenoa Fund Programs Overview

This document provides an overview and summary of a training on Chenoa Fund programs offered by CBC Mortgage Agency. The training covers conventional and FHA loan programs, how to calculate AMI, the loan registration process, underwriting, locking loans, securing down payment assistance approvals, and purchasing and servicing loans. It also includes a comparison matrix of FHA second mortgage products, including the Rate Advantage, DPA Edge Repayable Second, and DPA Edge Soft Second programs.

Az Legal Contract Buyers/Sellers - 8/2019 current

As of August 2019, the current legal process to purchase or sell a home. This contract is designed to be utilized by your realtor, and legally created by the Arizona Association of Realtors to protect home buyers/sellers legally in the sale of their home.

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BK

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BKDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Recovery from an Economic Event is the re-establishment of Satisfactory Credit (as defined on page 5 of this ML) for a minimum of twelve (12) months.NAR HAFA Brochure

The document discusses the Home Affordable Foreclosure Alternatives (HAFA) program, which provides incentives and uniform procedures for short sales and deeds-in-lieu of foreclosure. It was announced in 2009 and guidelines were released later that year. HAFA allows homeowners facing foreclosure to sell their home as a short sale or transfer ownership to the lender to avoid foreclosure. It provides incentives such as relocation assistance and pays administrators and investors to help facilitate the process. The document provides details on borrower eligibility, short sale procedures and timelines, common questions about the program, and implementation.

FHA Presentation

The document provides an overview of FHA mortgage products and guidelines presented by Steve Hankla. It discusses FHA fixed rate and ARM products offered by Envision Lending Group, guidelines on eligible borrowers, properties, down payments, debt-to-income ratios, credit evaluation, and appraisal processes. It also describes the FHA Streamline refinance product and the newer FHA Secure product for borrowers facing payment shock from an ARM reset.

More Related Content

What's hot

1.C (8.5) Conventional Chenoa Fund Programs Overview

This document provides an overview and details of CBCMA's training program for lenders. The training includes 13 modules that cover topics like Chenoa Fund programs, income limits, the loan application process, underwriting, locking loans, down payment assistance approvals, document drawing, and loan servicing. Product details are also provided for conventional 97% LTV loans and HomeReady loans, including requirements for down payment assistance, income limits, minimum credit scores, loan terms, and more. Clarifications are also included around lender fees, verification of housing expenses, and maximum origination fees.

FHA and VA LOan changes

The document summarizes FHA and VA loan programs that can help buyers with lower credit scores or who have faced prior bankruptcies or foreclosures. Key points include:

- FHA allows lower down payments of 3.5%, higher debt ratios, prior bankruptcies only 2 years old, and gift funds can cover down payment and closing costs. Maximum loan amount is $697,500.

- VA offers zero down payment, prior bankruptcies allowed after 2 years, and gift funds can cover closing costs. Maximum loan amount is $417,000 with no down payment required.

- Both programs accept alternative credit documentation for buyers with credit scores below 620 and allow prior fore

1.C Conventional Chenoa Fund Programs Overview (9.1)

This document provides an overview and details of CBCMA's training program for lenders. The training includes 13 modules that cover topics such as Chenoa Fund programs, underwriting, locking loans, and servicing. Product details are also outlined for HomeReady and 97% LTV conventional loans, including eligibility requirements and terms. Guidelines are clarified for verifying housing expenses, fees, rate sheets, and maximum origination fees.

Foreclosure PreveSlide show: What you need to know about foreclosure prevention

A detailed explanation of the foreclosure process with examples of the short–term and long-term options available to avoid foreclosure.

1.a (v8.3) all chenoa fund programs overview

This document provides an overview and summary of Chenoa Fund programs offered by CBC Mortgage Agency, including:

1. Chenoa Fund offers down payment assistance programs in the form of second mortgages for conventional and FHA loans.

2. Eligible property types include single family homes, condos, townhomes, and manufactured homes. Income limits, minimum credit scores, loan terms and forgiveness terms vary by specific program.

3. The document reviews the key details and requirements of specific Chenoa Fund programs, including Rate Advantage, DPA Edge Repayable Second, DPA Edge Soft Second, Conventional Standard 97%, and HomeReady. It also provides a quick comparison matrix of the programs

1.a (v8.2) all chenoa fund programs overview

This document provides an overview and summary of Chenoa Fund programs offered by CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. Key details summarized include:

1. The training covers Chenoa Fund programs, how to calculate AMI, the loan registration process, underwriting, locking loans, securing down payment assistance approvals, and the purchase clearing process.

2. Chenoa Fund offers 3.5% for down payment and closing cost assistance through second mortgages. Programs are available in all states except New York. First mortgages must be sold to CBC Mortgage Agency.

3. Product options include FHA Rate Advantage, FHA DPA Edge repayable

Wells Fargo HAFA Guidelines

Wells Fargo HAFA Guidelines: For more info visit us at http://shortsale.practicallist.com/wells-fargo-short-sale/

1.A All Chenoa Fund Programs Overview

This document provides an overview and details of Chenoa Fund programs offered by CBC Mortgage Agency. It includes 13 training topics that cover all aspects of the programs from initial registration to loan servicing. The programs offered are Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), DPA Edge: Soft Second (FHA), Conventional Standard 97% LTV Loans, and HomeReady® (Conventional). Each program is described in 1-2 paragraphs outlining key details such as eligible property types, minimum credit score, income limits, loan terms, and down payment assistance amount.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. Key details summarized include eligible property types, minimum credit scores, income limits, DTI requirements, terms of the secondary financing, and documentation requirements for verifying housing expenses and credit.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's DPA programs, including FHA and conventional loan options. It outlines the key details of 13 different down payment assistance programs such as eligible property types, minimum credit scores, income limits, loan terms, repayment requirements, and more. The training includes modules on calculating AMI, the URLA, underwriting, locking loans, securing approvals, document drawing, purchase clearing conditions, and servicing.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including conventional, FHA, and down payment assistance options. It outlines the key details of each program such as eligible property types, minimum credit scores, income limits, loan terms, down payment assistance percentages, and other requirements. The summary also includes a comparison matrix and FAQs to help lenders understand program guidelines and determine which options may work best for different borrower situations.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including details on their down payment assistance options for both conventional and FHA loans. The summary includes descriptions of the Rate Advantage, DPA Edge, and conventional standard 97% LTV loan programs, outlining key details such as eligible property types, minimum credit scores, income limits, loan terms, and down payment assistance percentages. Requirements for borrowers with credit scores between 620-659 are also outlined.

1.A All Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund's down payment assistance programs, including:

- Details on 13 training topics covering Chenoa Fund programs, underwriting, locks, documents, and servicing.

- An overview of Chenoa Fund's suite of DPA products offered in all states except New York, including details on approved property types, loan types, fees, underwriting, and more.

- Summaries of Chenoa Fund's specific DPA programs, including Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), DPA Edge: Soft Second (FHA), Conventional Standard 97% LTV Loans, and HomeReady® (Conventional

1.A All Chenoa Fund Programs Overview (10.0)

This document provides an overview and summary of Chenoa Fund programs offered through CBC Mortgage Agency, including details on their down payment assistance options for both conventional and FHA loans. The summary includes descriptions of the Rate Advantage, DPA Edge, and conventional standard 97% LTV loan programs, outlining key details such as eligible property types, minimum credit scores, income limits, loan terms, and down payment assistance percentages. Requirements for borrowers with credit scores between 620-659 are also outlined.

1.C Conventional Chenoa Fund Programs Overview (v9.2)

This document provides an overview and instructions for Chenoa Fund's training series on their down payment assistance programs. The training covers all aspects of originating and processing loans using Chenoa Fund's conventional and FHA down payment assistance, including program guidelines, underwriting, document drawing, and servicing. Specific topics covered include AMI calculations, the 1003 application, underwriting, locking loans, securing down payment assistance approvals, and post-closing loan purchasing.

HAFA: Sounds Simple, But The Devil Is In The Details

The document provides an overview of the Home Affordable Foreclosure Alternatives (HAFA) program, which aims to standardize the short sale process. It outlines key terms, eligibility requirements, and steps in the HAFA short sale process. This includes borrower qualification, determining if a short sale or deed-in-lieu is offered, signing a short sale agreement, listing and marketing the property, submitting a purchase agreement, and satisfying liens. The document notes some challenges in implementation, such as lenders meeting timelines and subordinate lien holders accepting payment amounts.

1.F FHA Chenoa Fund Programs Overview

This document provides an overview and summary of Chenoa Fund programs, including:

1. Chenoa Fund offers down payment assistance programs in all states except New York, including Rate Advantage (FHA), DPA Edge: Repayable Second (FHA), and DPA Edge: Soft Second (FHA).

2. The programs provide 3.5% assistance for down payments and closing costs, with various terms for repayment. The first mortgage must be sold to CBC Mortgage Agency.

3. Eligibility requirements include minimum credit scores and debt-to-income ratios. The document reviews guidelines for each program and requirements for borrowers with credit scores between 620-639.

1.F FHA Chenoa Fund Programs Overview

This document provides an overview and summary of a training on Chenoa Fund programs offered by CBC Mortgage Agency. The training covers conventional and FHA loan programs, how to calculate AMI, the loan registration process, underwriting, locking loans, securing down payment assistance approvals, and purchasing and servicing loans. It also includes a comparison matrix of FHA second mortgage products, including the Rate Advantage, DPA Edge Repayable Second, and DPA Edge Soft Second programs.

Az Legal Contract Buyers/Sellers - 8/2019 current

As of August 2019, the current legal process to purchase or sell a home. This contract is designed to be utilized by your realtor, and legally created by the Arizona Association of Realtors to protect home buyers/sellers legally in the sale of their home.

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BK

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BKDean Wegner of Guardian Mortgage, Arizona 602-432-6388

Recovery from an Economic Event is the re-establishment of Satisfactory Credit (as defined on page 5 of this ML) for a minimum of twelve (12) months.What's hot (20)

1.C (8.5) Conventional Chenoa Fund Programs Overview

1.C (8.5) Conventional Chenoa Fund Programs Overview

1.C Conventional Chenoa Fund Programs Overview (9.1)

1.C Conventional Chenoa Fund Programs Overview (9.1)

Foreclosure PreveSlide show: What you need to know about foreclosure prevention

Foreclosure PreveSlide show: What you need to know about foreclosure prevention

1.C Conventional Chenoa Fund Programs Overview (v9.2)

1.C Conventional Chenoa Fund Programs Overview (v9.2)

HAFA: Sounds Simple, But The Devil Is In The Details

HAFA: Sounds Simple, But The Devil Is In The Details

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BK

FHA Announces you can buy 1 year from Foreclosure, Short-Sale and BK

Similar to FHA/VA - Handout slides

NAR HAFA Brochure

The document discusses the Home Affordable Foreclosure Alternatives (HAFA) program, which provides incentives and uniform procedures for short sales and deeds-in-lieu of foreclosure. It was announced in 2009 and guidelines were released later that year. HAFA allows homeowners facing foreclosure to sell their home as a short sale or transfer ownership to the lender to avoid foreclosure. It provides incentives such as relocation assistance and pays administrators and investors to help facilitate the process. The document provides details on borrower eligibility, short sale procedures and timelines, common questions about the program, and implementation.

FHA Presentation

The document provides an overview of FHA mortgage products and guidelines presented by Steve Hankla. It discusses FHA fixed rate and ARM products offered by Envision Lending Group, guidelines on eligible borrowers, properties, down payments, debt-to-income ratios, credit evaluation, and appraisal processes. It also describes the FHA Streamline refinance product and the newer FHA Secure product for borrowers facing payment shock from an ARM reset.

Short Sales

This document provides information about the foreclosure process, homeowner options to avoid foreclosure like loan modifications and short sales, and the benefits and process of pursuing a short sale. It outlines the typical short sale timeline of 45-90 days and the documentation required for a short sale package. It also summarizes programs like HAMP and HAFA that provide guidelines and incentives for loan modifications and short sales. Special protections for active military members in foreclosure are mentioned as well.

Successfully Selling HUD Homes

This document provides information about buying and selling HUD homes. It defines what a HUD home is and explains that they can vary in price, location, and condition. Both owner occupants and investors are eligible to purchase HUD homes. The bidding process and requirements for submitting bids are outlined. Details are provided about listing codes, lead-based paint regulations, and programs like Good Neighbor Next Door that provide discounts. The steps for agents to register, search listings, fill out contracts, submit bids, and handle contingencies are covered.

Watson Title Services HAFA & HAMP Programs

The document summarizes the Home Affordable Modification Program (HAMP) and the Home Affordable Foreclosure Alternatives (HAFA) program. HAMP allows homeowners to apply for a loan modification to avoid foreclosure, while HAFA provides an alternative for homeowners who do not qualify for HAMP by allowing pre-approved short sales with incentives for all parties. The document outlines the eligibility requirements and processes for both programs.

Watson Title Services HAMP & HAFA Programs

This presentation is to aid anyone seeking more information regarding HAMP & HAFA short sale programs.

Watson Title Services | HAFA & HAMP Short Sale Programs

This presentation is to help aid anyone who is interested in learning more about HAFA and HAMP short sale programs

Brokers Guide To Selling Hud Homes

This document provides guidance for real estate brokers on selling homes owned by the Department of Housing and Urban Development (HUD). It outlines the process for brokers to register with HUD, access property listings on HUDHomestore.com, place bids on behalf of buyers, submit sales contracts, and handle other aspects of the transaction such as inspections, extensions, and closing. It also describes HUD's programs that provide discounts or special terms for certain buyer types such as first responders or non-profits.

Brokers guide to selling hud homes

HUD homes are foreclosed homes that are owned and sold by the Department of Housing and Urban Development (HUD). Licensed real estate brokers can list, show, and submit offers on HUD homes on behalf of buyers after registering with HUD. HUD homes are sold through an online bidding process and various programs provide priority to certain buyers like owner-occupants, non-profits, and first responders. FHA loans are typically available to finance the purchase of HUD homes.

Forfeiture and extension policy

This document outlines HUD's policies regarding:

1) Purchasers must close on property sales within 45 days or forfeit their earnest money deposit, except for certain documented special circumstances for owner-occupants.

2) Investor purchasers forfeit their entire deposit for uninsured sales and 50% for FHA-insured sales if they do not close.

3) Owner-occupants may get deposits back for documented reasons like family death, illness, job loss, or inability to get a mortgage.

4) Extensions may be granted for a fee if documentation shows mortgage approval is imminent.

Hafa For Homeowners Hollywoodhillsavoidforeclosure

HAFA for Home Owners. Options to avoid foreclosure. Includes highlights of Fannie and Freddie programs.

Understanding fha and va distressed property options aug2011

This document summarizes the key points of a presentation on FHA and VA distressed property options:

1) It outlines the process for the FHA Pre-Foreclosure Sale (PFS) program, including establishing the appraised market value as the listing price, tiered net proceeds requirements, marketing documentation requirements, and financial analysis of sellers.

2) It notes that 91% of sales under $358,000 have been FHA financed recently and details some of FHA's updated guidelines like higher debt-to-income ratios and lower mortgage insurance.

3) It provides an overview of how to handle VA loans in distress, noting special paperwork and issues to be aware of when working with a VA

Main Street Capital Short Sale Agreement (V1 8.11.08)

Main Street Capital Housing Corporation provides services to help homeowners avoid foreclosure through alternatives like loan modifications, short sales, forbearance agreements, and deed-in-lieu of foreclosure. They require homeowners to submit documentation like financial statements, bank statements, tax returns, and a real estate listing agreement to review the homeowner's eligibility for these options and begin negotiations with lenders. The review process takes 30-45 days and foreclosure proceedings continue until an agreement is reached.

Understanding FHA and VA Distressed Property Options

Making sure by doing this class you can help any VA or FHA home owner to quickly go through the short sale programs

HUD Buyer Select Training

The Buyer Select Closing Agent Program allows buyers to choose their own title company. Buyers must include the Buyer Select addendum and choose a title company to enter on the sales contract. The closing agent fee is now paid by the buyer. Extensions are handled through the Asset Manager rather than the title company. Title companies must meet HUD requirements to participate.

Hafa slideshow

HAFA is a government sponsored short sale and deed-in-liue program. It is an extension of the HAMP loan modification program. This slide show takes you through the HAFA process.

Loan Modifcications by a CPA

How MBS and HAMP are related and why a CPA is better suited to assist a borrower in the loan modification process.

dean.gittleson@gmail.com

Ed 2011-conventional-financing-add

This document outlines the terms of conventional financing for a property sale. It specifies that the purchaser will obtain either a fixed or adjustable rate first and possibly second deed of trust for specified loan amounts. It establishes financing and appraisal contingencies, requiring the purchaser to obtain loan commitments by certain deadlines or the contract becomes void. It also addresses terms like seller subsidies, lender-required repairs, and default conditions.

Fha Information

The document provides information on FHA loan guidelines including eligibility requirements, purchase limits, credit requirements, and other program details. Key points include:

- Anyone with a social security number who will occupy the home as their primary residence can qualify for an FHA loan.

- Borrowers can finance up to 97.75% of the purchase price with a minimum down payment of 3.5% and debt-to-income ratios not exceeding 31% and 43%.

- Credit requirements are flexible, requiring three credit references from the last 12 months and a minimum credit score of 600.

Short Sale Explained

To begin the short sale process, homeowners must compile and submit various documents including a signed purchase contract, listing agreement, hardship letter detailing their inability to pay, and permission for the bank to discuss the loan. Additional documents like income verification, bank statements, and tax returns may also be required. A short sale must involve an arm's length transaction where the buyer has no close ties to the homeowner. Junior lien holders must also agree to release their liens, which can delay the process. Factors that minimize processing time include prompt submission of documents, cooperation with appraisals, and ensuring the purchase offer is fair market value.

Similar to FHA/VA - Handout slides (20)

Watson Title Services | HAFA & HAMP Short Sale Programs

Watson Title Services | HAFA & HAMP Short Sale Programs

Hafa For Homeowners Hollywoodhillsavoidforeclosure

Hafa For Homeowners Hollywoodhillsavoidforeclosure

Understanding fha and va distressed property options aug2011

Understanding fha and va distressed property options aug2011

Main Street Capital Short Sale Agreement (V1 8.11.08)

Main Street Capital Short Sale Agreement (V1 8.11.08)

Understanding FHA and VA Distressed Property Options

Understanding FHA and VA Distressed Property Options

More from JTtheCoach.com

Six Steps To Success - add $90k to YOUR Income 9 months or less

In this course/workshop John Todaro (aka Coach JT) has put together the core building blocks and basics in a condensed format giving you the specific items, if implemented daily, weekly, monthly WILL add $90K or more to your income in $9 months or less. You can reach out to John Todaro (JT) with Fairway Independent Mortgage at 480-286-2384 or by email: JTodaro@Fairwaymc.com. Learn more about John and how he is helping families all across Arizona with their home financing by going to www.JTKnowsLoans.com

The value of being seen 10 07-2011

Real Estate Agent 3 Hr CE Class on How to Market listings to close on the first touch and generate buyer interest.

Hot to generate leads via Social Media Marketing for Realtors and Loan Officers

This document provides strategies for generating leads and attracting more customers through proven instant and organic lead generation methods. It discusses how social media marketing compares to traditional marketing, tools to use, and how to move from good to great. It outlines organic lead generation strategies and how to build an online identity. Specific strategies covered include using a blog, establishing a presence on LinkedIn, Facebook, Twitter and YouTube, understanding buyers and engaging them with relevant content, email marketing for lead retention, and content distribution.

Blogging with Coach JT and Mark Taylor

In this Learning Lab Coach JT and Mark Taylor take you through the power of ActiveRain and how to leverage it to create your own online identity and take over as a Real Estate agent in your focused farm as we call it BLARMING

LPS Title Presentation by Coach JT

This document outlines an education program called Educate2Earn that aims to help real estate professionals double their sales. It proposes delivering continuing education classes to agents to build relationships and trust. It highlights delivering systems, tools, and marketing support to build agents' online identities and increase the value they provide. The program claims it can help agents meet over 600 other agents per year and provide proven plans and support to ensure success in doubling income. It shares positive feedback from agents who have attended classes.

How We Can Help You Grow Your Real Estate Career

Attn Real Estate agents...if you are serious about closing your listing's on the "1st Touch" and getting those properties on the 1st page of GOOGLE search then we have a answer for you. Contact Coach JT @ 480-286-2384 or check out facebook.com/CoachJT....you can also shoot him an email at JT@JTtheCoach.com

Coach JT Omar Periu Keynote Speech 12 10 09

Keynote presentation on How to Generate new qualified leads and build trust via Inbound Marketing. What I call InBounding or Attraction Marketing.

More from JTtheCoach.com (7)

Six Steps To Success - add $90k to YOUR Income 9 months or less

Six Steps To Success - add $90k to YOUR Income 9 months or less

Hot to generate leads via Social Media Marketing for Realtors and Loan Officers

Hot to generate leads via Social Media Marketing for Realtors and Loan Officers

Recently uploaded

Temple of Asclepius in Thrace. Excavation results

The temple and the sanctuary around were dedicated to Asklepios Zmidrenus. This name has been known since 1875 when an inscription dedicated to him was discovered in Rome. The inscription is dated in 227 AD and was left by soldiers originating from the city of Philippopolis (modern Plovdiv).

Gender and Mental Health - Counselling and Family Therapy Applications and In...

A proprietary approach developed by bringing together the best of learning theories from Psychology, design principles from the world of visualization, and pedagogical methods from over a decade of training experience, that enables you to: Learn better, faster!

HYPERTENSION - SLIDE SHARE PRESENTATION.

IT WILL BE HELPFULL FOR THE NUSING STUDENTS

IT FOCUSED ON MEDICAL MANAGEMENT AND NURSING MANAGEMENT.

HIGHLIGHTS ON HEALTH EDUCATION.

A Visual Guide to 1 Samuel | A Tale of Two Hearts

These slides walk through the story of 1 Samuel. Samuel is the last judge of Israel. The people reject God and want a king. Saul is anointed as the first king, but he is not a good king. David, the shepherd boy is anointed and Saul is envious of him. David shows honor while Saul continues to self destruct.

How to Fix [Errno 98] address already in use![How to Fix [Errno 98] address already in use](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![How to Fix [Errno 98] address already in use](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This slide will represent the cause of the error “[Errno 98] address already in use” and the troubleshooting steps to resolve this error in Odoo.

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

Slides from a Capitol Technology University webinar held June 20, 2024. The webinar featured Dr. Donovan Wright, presenting on the Department of Defense Digital Transformation.

Jemison, MacLaughlin, and Majumder "Broadening Pathways for Editors and Authors"

Jemison, MacLaughlin, and Majumder "Broadening Pathways for Editors and Authors"National Information Standards Organization (NISO)

This presentation was provided by Racquel Jemison, Ph.D., Christina MacLaughlin, Ph.D., and Paulomi Majumder. Ph.D., all of the American Chemical Society, for the second session of NISO's 2024 Training Series "DEIA in the Scholarly Landscape." Session Two: 'Expanding Pathways to Publishing Careers,' was held June 13, 2024.Benner "Expanding Pathways to Publishing Careers"

This presentation was provided by Rebecca Benner, Ph.D., of the American Society of Anesthesiologists, for the second session of NISO's 2024 Training Series "DEIA in the Scholarly Landscape." Session Two: 'Expanding Pathways to Publishing Careers,' was held June 13, 2024.

Bossa N’ Roll Records by Ismael Vazquez.

Bossa N Roll Records presentation by Izzy Vazquez for Music Retail and Distribution class at Full Sail University

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

مصحف أحرف الخلاف للقراء العشرةأعد أحرف الخلاف بالتلوين وصلا سمير بسيوني غفر الله له

skeleton System.pdf (skeleton system wow)

🔥🔥🔥🔥🔥🔥🔥🔥🔥

إضغ بين إيديكم من أقوى الملازم التي صممتها

ملزمة تشريح الجهاز الهيكلي (نظري 3)

💀💀💀💀💀💀💀💀💀💀

تتميز هذهِ الملزمة بعِدة مُميزات :

1- مُترجمة ترجمة تُناسب جميع المستويات

2- تحتوي على 78 رسم توضيحي لكل كلمة موجودة بالملزمة (لكل كلمة !!!!)

#فهم_ماكو_درخ

3- دقة الكتابة والصور عالية جداً جداً جداً

4- هُنالك بعض المعلومات تم توضيحها بشكل تفصيلي جداً (تُعتبر لدى الطالب أو الطالبة بإنها معلومات مُبهمة ومع ذلك تم توضيح هذهِ المعلومات المُبهمة بشكل تفصيلي جداً

5- الملزمة تشرح نفسها ب نفسها بس تكلك تعال اقراني

6- تحتوي الملزمة في اول سلايد على خارطة تتضمن جميع تفرُعات معلومات الجهاز الهيكلي المذكورة في هذهِ الملزمة

واخيراً هذهِ الملزمة حلالٌ عليكم وإتمنى منكم إن تدعولي بالخير والصحة والعافية فقط

كل التوفيق زملائي وزميلاتي ، زميلكم محمد الذهبي 💊💊

🔥🔥🔥🔥🔥🔥🔥🔥🔥

Level 3 NCEA - NZ: A Nation In the Making 1872 - 1900 SML.ppt

The History of NZ 1870-1900.

Making of a Nation.

From the NZ Wars to Liberals,

Richard Seddon, George Grey,

Social Laboratory, New Zealand,

Confiscations, Kotahitanga, Kingitanga, Parliament, Suffrage, Repudiation, Economic Change, Agriculture, Gold Mining, Timber, Flax, Sheep, Dairying,

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

(𝐓𝐋𝐄 𝟏𝟎𝟎) (𝐋𝐞𝐬𝐬𝐨𝐧 𝟏)-𝐏𝐫𝐞𝐥𝐢𝐦𝐬

𝐃𝐢𝐬𝐜𝐮𝐬𝐬 𝐭𝐡𝐞 𝐄𝐏𝐏 𝐂𝐮𝐫𝐫𝐢𝐜𝐮𝐥𝐮𝐦 𝐢𝐧 𝐭𝐡𝐞 𝐏𝐡𝐢𝐥𝐢𝐩𝐩𝐢𝐧𝐞𝐬:

- Understand the goals and objectives of the Edukasyong Pantahanan at Pangkabuhayan (EPP) curriculum, recognizing its importance in fostering practical life skills and values among students. Students will also be able to identify the key components and subjects covered, such as agriculture, home economics, industrial arts, and information and communication technology.

𝐄𝐱𝐩𝐥𝐚𝐢𝐧 𝐭𝐡𝐞 𝐍𝐚𝐭𝐮𝐫𝐞 𝐚𝐧𝐝 𝐒𝐜𝐨𝐩𝐞 𝐨𝐟 𝐚𝐧 𝐄𝐧𝐭𝐫𝐞𝐩𝐫𝐞𝐧𝐞𝐮𝐫:

-Define entrepreneurship, distinguishing it from general business activities by emphasizing its focus on innovation, risk-taking, and value creation. Students will describe the characteristics and traits of successful entrepreneurs, including their roles and responsibilities, and discuss the broader economic and social impacts of entrepreneurial activities on both local and global scales.

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...Nguyen Thanh Tu Collection

https://app.box.com/s/tacvl9ekroe9hqupdnjruiypvm9rdaneRecently uploaded (20)

Gender and Mental Health - Counselling and Family Therapy Applications and In...

Gender and Mental Health - Counselling and Family Therapy Applications and In...

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

CapTechTalks Webinar Slides June 2024 Donovan Wright.pptx

Jemison, MacLaughlin, and Majumder "Broadening Pathways for Editors and Authors"

Jemison, MacLaughlin, and Majumder "Broadening Pathways for Editors and Authors"

SWOT analysis in the project Keeping the Memory @live.pptx

SWOT analysis in the project Keeping the Memory @live.pptx

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

مصحف القراءات العشر أعد أحرف الخلاف سمير بسيوني.pdf

Level 3 NCEA - NZ: A Nation In the Making 1872 - 1900 SML.ppt

Level 3 NCEA - NZ: A Nation In the Making 1872 - 1900 SML.ppt

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

Philippine Edukasyong Pantahanan at Pangkabuhayan (EPP) Curriculum

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

BÀI TẬP BỔ TRỢ TIẾNG ANH LỚP 9 CẢ NĂM - GLOBAL SUCCESS - NĂM HỌC 2024-2025 - ...

FHA/VA - Handout slides

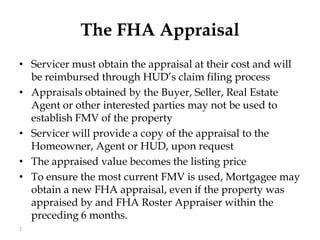

- 1. The FHA Appraisal Servicer must obtain the appraisal at their cost and will be reimbursed through HUD’s claim filing process Appraisals obtained by the Buyer, Seller, Real Estate Agent or other interested parties may not be used to establish FMV of the property Servicer will provide a copy of the appraisal to the Homeowner, Agent or HUD, upon request The appraised value becomes the listing price To ensure the most current FMV is used, Mortgagee may obtain a new FHA appraisal, even if the property was appraised by and FHA Roster Appraiser within the preceding 6 months. 1

- 2. 2 FHA PFS Basics: Program is for people with a hardship that have to sell their home and can’t due to loan being greater than the value To participate the seller must be willing to market the home with a Realtor for at least 90 days During the 90 days the Servicer will delay foreclosure If the property is sold in the 90 day period the seller will receive a $1000 incentive. $750 after that. If the property doesn’t sell then the Seller is encouraged to participate in the DIL process. No deficiency judgment will be sought if the Seller complies with the program in good faith HECM mortgages “reverse mortgages” are not eligible for the PFS program In order to participate in the PFS the Seller must be delinquent at least 30 days! (this excludes them from entering back into the market for 2 years on a conventional loan and 3 years using FHA again ((from time of claim paid))

- 3. 3 FHA PFS Basics: Qualifying: Are in default due to adverse and unforeseeable circumstances Have negative equity Are owner occupants ( non-owner exceptions are granted) Have only one FHA loan* Are not a corporation or partnership On the 32-60 day of default consumers will be sent HUD PA-426 “How to avoid foreclosure” in encourage initiation into the PFS program HUD-90035 Form “information disclosure” will be mailed to seller along with disclosures. Financial information will be furnished to the Servicer and upon approval of financial distress HUD-90045 Form “approval to participate” will be sent *Mortgagees are authorized to make reasonable exceptions for mortgagors who have acquired and FHA insured property through inheritance or co-signed to enhance the credit of another mortgagor.

- 4. 4 FHA PFS Basics: Financial Analysis: All documentation and statements either supplied electronically or on the phone will be verified. Sellers with additional assets will be required to exhaust those assets wherever possible to make the mortgagee as whole as possible Calculations will be entered into to examine borrowers fixed monthly expenses including food, bills, utilities outstanding debts, etc) Calculations to verify monthly net income including anticipation of fluctuations in income Calculating the surplus income from net that remains to offset the mortgage During this process if the seller is deemed not eligible for the PFS or another mitigation solution then they must be given a detailed denial and 7 days to refute

- 5. 5 FHA PFS Basics: Property Value: Must be listed at the as-is appraised value completed by HUD per the HUD handbook 4150-2 (195 page manual) Must be valid for 6 months Distressed sales cannot be used unless that is all the comps available Property Condition: Any and all repairs must be approved prior to approval of FMV. Repairs require a HUD – 90041 Request for variance to be completed and approved

- 6. 6 FHA PFS Basics:: Title: A title search must be performed prior to issuance of the approval to participate. If the issues conveyed on the Prelim can be resolved they must be resolved If discharging of a junior lien is necessary then the max contribution will be $2500 . This is $1500 from the Mortgagor/Mortgagee and $1000 from the Mortgagee that they would have given to the Mortgagor as the incentive for helping sell the home. If a promissory note is requested the Seller must do all they can to comply with those terms. Mortgagors who have the ability to do so must satisfy or obtain release of liens. Upon completion of all of the aforementioned steps a form 90045 approval to participate will be issued.

- 7. 7 FHA PFS Basics: Use of a Real Estate Broker (page 11 of 18 of ml 2008-43) Must be engaged with Broker within 7 days of the approval to participate HUD-90045 No conflict of interest allowed for Listing Agent No commission to be paid to Agent on their own property if doing a PFS If FSBO Seller had already entered into a contract there is no need for a Realtor Listing agreement must include the following language: "Seller may cancel this Agreement prior to the ending date of the listing period without advance notice to the Broker, and without payment of a commission or any other consideration if the property is conveyed to the mortgage insurer or the mortgage holder. The sale completion is subject to approval by the mortgagee.”

- 8. 8 FHA PFS Basics : Use of a Real Estate Broker, cont. (page 11 of 18 of ml 2008-43) Seller must maintain the property Arms length transaction at all times Contract will be approved within 5 business days of receiving it and a HUD-90051 “Sales Contract review” form will be sent to the Seller after ensuring no hidden terms or “special” agreements have been entered into Sale must occur within 4 months of approval and an extension of 2 months may be given if loan is a tier 1 http://www.hud.gov/offices/hsg/sfh/nsc/trsovrvw.cfm) or there is a signed contract that cannot perform within the 4 months

- 9. 9 Net Sale Proceeds and Marketing : First 30 days offers will be approved at Minimum Net Proceeds of 88% of FMV 30-60 days offers will be approved at MNP of 86% of FMV 61 days offers will be approved at MNP of 84% of FMV Max period is 6 months for marketing for participating if PFS they want the homes sold with in the first 90days ~ after that DIL is offered to seller. NET SALE PROCEEDS is defined as: Net Sale Proceeds (FMV minus marketing time) The Sales Price – The Closing/Settlement Costs Net Sale Proceeds

- 10. 10 More on Net Sale Proceeds: FHA PFC $ $ $ Costs Affecting NSP Commissions not to exceed 6% Taxes are prorated to date of closing Sellers costs for title transfer taxes $1000 incentive for selling home within 90 days Up to $2500 for releasing a junior lien after 90 days max is $2250 Up to 1% of buyers closing cost contributions $ $ $ $ $ $

- 11. 11 How to Qualify for a VA Compromise Agreement Property must be sold at fair market value Closing costs must be reasonable and customary Must be less costly to Servicer/Investor than a foreclosure Financial Hardship must be demonstrated by the Seller Loans funded prior to Dec 31st 1989, the seller must sign a promissory note No second liens! Where there are 2nd Liens, Seller must pay them or accept a promissory note Must obtain a sales contract prior to being considered for the program Realtors must protect the Seller by ensuring the contract states: “Sales contract is contingent and/or subject to the approval of a VA Compromise Sale”

- 12. 12 Rules for the Realtor and Seller(VACSP) Seller should contact their Servicer or their local VA asking them to participate in the VA Compromise Sale Program (VACSP) Seller to provide a written financial statement provided by their Servicer Seller must complete a letter of request to participate in VACSP Compromise Agreement Sale Application needs be completed by the Seller, obtained from the Servicer Seller needs be prepared to sign a promissory note to the VA for the loss incurred if they had a home loan prior to 12/31/1989

- 13. 13 Rules for the Realtor and Seller(VACSP) Sales contract submitted must include all signatures and state: “offer contingent upon approval of a VA compromise sale” GFE Needs be provided of all costs of the loan Letter to Servicer and VA asking to be considered for VACSP All supporting documentation of the hardship Compromise agreement sale Application submitted A current VA appraisal must be acquired by Seller’s Servicer and ordered by them – exception is if buyer is a VA applicant that appraisal may be used instead ( note VA has a 10 day turn around window) A compromise assumption agreement from the Servicer to the VA agreeing to modify their claim Review of the buyer to ensure that they do indeed qualify before finalizing the process

Editor's Notes

- ML 2008-43 is the HUD book on PFS

- The Link is to HUD’s website regarding the tier ranking system. HUD implemented the Tier Ranking System (TRS) in 2000 as a pilot to measure servicer's utilization of HUD's loss mitigation program.