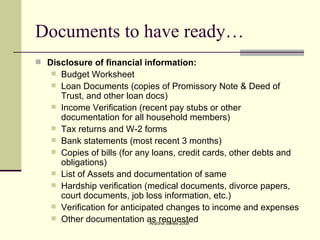

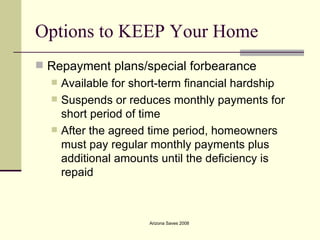

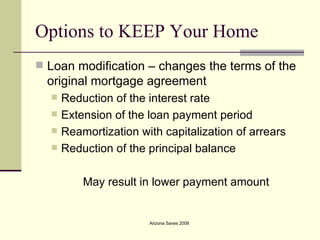

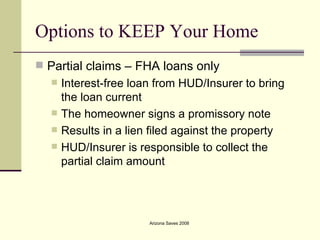

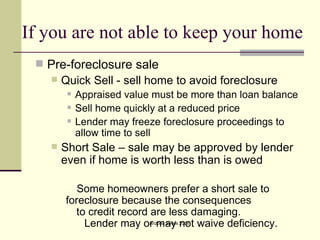

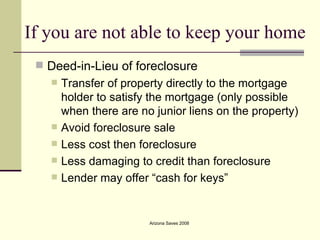

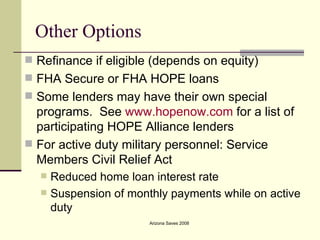

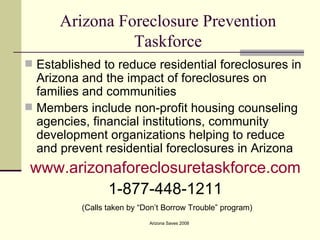

The document provides information on options for homeowners who are facing foreclosure or are at risk of defaulting on their mortgage. It outlines steps homeowners should take if they are behind on payments but not in default, including reducing expenses, liquidating assets, or refinancing. If in default, homeowners should contact their lender's loss mitigation department and provide documentation of their hardship. The document describes options to keep the home such as repayment plans, loan modifications, or partial claims. If unable to keep the home, options include short sales or deeds in lieu of foreclosure. It provides resources for assistance and prevention programs in Arizona.