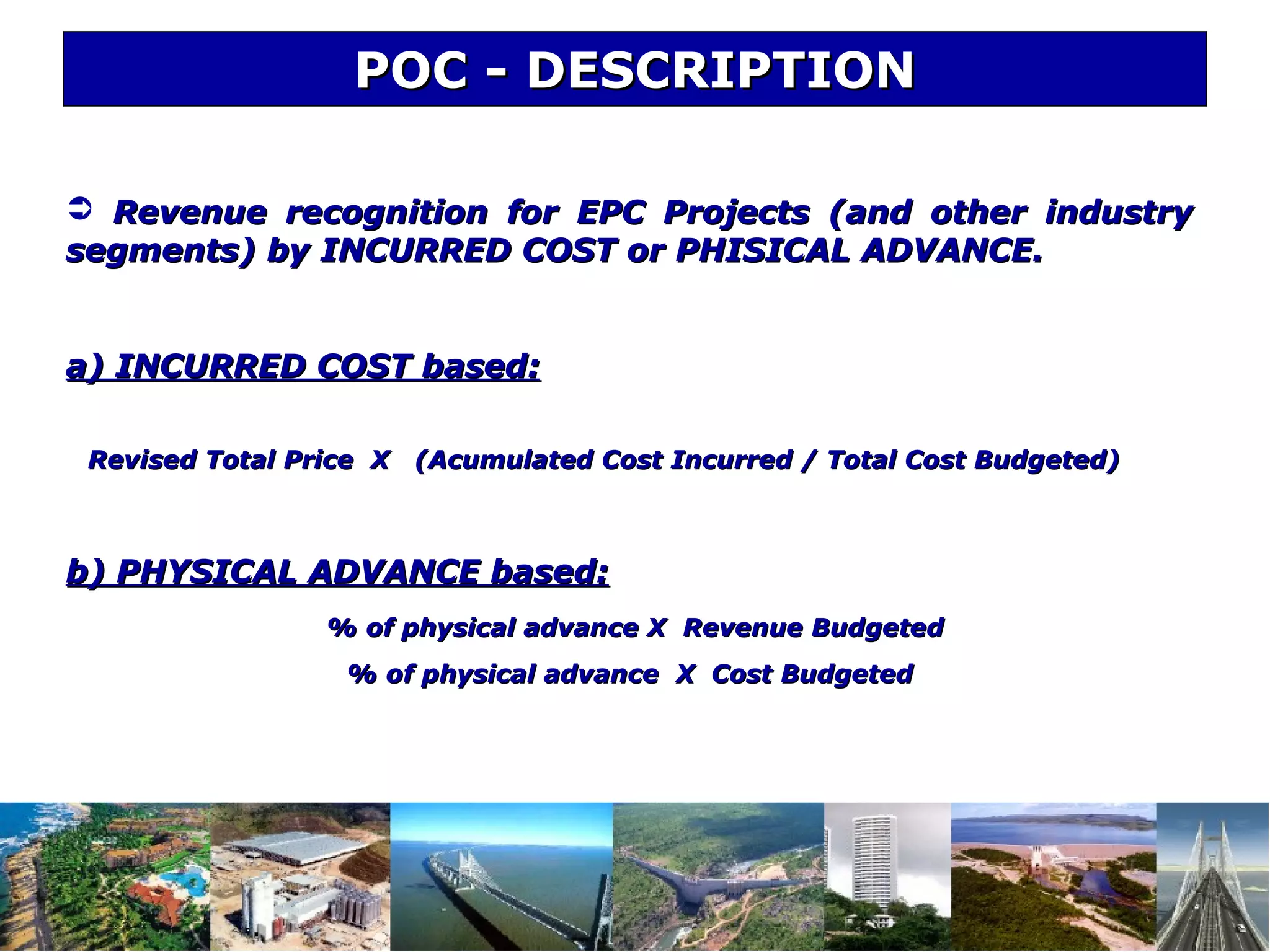

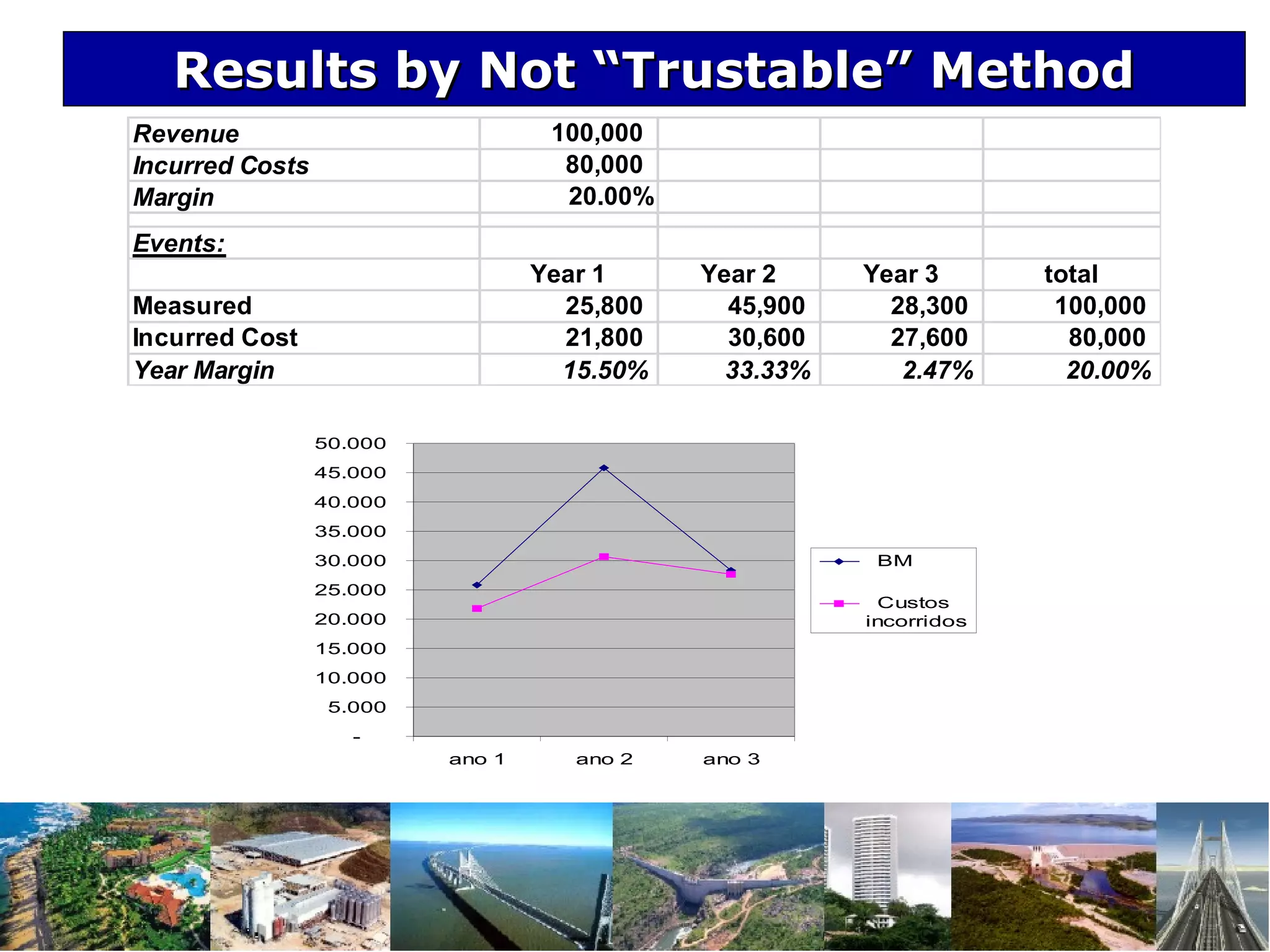

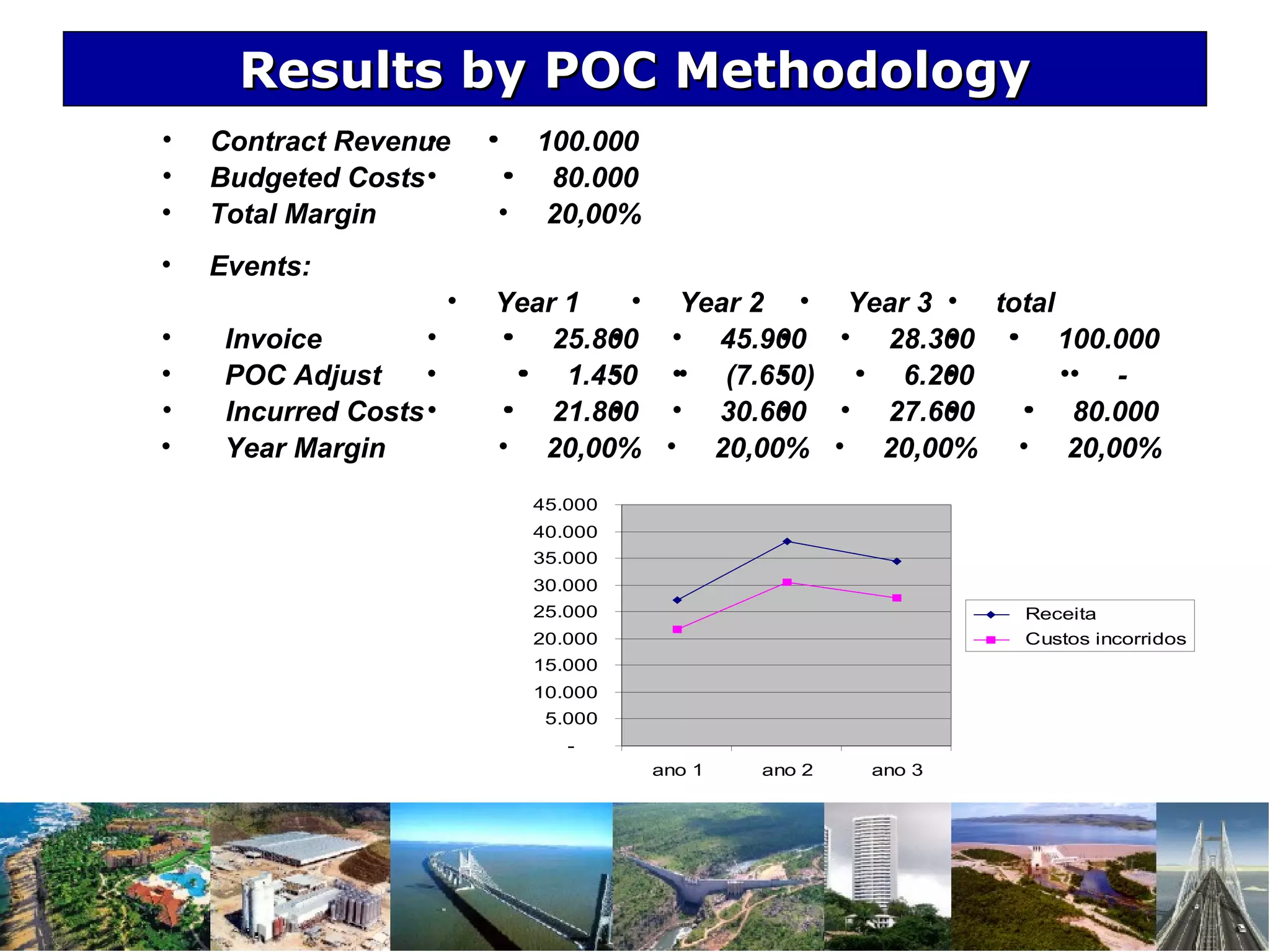

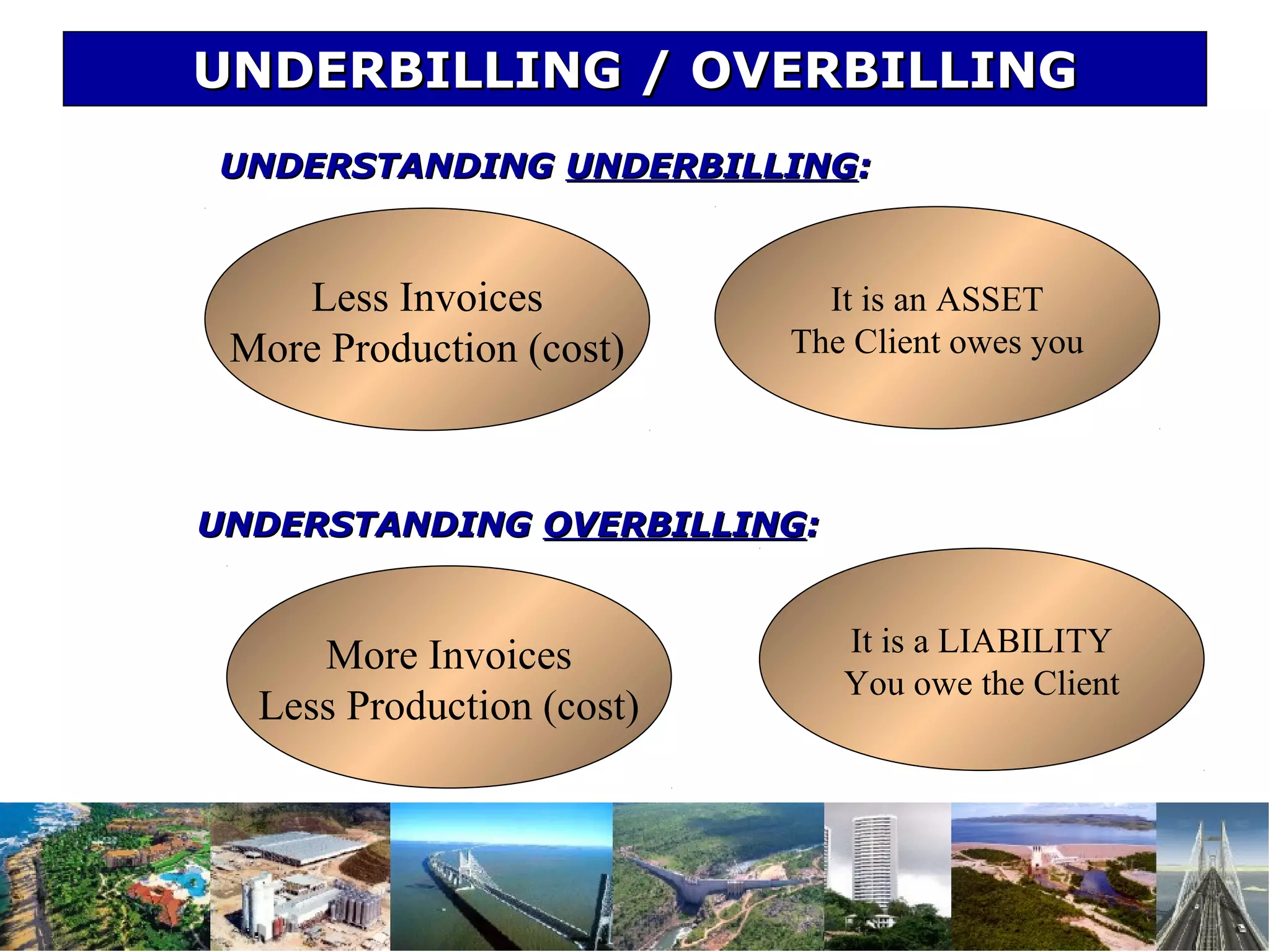

This document describes the percentage of completion (POC) methodology for revenue recognition on engineering, procurement, and construction (EPC) projects. It explains that revenue is recognized based on either incurred costs or physical progress. The POC methodology incentivizes on-budget and cost management practices, results in more predictable profit margins, and allows profits to be recognized in a manner that better matches fiscal years. Key concepts discussed include underbilling/overbilling, treatment of client acquisitions and subcontractor billing.