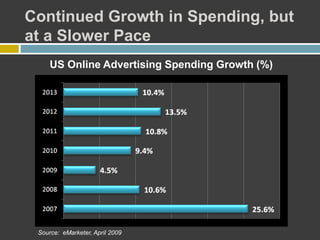

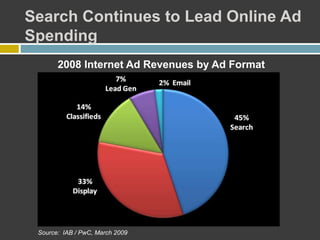

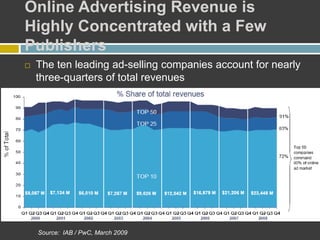

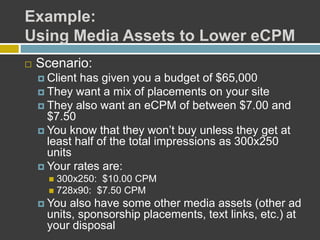

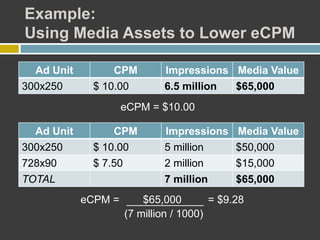

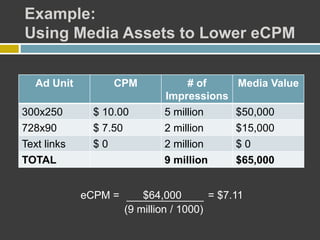

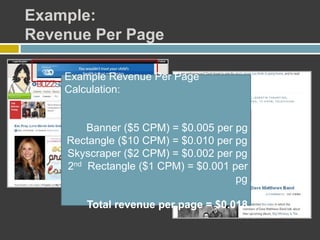

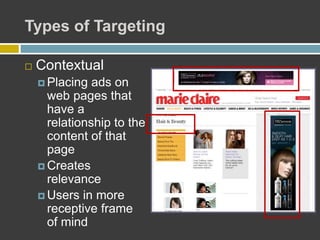

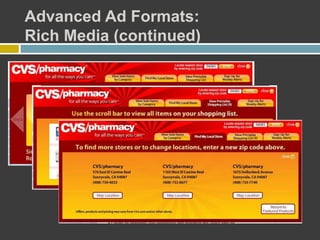

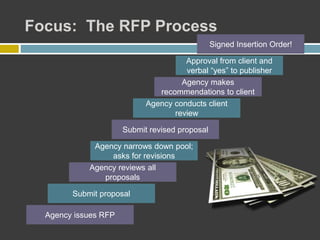

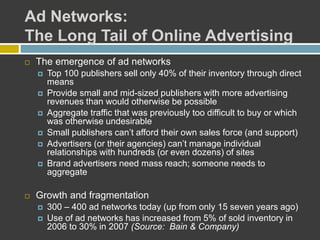

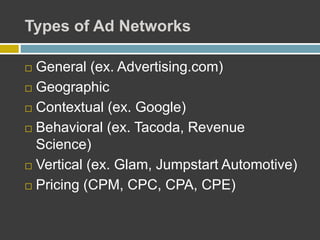

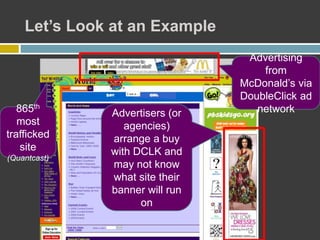

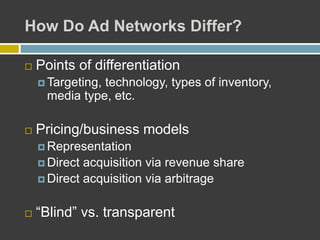

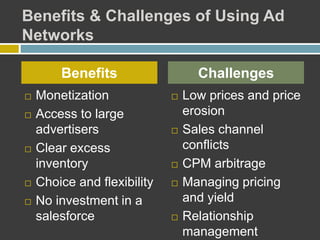

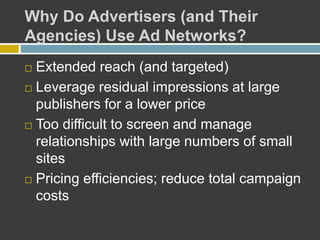

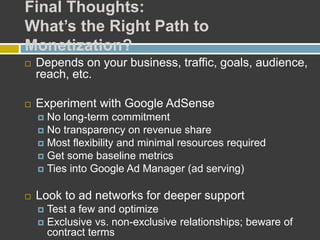

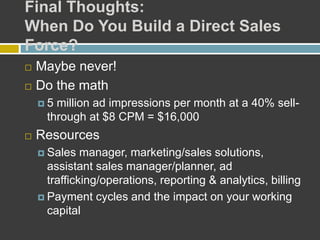

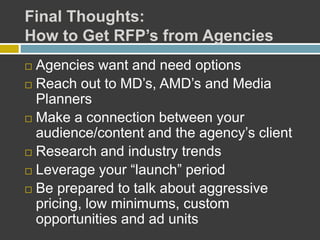

The document outlines the fundamentals of brand advertising, focusing on the online advertising landscape and the evolving relationship between advertisers and consumers. It covers the lifecycle of brand campaigns, the role of ad networks, and various targeting strategies in online advertising. Additionally, it provides insights into monetization tactics and effective measurement of advertising success.