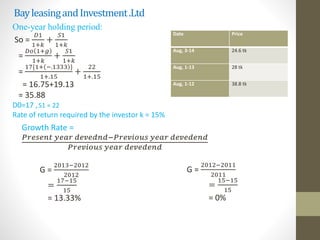

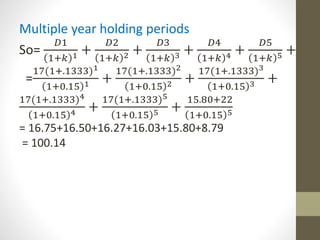

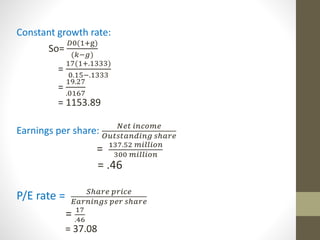

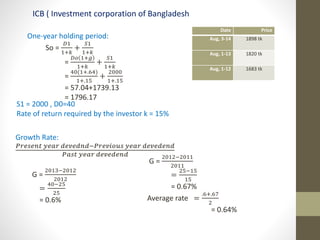

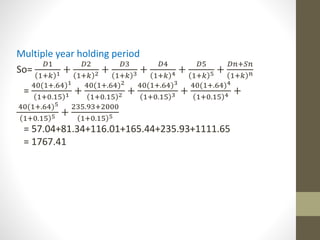

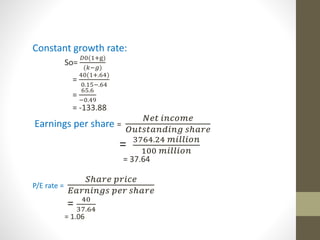

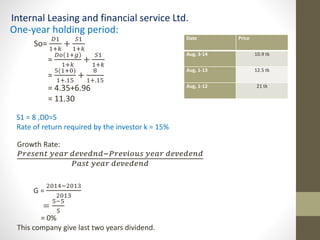

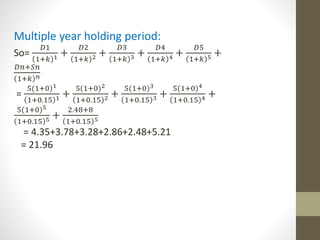

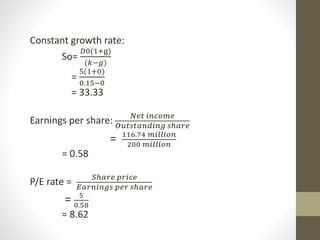

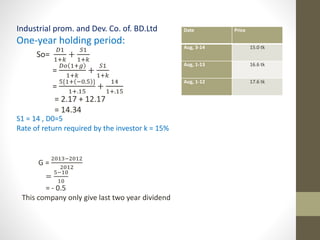

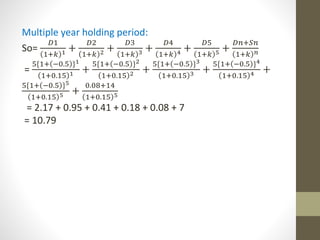

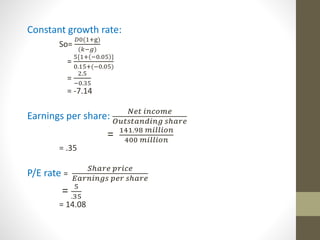

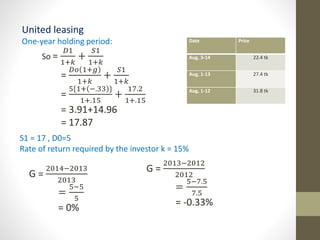

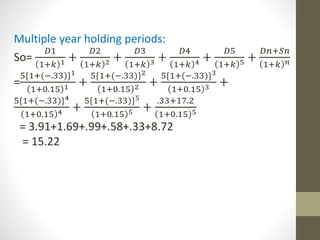

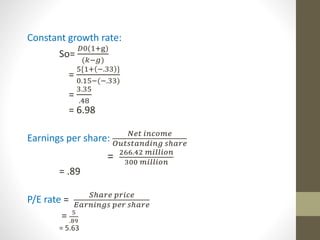

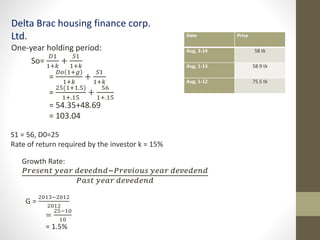

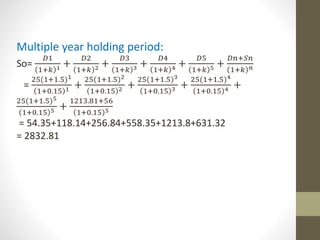

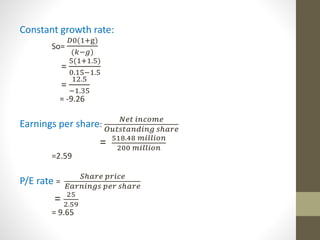

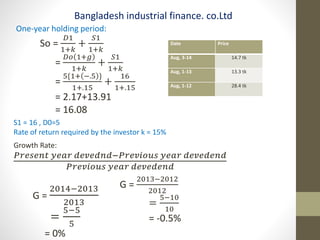

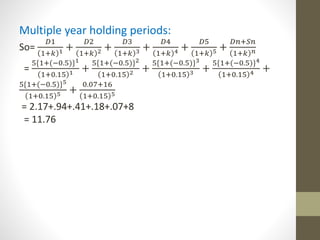

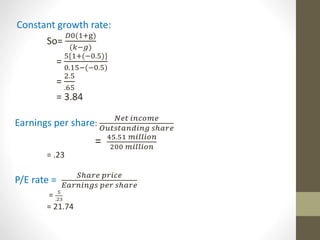

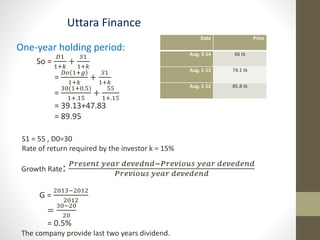

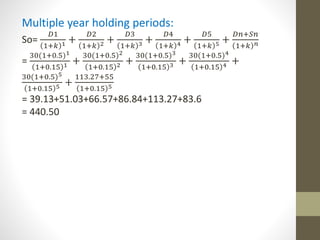

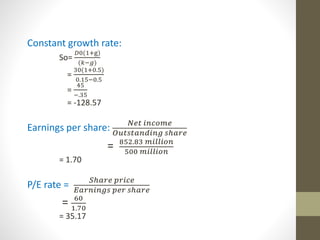

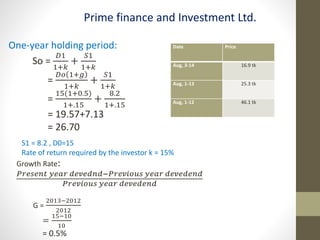

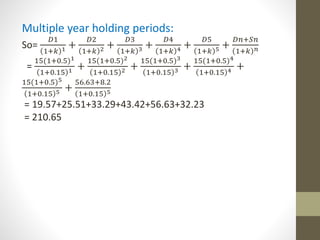

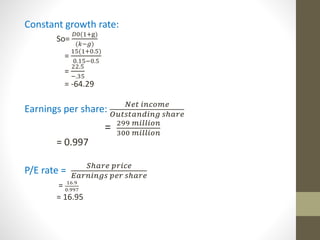

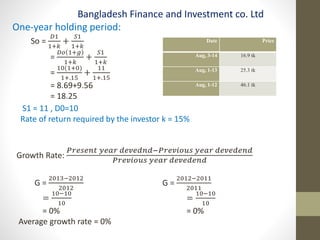

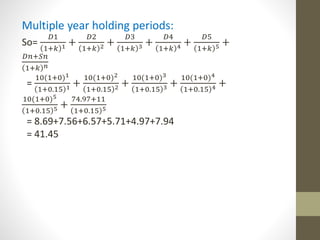

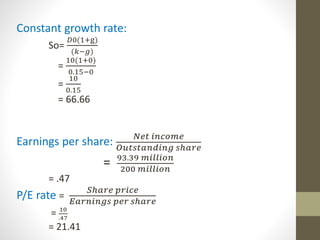

This document contains calculations for the net present value of holding periods for multiple companies. For each company, it calculates a one-year holding period value and a multiple year holding period value using constant dividend growth models. It also includes calculations for growth rates, earnings per share, and price-earnings ratios for each company. The document contains these calculations for six different companies over multiple dates and years.