This document outlines the steps to enable and make entries for service tax and TDS in Tally.

It describes 3 entries - 1) a journal entry to create an outstanding against the party and TDS on the expense, 2) a second journal entry to deduct the TDS amount, and 3) an entry in the purchase or sales screen to allocate service tax on services.

It also provides steps to create a tax adjustment voucher type and make an adjusting entry to reconcile input and output service tax balances.

![FOR ONLY TDS

1ST ENTRY IN JOURNAL (Creating outstanding against party)

Dr. :- Expense account

Cr.:- Party’s account

[then press enter and select “new ref” and create TDS

ON Expense (group:- Duties & Taxes – TDS– then

select appropriate category)]

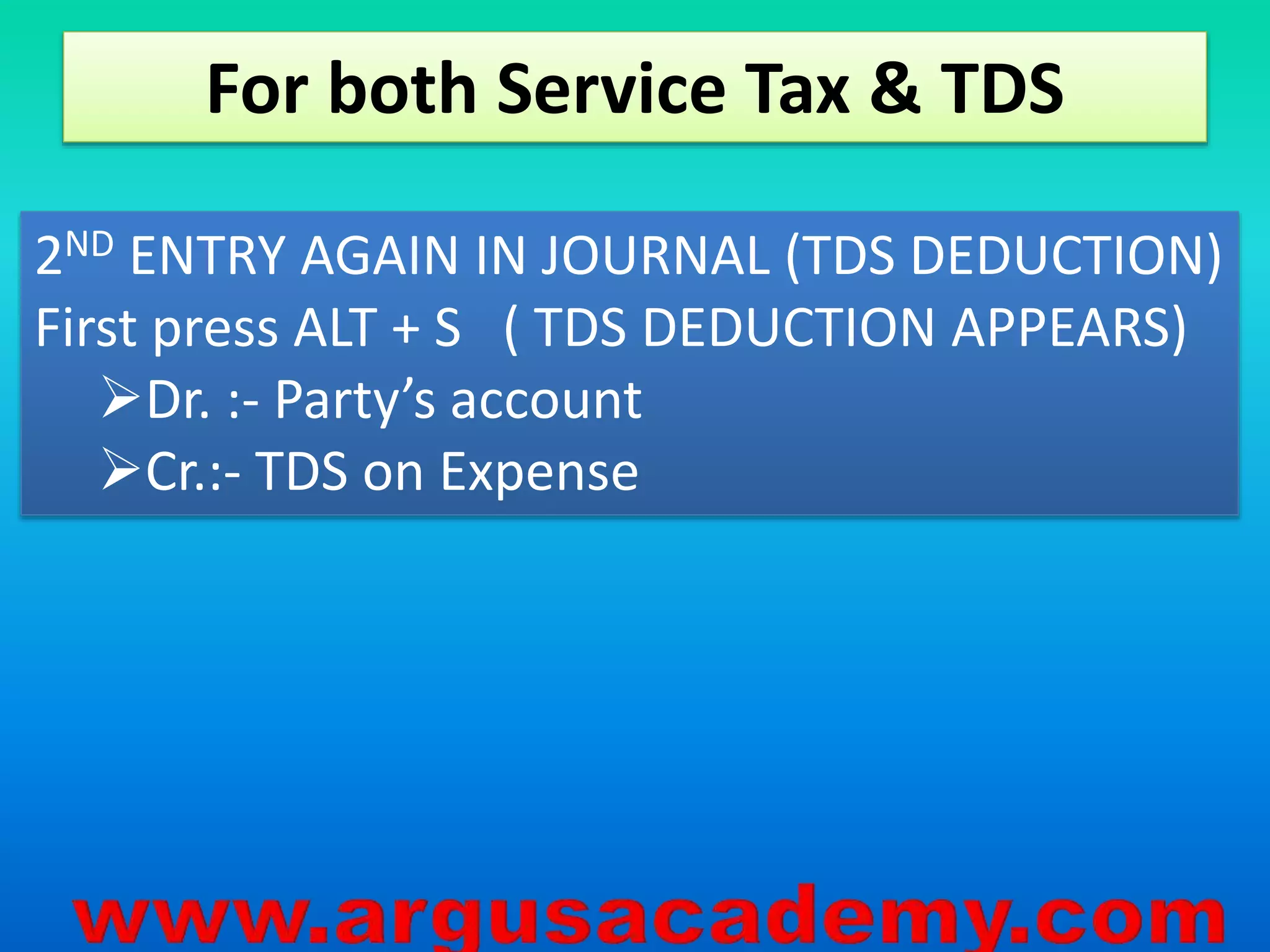

2ND ENTRY AGAIN IN JOURNAL (TDS DEDUCTION)

First press ALT + S ( TDS DEDUCTION APPEARS)

Dr. :- Party’s account

Cr.:- TDS on Expense](https://image.slidesharecdn.com/servicetaxtds-141101101007-conversion-gate02/75/TALLY-Service-tax-tds-ENTRY-2-2048.jpg)